georgemiller

Publish Date: Tue, 11 Feb 2025, 07:04 AM

Key takeaways

- RBI’s Monetary Policy Committee (MPC) unanimously decided to cut the benchmark repo rate by 0.25% to 6.25%. All six MPC members chose to retain the liquidity stance at “neutral”.

- Overall, we expect the current rate cut cycle to be a shallow one and expect one more 0.25% rate cut from the RBI in the April MPC meeting. However, we assign a high likelihood of further liquidity support to the financial system between now and the April MPC meeting.

- The RBI meeting was a positive for the domestic equity markets as the rate cut should lead to marginally lower borrowing cost for companies. The announcement to push back the implementation of more stringent Liquidity Coverage Ratio (LCR) measures to March 2026 is a clear positive for Financials. Hence, we retain our overweight stance on Indian equities, with a preference for the financials, industrials and healthcare sectors. As we expect 10-year yields to edge lower, we remain bullish on INR local currency bonds.

What happened?

On 7th February, the RBI’s Monetary Policy Committee (MPC) unanimously decided to cut the benchmark repo rate by 0.25% to 6.25%. At the same time, all six MPC members chose to retain the liquidity stance at “neutral”, allowing them the flexibility to move in either direction on rates or liquidity.

This was the first meeting under the new RBI Governor Malhotra, with markets looking at RBI guidance on rates, liquidity and regulations.

Heading into the meeting, we expected the RBI to cut rates by 0.25%, as we expected the central bank to increasingly focus on balancing both growth and inflation dynamics.

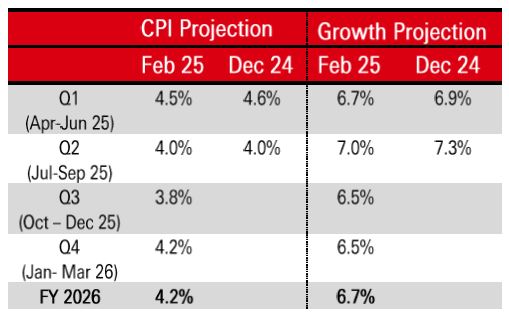

Latest projections by RBI MPC

Source: RBI, HSBC Global Private Banking and Wealth as of 7 February 2025

On the regulatory front, the central bank pushed back the implementation of more stringent LCR requirements to March 2026, and signalled a gradual implementation. We view this as a near-term positive for the financials sector.

In its updated projections, the RBI expects the economy to grow at 6.7% in FY 26 (Apr 2025 – Mar 2026) and expects inflation to average around 4.2% over the same timeframe.

The RBI Governor also spoke about using the flexibility embedded in the inflation targeting framework to improve outcomes and highlighted the central bank’s commitment to provide sufficient liquidity to the system. It is worth noting that the RBI has injected INR 2tn of liquidity over the past few weeks, through the use of a variety of instruments, such as OMOs, FX swaps and long-dated VRRs.

Overall, we expect the current rate cut cycle to be a shallow one and expect one more 0.25% rate cut from the RBI in the April MPC meeting. However, we assign a high likelihood of further liquidity support to the financial system between now and the April MPC meeting.

Investment implications

RBI’s FY26 growth and inflation projections indicate that the policymakers remain comfortable with India’s growth trajectory and expect further easing in inflation, broadly in line with our expectations.

While the monetary policy stance is still “neutral”, we believe that the RBI is likely to provide further liquidity over the coming months and deliver further rate cuts, which are positive for both equities and bonds.

In our assessment, the RBI meeting was a positive for the domestic equity markets from two aspects. First, the 0.25% rate cut and robust growth projections lead to marginally lower borrowing cost for companies - improving their margins - also encouraging them to resume capex. Secondly, the announcement to push back the implementation of more stringent Liquidity Coverage Ratio (LCR) measures is a clear positive for Financials.

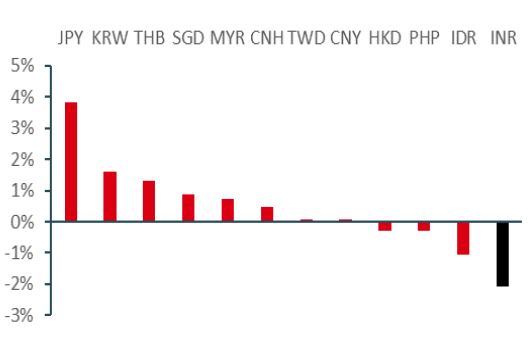

INR has been amongst the worst-performing Asian currencies in 2025

Source: Bloomberg, HSBC Global Private Banking and Wealth as of 7 February 2025. Past performance is not a reliable indicator of future performance.

Hence, we retain our overweight stance on Indian equities, with a preference for the financials, industrials and healthcare sectors.

Counter-intuitively, the 10-year Indian government bond yields rose by c.0.05% following the rate cut announcement. It was likely due to a combination of the fact that markets had largely priced in the rate cut prior to the meeting and potentially the disappointment that the RBI kept monetary policy stance unchanged at “neutral”. Nonetheless, we believe that further rate cut in April, along with the lower net supply indicated in FY26 budget and robust demand means that 10-year yields are likely to edge lower. We therefore remain bullish on INR local currency bonds.

With real interest rate differentials between the US and India close to flat, our expectation of a 0.25% RBI rate cut in April and Fed pause over the same period may lead to unfavorable dynamics for the INR in the near term.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/rbi-commences-the-rate-cut-cycle/