georgemiller

Publish Date: Wed, 05 Feb 2025, 21:04 PM

Key takeaways

- India announced tax cuts to support consumption, held on to its capex thrust, and yet stuck to a fiscal consolidation path.

- On the budget math, expenditure assumptions can be met with the pruning of schemes...

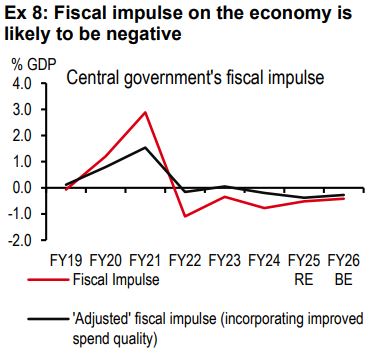

- ... but tax revenues could disappoint mildly; overall fiscal impulse will likely be negative.

The government walked the tightrope in their 1 February budget, balancing several conflicting objectives. It provided near-equal stimulus to both consumption (personal income tax cuts amount to INR1trn) and capex (budget outlays rise by INR1trn), while lowering the fiscal deficit (as promised, from 4.8% in FY25 to 4.4% of GDP for FY26). It also announced its intention to lower the centre’s debt to c50% of GDP by FY31.

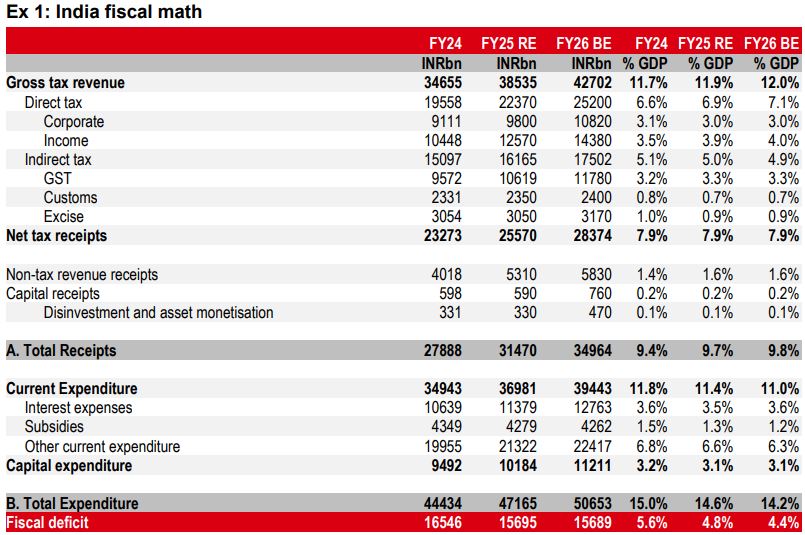

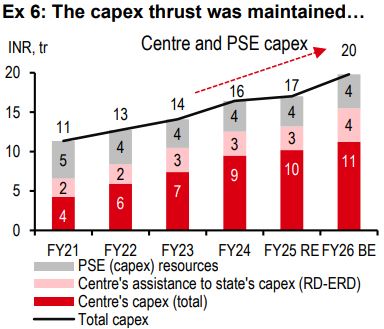

On the budget math, the personal tax revenue growth assumption (of 14.4% y-o-y) looks overoptimistic given those earning up to INR1.2m per year (INR0.7m earlier) will not be liable to pay income tax under the new regime. However, non-tax revenue assumptions look realistic. Central government capex is expected to grow in line with nominal GDP (at 10% y-o-y). But when scheme transfers to states and public sector enterprise (PSE) capex are added, overall capex is likely to grow faster at 16% y-o-y. Central to meeting the fiscal deficit target is cutting current expenditure. Here, a lower fertiliser subsidy bill and pruning other outlays is key.

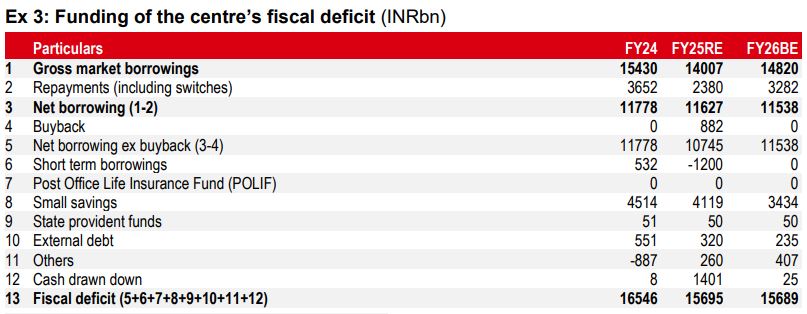

With fiscal consolidation, net market borrowing in FY26 is lower than a year ago. But because of a higher redemption bill, gross market borrowing is higher. However, we are not worried. The growth in borrowing is well under nominal GDP growth, and with the RBI having turned buyer, should be comfortably funded.

