georgemiller

Publish Date: Tue, 11 Feb 2025, 12:02 PM

Key takeaways

- In recent weeks, the introduction and threats of US tariffs…

- …have caused shocks across markets…

- …and threatens what had been a steadily improving growthinflation mix.

Uncertainty is back with a vengeance in the global economy, with the first few weeks of President Trump’s second term leading to tariff announcements and delays, triggering market volatility across currencies, rates, equities, and cryptocurrencies.

Tariff impacts

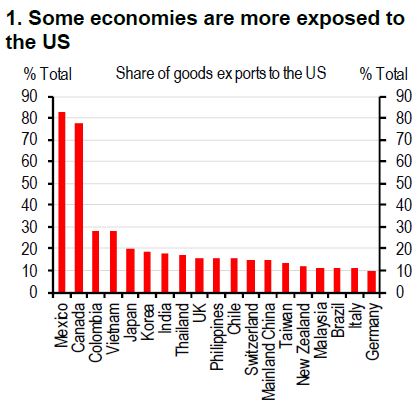

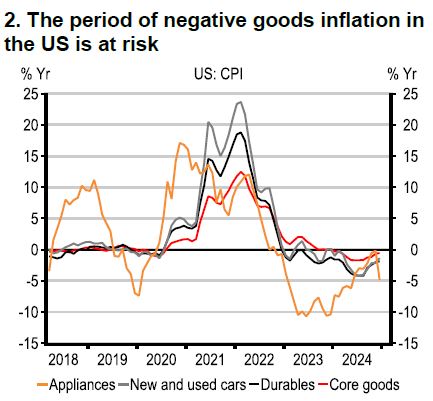

Should US tariffs and retaliatory action take effect, the impact could be significant, particularly for Canada and Mexico, given more than 75% of their exports go to the US (Chart 1). For now, US inflation has remained broadly under control (Chart 2), but tariffs risk upsetting that trend, potentially adding to goods inflation, even if US imports of goods are less than 10% of GDP.

At the same time, tariffs threaten both global trade and broader growth. The increased level of uncertainty in the global trading system is likely to weigh on investment plans, whilst supply chains are ripe for rejigging around any potential tariff targets.

Source: Macrobond, IMF DOTS

Source: Macrobond. Note: Estimates are baselines.

Activity data have been strong in the US…

That said, the US is starting the year from a position of strength after a barnstorming Q4 for consumers that saw consumption rise by 4.2% q-o-q annualised on the back of strong real income growth. Survey data suggest there could be further growth momentum into 2025, even if labour market indicators are a little more mixed.

…but generally softer across the globe

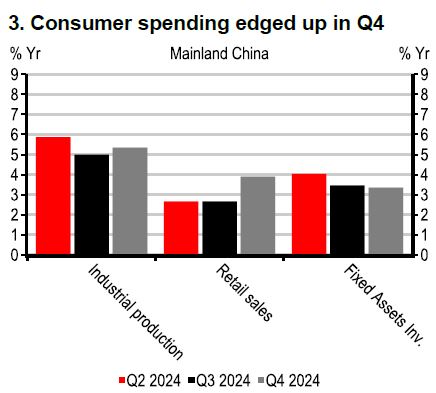

The rest of the world is vulnerable to this uncertainty – particularly mainland China – where an additional 10% tariff was imposed on 4 February. Growth revived in some areas in Q4 (Chart 3), but uncertainty over the future for exports and still subdued confidence look likely to hold back any significant growth recovery, absent a further substantial fiscal stimulus package.

Source: Macrobond

Source: Macrobond

In Europe, tariff threats further cloud a gloomy outlook, where continued struggles on the industrial front are not being offset by consumers opening their wallets. Despite tight labour markets in most economies and improving real incomes, confidence remains weak and GDP growth has ground to a halt in both the eurozone and the UK.

Across the emerging world, the previous growth star of India has shown some wobbles of its own, leading the Reserve Bank of India (RBI) into cutting rates, while in Brazil stronger growth data and a deteriorating inflation outlook have played a role in driving even more tightening from the central bank.

Heightened uncertainty

It’s a challenging world for central banks weighing up the inflationary and growth consequences of a tariff-related supply shock – at a time when food and gas prices are rising. The job isn’t made any easier as 2025 has started with the level of uncertainty pushed into a new gear.

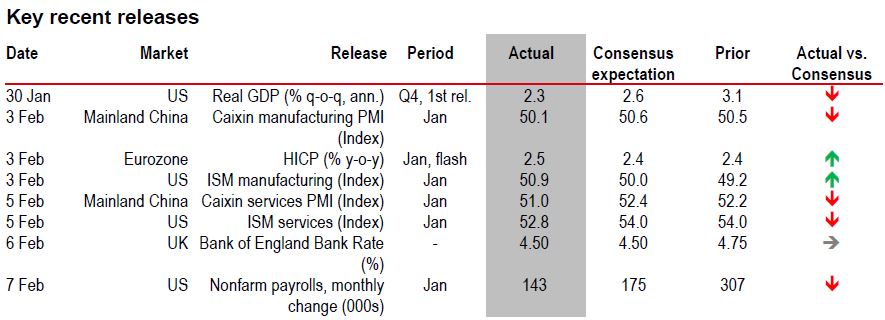

Source: Bloomberg, HSBC

⬆Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Datastream, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/tariff-threats/