georgemiller

Publish Date: Mon, 03 Feb 2025, 12:02 PM

Key takeaways

- As widely expected, the Federal Reserve kept rates unchanged at 4.25-4.50% unanimously. It seems this pause was just that and not a consideration of a change in the direction of monetary policy. We no longer expect the first cut this year to come in March but look for three rate cuts delivered in 0.25% steps at the June, September and December policy meetings.

- During the press conference, Jerome Powell continued to stress that the current stance of monetary policy is "meaningfully above the neutral rate”. He said that the unemployment rate has stabilised at a low level in recent months, and labor market conditions remain solid while economic activity has continued to expand at a solid pace. Powell also stated that “Inflation has eased significantly over the past two years but remains somewhat elevated relative to our 2% longer-run goal”.

- We maintain our overweight on US equities as we believe the fundamentals remain favourable for solid equity market returns, underpinned by lower interest rates, lower inflation, deregulation, AI adoption, and economic stability. Fixed income returns could be more muted as rates fall more slowly with the extension of the monetary policy easing cycle.

What happened?

As expected, the Federal Reserve kept rates unchanged at 4.25-4.50%. The decision was unanimous.

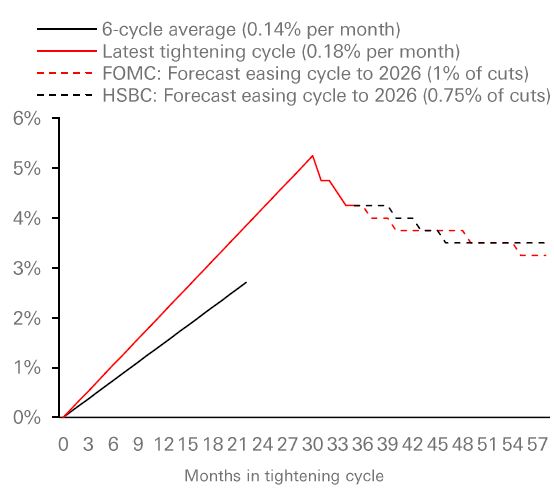

We still forecast 0.75% of gradual rate cuts in 2025, which will be delivered in 0.25% steps at the June, September and December policy meetings, followed by no change in policy rates in 2026. As a result, the federal funds target range will remain 3.50-3.75% for both end-2025 and end-2026.

Fed Chair Jerome Powell said on at least five separate occasions that the Committee did not need to be “in a hurry” to make further adjustments to policy rates. The FOMC’s latest assessment follows another year of economic growth outperformance relative to expectations.

Powell continued to stress that the current stance of monetary policy is “meaningfully” above the neutral rate”. If policy is still that restrictive, it would not take much to restart interest rate cuts. If policy is much closer to neutral, the bar to restart cuts is higher.

Fed easing will be less aggressive than the last tightening cycle

Source: Bloomberg, HSBC Global Private Banking as of 29 January, 2025. Forecasts are subject to change.

On the economy, Chair Powell stated that “the unemployment rate has stabilised at a lower level in recent months, and labour market conditions remain solid” and that the “economic activity has continued to expand at a solid pace”.

Powell said the Fed feels it is “meaningfully restrictive” and doesn’t need inflation to hit the 2% target to begin easing again. He said, “the Fed just needs to see further progress”. Inflation has eased significantly over the past two years but remains somewhat elevated relative to the 2% longer-run goals. Housing inflation is set to decline this spring.

Tariffs were lifted from 2018-2019 and US inflation slowed in the subsequent year. Strong US dollar means imported goods prices should remain muted.

DeepSeek deflation: the innovation implied by this next generation of AI, suggests the possibility of less demand for computers, storage and energy in future. However, it remains to be seen if AI adoption could pick up pace due to this lower price point, thereby fuelling higher productivity and lower prices.

Investment implications

US economic growth remains healthy and well above the long-term trend. Dollar strength should continue as other central banks could ease more aggressively. US dollar-denominated investing should remain popular with global investors, driving asset flows and the currency.

The technology revolution is just beginning and the productivity enhancing technologies that will diffuse throughout the economy should lift growth, reduce costs and expand profitability. The reindustrialisation of the US continues, and construction of new manufacturing facilities remains quite strong. Near/onshoring of jobs and the securing of supply chain remains a major theme for US corporations. This will continue to be a factor stabilising labour markets and creating wealth.

For US equities, the fundamentals remain constructive. However, with a less aggressive Fed easing cycle, the slightly more hawkish tone to monetary policy will have to be offset by increased fiscal stimulus and better economic growth, which the Fed is forecasting. This would allow the earnings-led bull market to broaden out.

From a sector perspective, interest rate relief will probably be less dramatic, and the growth imperative remains. Interest rate sensitive sectors should see a less emphatic stimulus from lower market rates. The growth emanating from technology revolution should be positive for the technology, communication services and healthcare sectors. Also, the increased demand for energy from the adoption of these technologies is positive for industrials.

Lower interest rates, a positive slope to the yield curve and less regulation should culminate in better economic growth, increased M&A and possibly more IPOs, all of which would be positive for the financial sector.

Fixed income returns could be more muted as rates fall more slowly with the extension of the monetary policy easing cycle.

If the ongoing backdrop of solid growth is coupled with further disinflationary momentum in the next months, it will extend the Goldilocks scenario. This would be supportive of a risk-on stance, and therefore, we remain overweight on US equities in our asset allocation.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/cautious-fed-pauses-awaiting-further-evidence-of-lower-inflation/