Aside from the consumption stimulus and the capex thrust, import tariffs were lowered for key inputs, and several tariff rates eliminated, in a bid to help India plug into global supply chains as they get rejigged. The FDI limit in insurance was raised, and promises to lower the regulatory burden on industry were made.

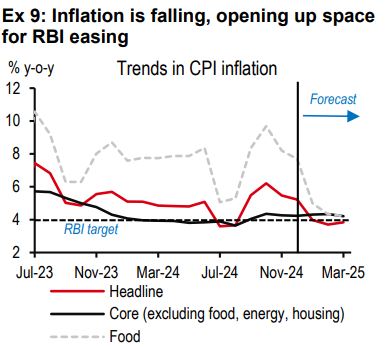

With consolidation, the fiscal impulse is likely to be negative. But inflation is falling, and we expect the RBI to cut rates and infuse domestic liquidity, picking up the growth baton.

Adhering to fiscal consolidation

The government announced the following fiscal deficit path -

- A fiscal deficit of 4.8% of GDP for FY25, lower than the budget estimate of 4.9% of GDP.

- A fiscal deficit target of 4.4% of GDP for FY26 (HSBC: 4.4% of GDP), marking 0.4% of GDP fiscal consolidation.

Despite nominal GDP growth coming in lower than budgeted (9.7% y-o-y vs. 10.5%), the government expects to end FY25 with a lower-than-budgeted fiscal deficit. This has been made possible by lower than budgeted capital expenditure on account of election-led delays (INR10.2trn vs INR11.1trn budgeted).

Despite pressures to support growth, the government stuck to its promise of lowering the fiscal deficit further in FY26, to below 4.5% of GDP. This, we believe, is a big positive for macro stability.

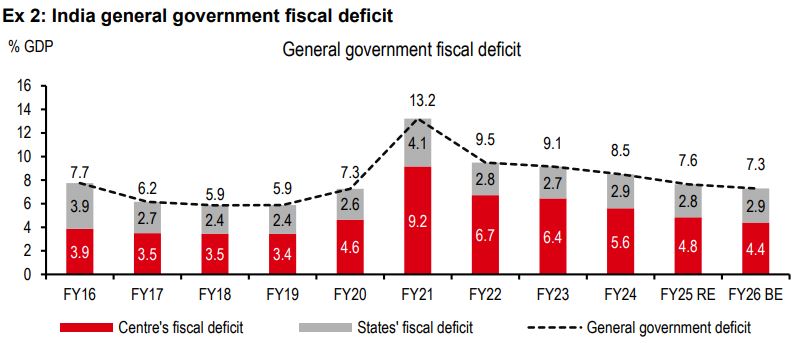

Following the numbers released on 1 February, the general government fiscal deficit stands at 7.3% of GDP, lower than 7.6% a year ago, but higher than 5.9% in the pre-pandemic period (see exhibit 2). As such, some sense of a future consolidation path post-FY26 becomes important.

Here, the government also announced its medium term fiscal consolidation path. In the years ahead, it plans to “keep the fiscal deficit each year such that Central Government debt remains on a declining path as a percentage of GDP”. It has set a new target of central government debt at 50% +/-1% of GDP by FY31, from 57.1% in FY25.

Fiscal math: Spending numbers reasonable; revenues a tad high

To meet the fiscal target of FY25, tax revenue growth in 4Q must be around 12% y-o-y, and expenditure growth around 7%, Both targets look achievable to us (though we may have some minor quibbles that direct tax collection looks too high, and indirect too low).

Next, we look into the FY26 math carefully. Nominal GDP growth has been pegged at 10.1%, broadly in line with expectations.

We believe personal tax growth of 14.4% is a tad high at a time when nominal GDP is growing 10.1%, the capital gains tax component is slowing (led partly by the recent fall in equity markets), and most importantly, the government has cut personal tax rates for FY26, and thereby foregone revenue of INR1trn (more on this later).

Overall gross tax buoyancy is assumed to be 1.1, and our calculations suggest that there could be disappointment here as the year progresses.

Non-tax revenues look reasonable. Dividends from the RBI and other financial institutions remain elevated at INR2.6trn (versus 2.3trn in FY25), led partly by the central bank’s FX intervention though the year. Spectrum sales numbers are a bit muted, but could be offset by slightly higher ‘other non-tax revenue receipts’.

Expectations from disinvestment receipts are surprisingly muted, perhaps signalling lukewarm appetite for disinvestment.

