georgemiller

Publish Date: Thu, 28 Nov 2024, 12:02 PM

Key takeaways

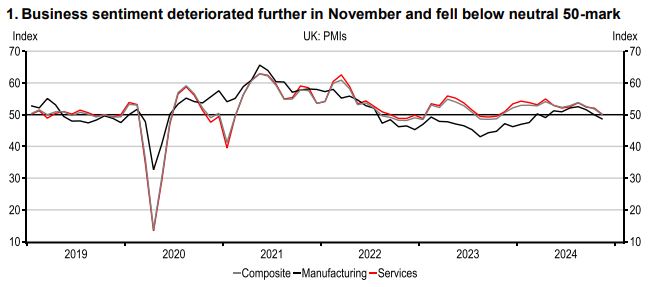

- UK PMIs fell below the 50-mark as uncertainty weighs.

- Bank of England updated its forecasts after the Budget.

- Hard data moved in the wrong direction – GDP growth was slower and inflation accelerated.

Source: HSBC

A lot to digest and greater uncertainty ahead

Since the UK Budget on 30 October, macro and political news has come thick and fast, leaving markets, households and businesses with a lot to digest. Politically, a change of government in the US could see a further rise in protectionist policies and raises questions as to how the UK government will seek to work with President-elect Trump. Meanwhile, a looming confidence vote for German Chancellor Scholz could see a general election in Europe’s largest economy in early 2025. The European Central Bank, Federal Reserve and Bank of England (BoE) all cut interest rates by a further 25bp and signalled more to come, but that was not enough to reassure business sentiment. UK PMI fell into contractionary territory in November for the first time this year and future expectations of growth fell. For consumer confidence, the headline measure remains weak, but seasonal sales helped see an improvement.

The BoE pushed back against higher interest rates

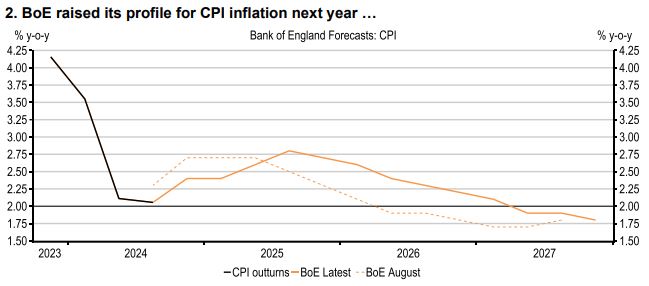

Alongside a second 25bp rate cut, the BoE’s November monetary policy meeting also included updated economic forecasts that incorporated the latest fiscal policy announcements. GDP growth and inflation were upwardly revised and estimates for the unemployment rate was lowered. In spite of that, rhetoric was centred on a keep calm and carry on approach to gradual rate cuts.

Additional Budget-related near-term inflationary pressures were expected to abate fairly quickly (Chart 2) and, conditioned on an average interest rate of 3.7% from 2025, inflation is seen below target. That implies that the BoE deems an interest rate at that level to be too high and may be an implicit push back against market expectations of a 4.0% medium-term rate. And we are inclined to agree and see interest rates falling more quickly in the second half of 2025 to 3.25% by year-end 2024.

GDP growth slows and headline inflation rises back above 2%

GDP growth moderated by more than expected to 0.1% in Q3. More positively, however, household consumption saw a broad-based acceleration while business investment also rose. That said, retail sales fell sharply in October, offering a soft start for output growth in the final quarter of 2024. Headline CPI inflation rose to 2.3% y-o-y in October from 1.7% previously, although that was predominantly driven by a c10% rise in the Ofgem Price Cap. Indeed, the BoE will look through the known volatility in energy prices, but still elevated services inflation and private sector wage growth are in keeping with a hold in Bank Rate at 4.75% at the final BoE policy meeting of 2024 on 19 December.

Source: Macrobond, S&P Globa

Source: Macrobond, ONS, BoE forecasts

Source: Macrobond, BoE

https://www.hsbc.com.my/wealth/insights/market-outlook/uk-in-focus/2024-11/