georgemiller

Publish Date: Wed, 19 Feb 2025, 12:02 PM

Key takeaways

- Singapore’s 2025 budget strived to balance between providing generous short-term support to Singaporeans and supporting long-term priorities. Despite the increased social welfare announcements, the government guided towards a fiscal surplus of SGD 6.8bn (c. 0.9% of the GDP). We view the budget as supportive of Singapore’s short- and medium-term growth outlook.

- In the budget announcement, Prime Minister Wong acknowledged the cost-of-living pressures and announced several measures to support Singaporean households including SGD 800 vouchers for all Singaporean households and additional vouchers ranging from SGD 600 – SGD 800. The budget also focused on long-term priorities like R&D, clean energy, infrastructure, upskilling of population and measures to prepare for an aging society. We see the budget as supportive of growth and expect 2.6% GDP growth in 2025.

- We retain our overweight stance on Singapore equities. The budget announcements are mildly positive for Banks (the largest sector by index weight) and retail REITs. Despite the recent rally, Singapore equities trade at reasonable valuations and offer an attractive dividend yield. The measures to boost the attractiveness of Singapore’s stock exchange may lead to greater capital inflows in the longer run.

What happened?

Singapore’s Prime Minister Lawrence Wong announced the 2025 budget on 18th February. The budget, which comes ahead of the country’s 60th anniversary of independence, was broadly in line with our expectations as it strived to balance between providing generous short-term support to Singaporeans and keeping an eye on long-term priorities.

In his first budget as the Prime Minister, Mr. Wong acknowledged the cost-of-living pressures and announced several measures to support Singaporean households.

PM Wong also announced support measures for companies grappling with higher costs. The government would offer a 50% rebate on corporate taxes capped at SGD 40k.

Dubbed as “Onward Together for a Better Tomorrow”, the budget was also notable in its focus on strengthening the medium-term growth potential of Singapore. The budget announced additional top-ups for the National Productivity Fund (SGD 3bn), Future Energy Funds (SGD 5bn) and Changi Airport Development Fund (SGD 5bn). Additionally, PM Wong announced SGD 1bn to fund a national semiconductor fabrication facility and a SGD 1bn Private Credit Growth fund to finance high-growth local businesses.

To upskill the workforce and prepare for an aging society, the government bolstered the SkillsFuture program, allowing part-time training with fixed allowance for citizens above the age of 40. The government also extended the senior employment credit scheme by one year, offering wage offsets for companies hiring Singaporeans above the age of 60. Additional support for seniors in the form of top-ups through the MediSave scheme was also announced. Overall, the plans are to spend SGD 124bn in 2025.

While Singapore may not be directly targeted by the US for trade tariffs, given that Singapore runs a trade deficit with the US, uncertainty around global trade is a headwind to an open economy like Singapore. In our view, the budget leaves room for the government to provide additional support for the economy should downside risks increase due to global trade uncertainty.

Overall, we expect Singapore’s economy to expand by 2.6% in 2025, closer to the upper end of the 1-3% range indicated by the government.

Investment implications

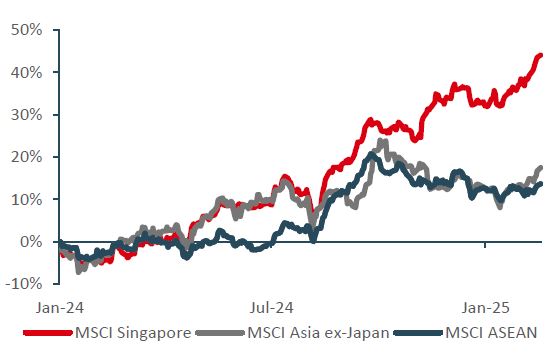

The budget largely reinforces our bullish stance on Singapore equities, which have outperformed Asian and ASEAN counterparts since the start of 2024 on the back of strong fundamentals, which remain in place. The enhanced cost-of-living support measures should support domestic consumption.

The measure to provide tax relief to smaller companies and to provide wage offsets to companies hiring senior employees should further boost employment. The measure is a marginal positive for banks as it should result in lower credit stress.

The proposed tax incentives for companies listed in Singapore and fund managers who invest “substantially” in Singapore-listed equities may result in additional capital inflows.

Singapore equities have outperformed ASEAN and Asian equities since the start of 2024

Source: Bloomberg, HSBC Global Private Banking and Wealth, as at 18 February 2025. Past performance is not a reliable indicator of future performance.

While the banking sector is likely to face modest margin pressures due to lower interest rates, we believe their focus on wealth management and expansion to neighbouring countries should help offset some of these headwinds. The real estate sector, especially REITs, should benefit from lower yields as most of the major central banks and the MAS ease monetary policy.

Singapore equities are still trading at reasonable valuations. This combined with their attractive dividend yield could lead to greater investor interest, especially from investors seeking to generate regular income. Outside of financials and property, other sectors such as telecoms and utilities are also picking up traction as yield plays.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/singapore-budget-2025-something-for-everyone/