georgemiller

Publish Date: Tue, 04 Feb 2025, 12:02 PM

Key takeaways

- In the Indian Union Budget for FY 2026 (Apr 2025 – Mar 2026) announced on 1st February, Finance Minister Nirmala Sitharaman struck a delicate balance of providing a boost to capex and consumption while maintaining the path of fiscal consolidation.

- The government targets to reduce the fiscal deficit to 4.4% (from 4.8% previously) while lowering the personal income tax for the middle-income households. Individuals earning up to INR 1.2m per year will not be liable to pay any income tax. FDI limits for the insurance sector have been increased to 100% and the government has also reduced or scrapped tariffs on several capital goods and raw materials.

- We view the budget’s focus on boosting both consumption and capex as supportive for Indian equities, especially for the healthcare, financials and consumer-related sectors. Hence, we retain our overweight stance. Income tax cuts can lead to lesser asset quality pressure, faster deposit growth and fee income for Financials, while Healthcare should benefit from measures to boost medical tourism. Lower net borrowing and the aim to reduce central government debt/GDP ratio are positive for INR bonds.

What happened?

In the Union Budget for FY 2026, Finance Minister Nirmala Sitharaman struck a delicate balance of providing a boost to capex and consumption while maintaining the path of fiscal consolidation. Some of the key highlights of the budget were as follows:

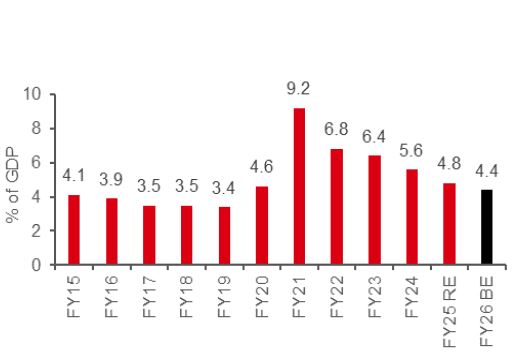

Fiscal discipline: In line with our expectation, the government revised their estimate for FY25 fiscal deficit to 4.8%, as the impact from lower nominal GDP growth was more than offset by lagging capital expenditure. More importantly, Finance Minister Sitharaman stuck to their prior guidance to lower fiscal deficit, despite the recent slowdown in growth and announced that they target a 4.4% fiscal deficit in FY26. India’s commitment to stay on the path of fiscal consolidation is a big positive from a macro-economic perspective.

India is projected to remain on the path of fiscal consolidation

Source: Budget documents, HSBC Global Private Banking & Wealth as of 2 February 2025. Past performance is not a reliable indicator of future performance.

Consumption boost and Income tax cuts: The focal point of the budget announcement was the decision to cut personal income tax liability, especially for the middle-income households. Now individuals earning up to INR1.2m per year will not be liable to pay any income tax. This measure is likely to cost the government approximately INR 1tn (~USD 12bn) or 0.3% of the GDP.

Capital Expenditures & Lower Borrowing: The government projected the capex to rise by around 10% to INR 11.2tn in FY26, broadly in line with the nominal GDP. This would keep capex unchanged at 3.1% of GDP. However, there appears to be a shift in focus from capex on prior beneficiaries such as roads (+1.5% y-o-y) and railways (0% y-o-y) towards urban infrastructure (+20% y-o-y) and housing (+62% y-o-y). The net government borrowing is also projected to decline towards INR 11.5tn (vs 11.6tn in FY25).

FDI Limits & Tariffs: In line with the recommendation of Chief Economic Advisor, the government took steps towards further deregulating the market and has now allowed 100% FDI in the insurance sector. Import tariffs for several goods and equipment across sectors, ranging from textiles to electronics, were reduced or eliminated. The move signals India’s intention to reduce the barriers to trade and gradually incentivize the domestic manufacturers to become more competitive on a global scale.

Broadly, the fiscal math seems reasonable to us, based on the assumption of 10.1% nominal GDP growth. However, projections of 12% revenue growth look somewhat optimistic. The government expects 14.4% personal income tax growth (despite the announced income tax relief). Assumptions of non-tax revenues (dividends from the RBI and PSUs) look realistic to us. Hence, we see some risk of disappointment on the revenue and overall fiscal deficit side. However, should the tax cuts unleash a rebound in spending, then the government may still be able to achieve its targets.

Investment implications

We view the Budget’s focus on supporting consumption and capex, while maintaining fiscal prudence as positive for Indian equities. Hence, we retain our bullish stance .

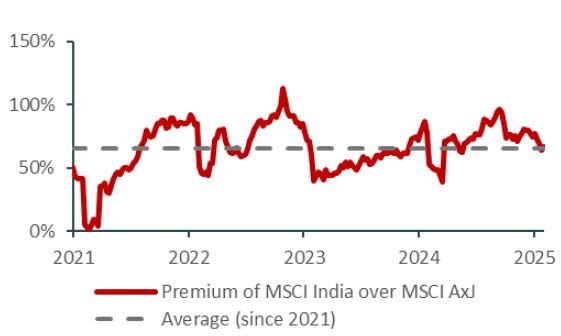

Clearly, Indian equities have been under pressure since September 2024, as a combination of profit-taking, growth concerns and downward revisions of earnings estimates have led to large outflows from foreign investors. Foreign institutional investors pulled out USD 8.4bn from Indian equities in January itself. However, the potential for the recent budget announcement to uplift the sentiment, which combined with India’s more reasonable valuations, can help stabilise the flows. Domestic flows into the equity market continue to be supportive.

Indian equities now trade in-line with their historical P/E premium over Asia ex-Japan equities

Source: Bloomberg, HSBC Global Private Banking & Wealth s of 2 February 2025. Past performance is not a reliable indicator of future performance.

From a sectoral perspective, we see the budget announcements as being positive for the healthcare, financials and consumption-related sectors. Lower personal income tax should lead to more disposable income for the middle-income households, better debt servicing and greater demand for credit cards and investment products. The healthcare sector should benefit from the push for medical tourism under the “Heal In India “ program. The impact on Industrials appears to be mixed, as the slower capex growth might be mildly negative whereas higher disposable income could lead to stronger demand for automotives.

The FY26 budget doesn’t alter our bullish stance on Indian local currency government bonds. At the margin, the reduction in net supply is a positive. While the index-inclusion linked flows have stagnated over the past few months, we expect them to resume once the global uncertainty eases.

We continue to expect a cumulative of 0.5% rate cuts by the Reserve Bank of India (RBI) in 2025. Therefore, investors are likely to not only receive the relatively attractive coupons, but also potential capital appreciation by maintaining exposure to bonds.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/indian-budget-threading-the-needle/