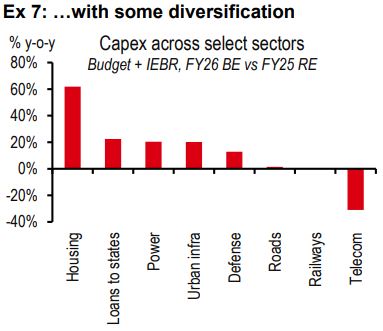

On the current expenditure front, the government expects a cut in the fertiliser subsidy bill, though a lot will depend on the FX and global commodity prices though the year. It also expects a cut in non-subsidy current expenditure, especially outlays to the telecom sector and transfers to some reserve funds (like the Guarantee Redemption Fund).

Capex is expected to grow in line with nominal GDP growth, coming in at INR11.2trn in FY26 (vs INR10.2trn in FY25), and suggesting that the government intends to hold on to the capex thrust it has carefully nurtured. In fact, as we note below, the overall capex thrust is higher than it looks at first glance.

In fact, we find that the quality of expenditure continues to improve, though more gradually now (see exhibit 4).

All told, we think that with careful pruning, expenditure numbers can be met, while tax revenues could disappoint mildly.

Gross versus net market borrowing

In line with the fiscal consolidation, the government announced net market borrowing of INR11.5trn in FY26, lower than INR11.6trn in FY25.

But because the redemption bill for FY26 is rather high (at INR3.3trn), gross market borrowing came in higher than a year ago, at INR14.8trn (versus INR 14trn in FY25).

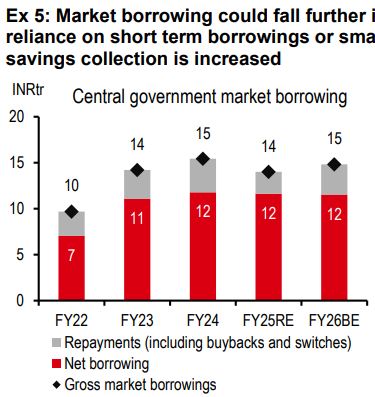

As the year progresses, the government may use more short term borrowing or get a higher collection from the small saving scheme than has been budgeted, resulting in lower market borrowing (see exhibit 5). But we will have to wait for several months to getclarity there.

Despite higher gross market borrowing compared to a year ago in INR terms, it remains below nominal GDP in growth terms (5.8% y-o-y gross borrowing growth vs.10.1% y-o-y nominal GDP growth). And after a long wait, the RBI has also started buying government bonds.

As such, the borrowings are likely to be comfortably funded.

Focus areas in FY26

Consumption boost: The hallmark of the budget was the cut in personal income tax. Individuals earning up to INR1.2m per year (INR0.7m earlier) will not be liable to pay income tax under the new regime. 10m individualsare likely to benefit from this.

Tax slabs and rates were changed across the board. All of this will likely cost the government INR1trn of revenue foregone.

Capex diversification: The capex thrust was maintained at 3.1% of GDP (INR11.2trn, 10% y-o-y growth) despite the consumption stimulus. But there is more than meets the eye:

- Once we include scheme specific capex revenues transferred to states, it adds up to INR15.5trn (17% y-o-y growth). And when we add PSE capex, the number goes up to INR19.8trn (16% y-o-y growth), see Exhibit 6.The power sector is a case in point where PSE outlays have been quite high (growing 21% y-o-y).

- There has been some diversification in central government capex, moving away, on the margin, from just roads (1.5% y-o-y) and railways (0% y-o-y), towards urban infrastructure (20% y-o-y), housing (62% y-o-y), interest-free loans to states (budgeted at INR 1.7tr for FY26), and funds earmarked for any ministry that mayneed extra capex funds as the year progresses, see Exhibit 7.

Rural spending is budgeted to be higher than a year ago, led largely by the clean water mission.

Import tariffs were slashed across a variety intermediary inputs and equipment. This is expected to help India plug into Asian supply chains. Furthermore, changes are being made for easier access to export credit and support to MSMEs.

FDI limit in insurance was raised from 74% to 100%.

In terms of reforms, a high level committee will be tasked to lower the regulatory burden businesses face.

Impact on growth

The 0.4% of GDP fiscal consolidation in FY26 is likely to impart an overall negative fiscal impulse on the economy (see exhibit 8).

The task of lifting growth is likely to pass on to the RBI. With inflation falling, room for rate cuts and easier liquidity has opened up. We expect a 25bp rate cut in the Feb 7 meeting, followed by another one in April, taking the repo rate to 6%.

https://www.hsbc.com.my/wealth/insights/market-outlook/india-economics/consumption-capex-consolidation/