georgemiller

Publish Date: Mon, 09 Dec 2024, 12:02 PM

Key takeaways

- Gold prices rose sharply in 2024, fuelled by geopolitical risks, rate cut expectations, and fiscal concerns.

- Many gold-bullish factors are likely to remain in 2025, but USD strength and relatively high US yields could weigh on gold.

- Gold may also face headwinds from weaker physical demand and rising supply.

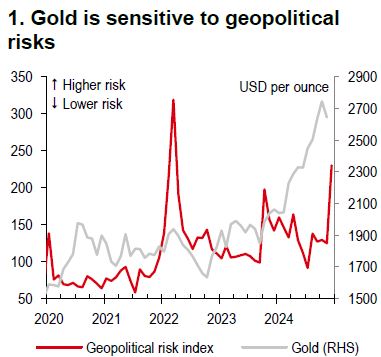

Gold has had a strong year, gaining c28% (Bloomberg, 5 December 2024), supported by a combination of geopolitical risks, political uncertainties, rate cut expectations, and fiscal concerns. Approaching the end of 2024, the geopolitical risk thermometer is still gold-supportive (Chart 1), but political uncertainties in the Eurozone that may weigh on the EUR and indirectly support broad USD strength could limit any further gold rally.

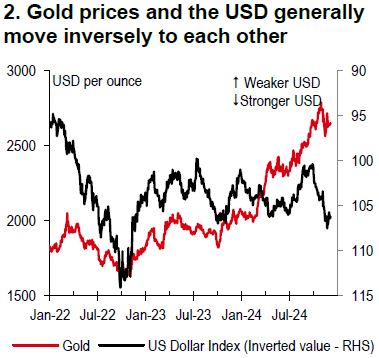

It is worth remembering that gold being priced in USD generally moves inversely to the USD (Chart 2). Our base case for 2025 is that USD strength is likely to be supported by relatively high US yields, global growth uncertainties, and potentially its “safe haven” status. Nevertheless, there could be moments when the USD may face a squeeze lower. With this in mind, our precious metals analyst thinks that gold prices are likely to have a volatile year, moving moderately lower by end-2025.

Note: Caldara, Dario, and Matteo Iacoviello (2021), "Measuring

Geopolitical Risk," working paper, Board of Governors of the Federal

Reserve Board, November 2021.

Source: Macrobond, HSBC

Source: Bloomberg, HSBC

Current gold prices are high enough to limit jewellery and gold coin & bar demand, primarily in price-sensitive emerging markets, but also in less sensitive western markets, while at the same time encouraging mining and additional recycling supply. In our precious metals analyst’s view, physical gold market’s supply and demand dynamics may help curb the gold rally.

Nevertheless, declines in gold prices may be limited amid geopolitical risks and their associated trade risks, with tariff concerns. Should trade frictions rise to the level where trade flows are negatively impacted, this may be highly supportive of gold, in our precious metals analyst’s view. Besides, mounting fiscal deficits worldwide, with high debt-to-GDP ratios, have aided the gold rally in 2024 and may continue to do so next year. Central banks’ demand for gold may also help.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/2024-12-09/