georgemiller

Publish Date: Mon, 03 Mar 2025, 12:01 PM

Key takeaways

- As widely expected, the RBA started its easing cycle by delivering a 25bp hawkish cut at its first meeting in 2025.

- The RBNZ delivered the much anticipated third straight cut of 50bp, and is expected to slow its easing pace from here.

- Rate differential with the US could eventually drag the AUD and the NZD, but external factors are crucial over the near term.

External drivers continue to dominate the price action in AUD-USD and NZDUSD. A number of two-sided risks, such as China’s fiscal agenda, various US trade policy deadlines, and developments on the Russia-Ukraine front, are set to unfold over the next few weeks. For example, tariff developments could impact both the AUD and the NZD via risk appetite channel, but targeted US tariffs on China may hurt the AUD more, whereas VAT-related tariffs may weigh on the NZD more.

But looking beyond the near-term movements, fundamental factors, especially their terminal rate differentials with the USD, could eventually weigh on the AUD and the NZD over the medium term. Unlike the Federal Reserve (Fed), which held rates unchanged, the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) both cut rates, as expected, at their first meetings in 2025.

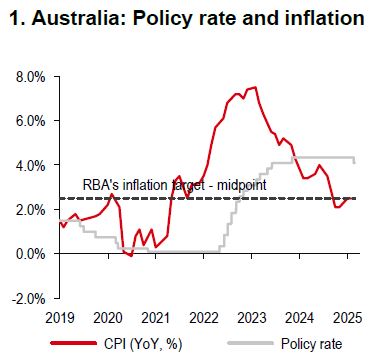

On 18 February, the RBA delivered its first interest rate cut after more than four years, lowering its cash rate by 25bp to 4.1% (Chart 1). However, the overall tone was quite hawkish, with the statement saying that “the Board remains cautious on prospects for further policy easing”. Our economists expect the next RBA cut to be in 3Q25, while markets have priced in a c60% chance for this to happen in May (Bloomberg, 27 February 2025), amid softer CPI inflation. Australia’s weakening current account balance could also drag the AUD over the medium term.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

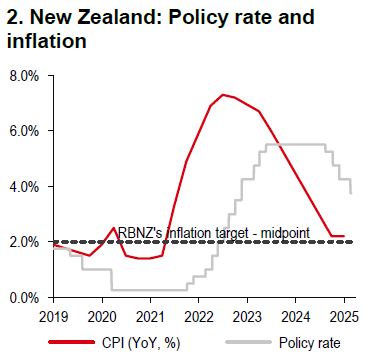

A day after the RBA’s announcement, the RBNZ cut its cash rate by 50bp to 3.75%. In the face of a weak domestic economy where GDP has fallen, the unemployment rate has risen significantly, and this has brought inflation back to target (Chart 2). But with a total of 175bp of cuts delivered since August 2024, our economists expect the RBNZ to slow its easing pace from here, with 75bp of further cuts probably being delivered, taking the cash rate to 3.00% by 3Q25. The NZD may also face risks of an underfunded current account deficit, as foreign ownership of New Zealand government bonds remains high.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/aud-and-nzd-after-rate-cuts-in-february/