georgemiller

Publish Date: Wed, 13 Nov 2024, 12:02 PM

Key takeaways

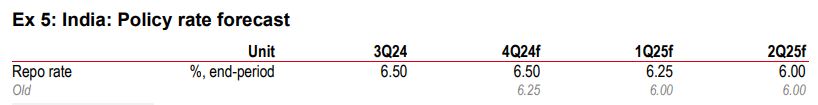

- We push out our first RBI rate cut call from December 2024 to February 2025...

- ...as the RBI waits for the likely October inflation spike to drop, and global financial markets to stabilise.

- A few better activity prints in October, thus far, have lowered the urgency to cut, though several others indicate that easing will be needed down the line.

When the RBI changed its stance from hawkish to neutral in the August policy meeting, it seemed a rate cut would follow soon. And when the chorus around the release of softer growth data got louder, it seemed like a rate cut was just around the corner, in fact in the upcoming December policy meeting.

But the backdrop has changed. We think four developments over the past four weeks will make the RBI hold the repo rate steady at 6.5% at its December meeting.

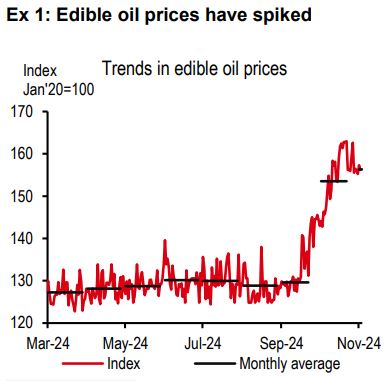

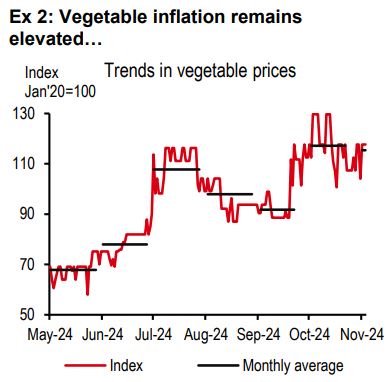

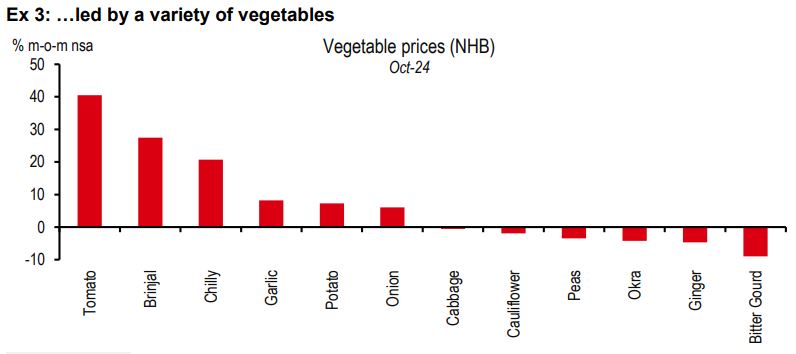

Game-spoiler inflation. CPI inflation rose from 3.7% in August to 5.5% in September, led by a combination of a weak base, as well as a strong sequential rise in prices. CPI inflation is likely to rise further to 5.9% in October, led by higher food inflation. In particular, we find a sharp spike in edible oil prices, triggered in part by higher import taxes (Exhibit 1), and still high vegetable inflation (Exhibits 2 and 3).

In the past the RBI used to often look through vegetable price inflation, but that is not the case anymore. Back-to-back shocks seem to have made officials distrustful of quick disinflation in vegetable prices. In fact, we believe they will not even take solace in the fact that the prices of pulses, eggs, meat, and fish, have softened recently.

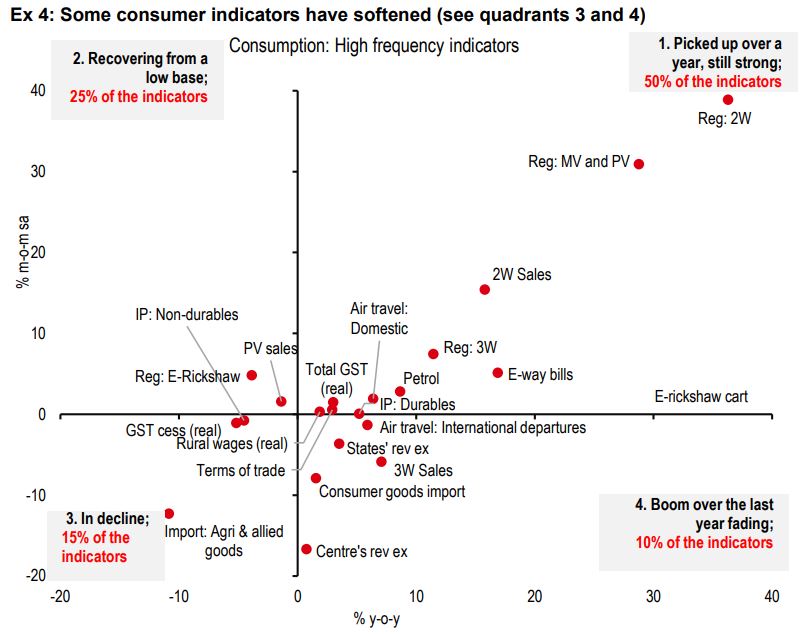

October growth-comeback? Some data points have come in stronger in October. These include GST revenue growth, the manufacturing and services PMIs, vehicle sales and registration, petrol and diesel consumption, and international passenger arrivals.

And even though, as the month progresses, several other growth indicators may come in weaker than before, these improved prints seem to have taken off some of the urgency around rate cuts, making the RBI more open to waiting a while longer before easing.

External volatility returns. With the dollar appreciating 4.2% since early-October, of which c1% happened over the last 48 hours, there has been weakening pressure on EM currencies. And while the RBI has ample FX reserves to support the currency, it may prefer to wait now, and ease at a time global markets are more stable.

Unwaveringly hawkish communication. True, the RBI softened its stance in the August meeting. But since then, the governor has spoken at several forums about the perils of premature easing, calling it “very risky” at a time of “significant upside risk to inflation” (Bloomberg, 6 November 2024). This commentary is also at a time when markets have reprised Fed rate cuts.

All said, we expect the RBI to stay on hold at its December meeting.

But we hold on to our view of two rate cuts in this cycle, spread across the February and April meetings (December and February earlier, Exhibit 5). Our sense is that when the new vegetable crop is harvested at end-2024, food inflation could fall quickly, with cooler temperatures and full-up reservoirs aiding the process.

When we look at a broad set of growth indicators, we find that a lower proportion are growing at a fast clip compared to a quarter ago, particularly in financial services and consumption-related sectors (Exhibit 4).

As such, it’s only a matter of time before we see rate cuts, even though it won’t likely be at the December meeting, nor will it be a deep rate cutting cycle.

https://www.hsbc.com.my/wealth/insights/market-outlook/india-economics/2024-11/