georgemiller

Publish Date: Wed, 02 Oct 2024, 08:05 AM

Key takeaways

- US stocks and Treasury yields fell amid geo-political worries.

- European stocks fell; government bonds rose.

- Asian stocks were mixed.

Markets

US equities declined on Tuesday, as investors weighed heightened geopolitical tensions in the Middle East and the start of the US East and Gulf Coast Port strike. The S&P 500 closed 0.9% lower, led by losses in technology shares, while energy stocks rallied.

US Treasuries rose (yields fell), supported by flight to quality/safety demand. Investors also awaited key jobs data on Friday after headline JOLTS job openings rose more than expected in August. 10-year yields fell 5bp to 3.73%.

European stock markets mostly fell on Tuesday, as markets awaited key US jobs data amid rising geopolitical tensions. The Euro Stoxx fell 0.9%, led by consumer cyclicals. The German DAX lost 0.6%, as the French CAC was down 0.8%. In the UK, the FTSE-100 rose 0.5%, aided by higher energy stocks.

European government bonds rose (yields fell) as Eurozone inflation fell below the 2% target, boosting expectations of an ECB rate cut at the next meeting in October. 10-year German yields fell 9bp to 2.03%, as 10-year French yields declined 10bp to 2.82%. In the UK, 10-year gilt yields were down 6bp to 3.94%.

Asian stock markets were mixed on Tuesday. Markets in China, Hong Kong and Korea were shut for holidays. Japan’s Nikkei 225 climbed 1.9%, partially reversing Monday’s losses following the election victory for Ishida as the LDP president. Elsewhere, India’s Sensex closed flat.

Crude oil prices jumped on Tuesday amid growing worries over the supply impact from geopolitical tensions. WTI crude for November delivery rallied 2.4% to settle at USD69.8 a barrel.

Key Data Releases and Events

Releases yesterday

US ISM manufacturing index was unchanged in September at 47.2, remaining in contraction territory and below market expectations.

The US JOLTS index surprised on the upside in August, rising to 8.04 million compared to a revised 7.71 million in July but remained low. The quits rate fell further in August, pointing to moderating wage growth in the near-term.

Eurozone headline inflation fell to 1.8% yoy in September, from 2.2% yoy in August, matching the market consensus. Core CPI eased to 2.7% yoy in September compared to 2.8% yoy in August.

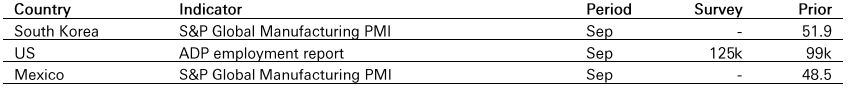

Releases due today (2 October 2024)

n the US, the ADP employment measure likely rose by 125k in September after a 99k increase in August.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-daily/2024-10-02/