georgemiller

Publish Date: Tue, 18 Feb 2025, 12:01 PM

Key takeaways

- Trade tensions with the US may have an impact on China’s growth, but could be a blessing in disguise…

- …if they help to accelerate structural reforms, among which fiscal reform is a high priority.

- The key objective is to enhance fiscal sustainability and streamline central-local fiscal relationships.

China data review (January 2025)

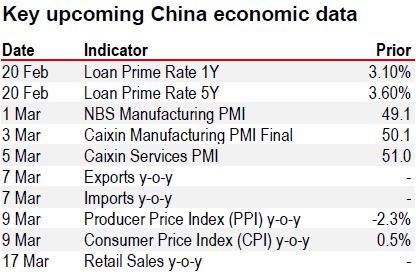

- China’s headline CPI inflation improved to 0.5% y-o-y in January, given a boost from an earlier Chinese New Year (CNY) holiday, which started in January this year instead of February last year. Core CPI y-o-y growth improved for the fourth consecutive month, up 0.6%, as strong travel activity during the holiday helped boost services consumption. On the producer front, PPI deflation remained unchanged at 2.3% y-o-y as weak demand for industrial products may have weighed on prices.

- China’s January NBS PMIs showed a broad-based contraction in the manufacturing sector, a fall in construction, and a moderation in services activity momentum. While the earlier CNY holiday may have impacted activity as workers returned to their hometowns, these effects should be mostly mitigated by seasonal adjustments. Thus, the softer activity print means more needs to be done to help revive activity. We anticipate a strong policy push this year, led by fiscal stimulus, although the details will need to wait until March’s Two Session.

- Credit growth saw a strong seasonal start to the year in January driven by a surge in longer-term corporate lending (RMB4.8trn) as well as more elevated than usual government bond issuances (RMB693bn). An improvement in household longer-term lending is also an encouraging sign. The monthly increase in total social financing (RMB7.1trn) reached a new record high, while growth stayed steady at 8% y-o-y. That being said, durability of the boost to credit remains to be seen and we think policymakers will need to step up support in order to help cushion growth against increased global headwinds.

Speeding up reforms to counter external risks

While external uncertainties and rising trade tensions may present more challenges to China’s economy, they may also serve as a catalyst for more forceful fiscal easing and structural reforms. Among the policy initiatives laid out by the Third Plenum last year, fiscal sustainability was considered an important long-term objective, and essential for restoring local government fiscal discipline and tackling debt risks. We believe more details will be announced at the National People’s Congress in early March.

Fiscal reform to accelerate

In July 2024, the Third Plenum pledged to deepen China’s fiscal reforms and the meeting laid out three key themes: enhancing the budget system, refining the tax system, and streamlining the fiscal relationship between central and local governments; the latter received the most attention. While the recent RMB12trn local government debt swap is a positive step to addressing near-term financial pressure for local governments, more needs to be done to achieve fiscal sustainability and prevent recurrence of local government debt pressure.

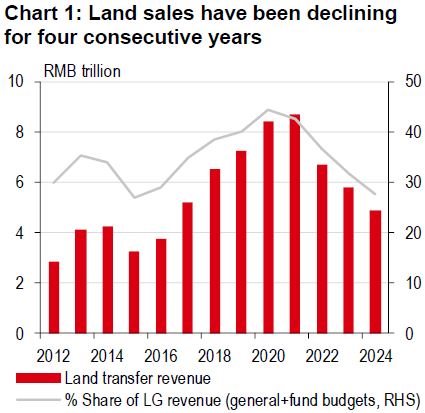

Among the various measures, establishing an incentive-compatible framework between central and local governments will play a vital role. This may include lifting the revenue share for local governments and increasing central government spending responsibilities. Indeed, with the recent economic slowdown and housing market correction, local governments have seen their traditional income sources decline for four years by a total of RMB3.8trn.

Source: Wind, HSBC

Source: Wind, HSBC

Reforming tax collection

Tax reform will be the cornerstone for streamlining the central and local government fiscal relationship. An example is shifting the collection point for consumption tax from production to consumption and giving a share to the local governments. This should boost local tax collection and incentivise local governments to focus more on consumption. Reforms may also aim to better align with new types of business (e.g., the digital economy), support key sectors (e.g., green development), and simplify the tax system by increasing the share of direct taxation.

Enhancing budget management

The Third Plenum suggested that all types of government resources should be placed under budget management for efficient resource allocation and enhancement of fiscal discipline, including both on- and off-budget revenue and spending. On the expenditure side, zero-based budgeting (where all expenses need to be justified each new fiscal year) will be advanced after rolling out several pilot projects, while a performance-based approach is expected to be adopted to improve budgetary management.

Source: LSEG Datastream

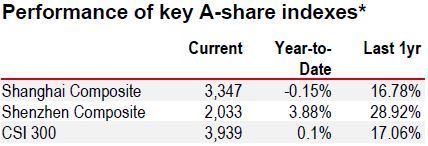

Note: *Past performance is not an indication of future returns. Priced as of 14 January 2025.

Source: LSEG Datastream

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/speeding-up-reforms-to-counter-external-risks/