georgemiller

Publish Date: Mon, 14 Oct 2024, 07:04 AM

Key takeaways

- As expected, the RBI changed its stance from “withdrawal of accommodation” to “neutral”, in order to buy itself more flexibility, while keeping rates unchanged.

- While the RBI will be carefully analysing the “inflation hump” expected in the September print, it expects one year-ahead-inflation at target levels of c4%.

- The sequencing is important; the stance was changed today, and we believe rate cuts will begin in the next meeting; we expect 50bp in rate cuts over December and February, taking the repo rate to 6%.

In line with our expectation, the RBI kept the policy repo rate unchanged at 6.5%, but changed its stance from ‘withdrawal of accommodation’ to ‘neutral’. It further explained its intent to “remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth”. It also said that a neutral stance will give “greater flexibility and optionality” in monetary policy making.

Five of the six MPC members voted for a pause in rates. The new MPC member, Dr. Nagesh Kumar, voted for a cut. All six members voted for the change in stance.

As per Bloomberg consensus, a clear majority (40 out of 44 respondents) called for no change in rates. But it was rather divided house between those expecting a stance change, and those not.

We believe that a bunch of softer growth indicators of late and our expectation that inflation will get to the 4% target by March 2025, made a case for a softer stance. But with key global uncertainties in the horizon such as US elections and oil prices, it would have been too soon for a rate cut.

Careful sequencing

We believe the RBI aptly put the horse before the cart.

One, being an inflation targeter, it spoke more of upside inflation risks than downside growth risks. The animal analogy was not lost on us. The inflation elephant alluded to in past meetings had been sluggish, taking time to rein in. Meanwhile the inflation horse, mentioned in today’s meeting, had understandably been taken to the stables, but could bolt again if the stable doors were to be opened. We don’t particularly see this as hawkish. We see it aptly aligned with the RBI’s desire to remain close to the 4% inflation target.

Two, the RBI seems to be sequencing its moves carefully, starting off with a softening of stance today. We believe the next move will be a 25bp rate cut in the December meeting.

RBI style growth-inflation balance

While the RBI mentioned that the balance between growth and inflation remains well-poised, we believe it fully acknowledged upside risks to inflation (namely adverse weather events, geopolitical conflicts, commodity price spikes), while not acknowledging the downside risks to its growth forecast.

On inflation, Deputy Governor Patra spoke about the short term “inflation hump”, and RBI’s desire to see it pass. Indeed, September inflation is expected to come in at 5.2% y-o-y (versus 3.7% last month), led by base effects and select sticky food prices.

On growth, the RBI continues to forecast GDP growth at 7.2% in FY25, which is higher than our forecast of 7%. In the Monetary Policy Report (MPR) which was released along with the policy statement, the FY26 growth forecast has also been kept at an elevated 7.1% (HSBC: 6.6%).

But we are going to read between the lines. Even as the RBI highlighted upside inflation risks, the MPR unveiled a 4.1% inflation projection for FY26 (i.e. one year ahead inflation). Given the RBI is driven by future inflation expectations, this is another reason why we think a rate cut is coming up in December.

Confident but not complacent

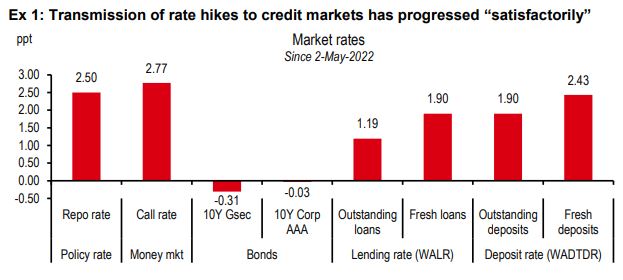

The RBI sounded confident on many aspects of the macro economy: Liquidity has eased (after a tight second half of September), the term premium has been stable and transmission to credit markets has progressed satisfactorily (see exhibit 1). On the external front, the current account deficit is likely to remain at sustainable levels, portfolio flows have risen, and FX reserves are at record highs (of over USD700bn). Fiscal consolidation is also underway (though we believe that the centre’s consolidation may be partly offset by wider deficit at the states).

But despite the confidence, the RBI was not complacent. In particular, it highlighted two areas of financial stability that need to be monitored. One, stress build-up in a few unsecured loan segments (like loans for consumption purposes, micro finance loans and credit card payments outstanding). And two, some NBFCs pursuing growth too aggressively with an “imprudent growth at any cost approach”.

What next?

We believe the recent softness in select fast moving growth indicators (PMI Manufacturing, motor sales, cement production, bank credit, corporate tax collections, GST revenue growth and goods exports) is more representative of sector rotation (from urban to rural) rather than a marked slowdown. Therefore, we think this will be a shallow rate cutting cycle, with an aggregate 50bp in easing. We expect a 25bp rate cut in December, followed by another one in February, taking the policy rate to 6%.

This aligns with our real rate calculation of neutral rates at 1.75% (the average of the band the RBI communicated in the monthly bulletin), and our medium-term inflation forecast of 4.25%.

https://www.hsbc.com.my/wealth/insights/market-outlook/india-economics/2024-10/