georgemiller

Publish Date: Tue, 08 Oct 2024, 07:05 AM

Key takeaways

- US stocks and Treasury yields edged lower.

- European stocks fell; government bonds rose.

- Asian stocks traded lower.

Markets

US stocks ended mostly lower on Tuesday amid mixed US economic data releases. The S&P 500 fell 0.2%.

US Treasuries rose modestly after mixed and noisy jobs data. 10-year yields fell 2bp to 4.15%.

European stocks fell on Tuesday. The Euro Stoxx 50 closed 0.6% lower. The German DAX lost 0.6% while the French CAC fell 0.2%. In the UK, the FTSE 100 ended down 0.7%.

European government bonds posted modest gains. 10-year German and French bond yields edged down 1bp to 2.84% and 3.55% respectively. Bucking the regional trend, 10-year UK gilt yields rose 3bp to 4.52%.

Asian stock markets mostly fell on Tuesday amid investor caution ahead of US jobs reports. Regional tech shares declined on concerns over their US peers’ AI capex and lofty valuations. Japan’s Nikkei 225 lost 1.6% on a stronger yen, while Korea’s Kospi dropped 2.2%. China’s Shanghai Composite and Hong Kong’s Hang Seng fell 1.1% and 1.5% respectively. Elsewhere, India’s Sensex shed 0.6%.

Crude oil prices dropped on Tuesday. WTI crude for January delivery settled 2.7% lower at USD55.3 a barrel.

Key Data Releases and Events

Releases yesterday

In the US, nonfarm payrolls rose 64k in November after a 105k decline in October. The October reading was dragged down by a sharp drop in federal employment from the government’s deferred resignation programme. The unemployment rate rose to 4.6% in November from 4.4% in September. Retail sales were flat over the month in October, with headline sales held down by a drop in auto sales. Auto sales fell after consumers front-loaded purchases ahead of the 30 September expiration of electric vehicle credits. Excluding autos, retail sales rose 0.4% mom in October while controlled retail sales (ex-autos, gasoline, and building materials) posted a 0.8% mom gain. Meanwhile, the flash composite PMI dipped to 53.0 in December, from 54.2 in November, but remains in expansion territory.

The Eurozone flash composite PMI fell to 51.9 in December, from 52.4 in November, below market expectations.

The UK flash composite PMI rose to 52.1 in December, from 51.2 in November, exceeding the market consensus.

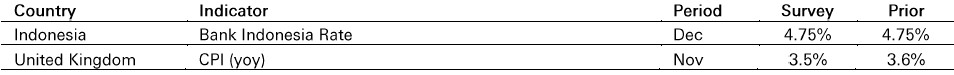

Releases due today (17 December 2025)

In the UK, CPI inflation likely moderated to 3.5% yoy in November, from 3.6% yoy in October.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-daily/id/