georgemiller

发布日期: Wed, 12 Mar 2025, 12:02 PM

Key takeaways

- Uncertainty around US tariffs continues…

- …creating both growth and inflation risks…

- …with survey data heading in the wrong direction across the board.

Global sentiment, both on the consumer and business fronts, has taken a hit in recent weeks, with uncertainty around tariffs, geopolitics and price spikes starting to show up in the data.

Subdued data

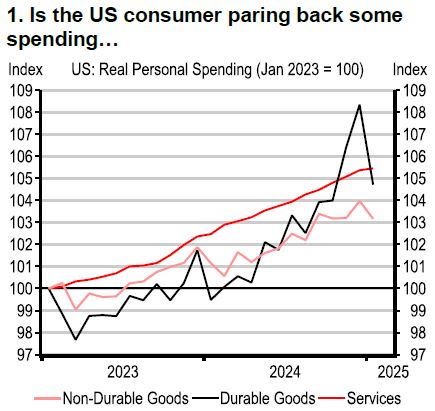

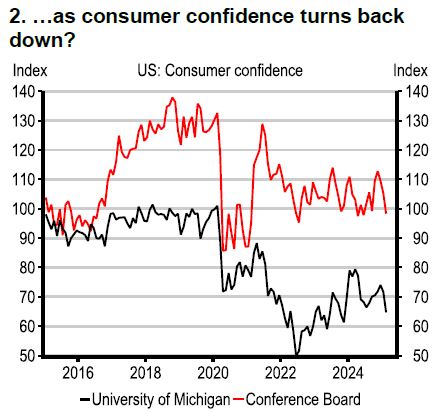

The post election run up in US survey data, risk asset prices and broader optimism has come off the boil in recent weeks. Almost every survey reading that we follow has dipped, some sharply, and the limited hard data we’ve had since the start of the year point to a US economy that may be slowing sharply.

Of course, tariffs are a key part of this, and trade-related uncertainties continue to dominate news headlines, with tariffs on Canada and Mexico and further tariffs on Chinese goods coming into force, as well as plans for a much wider set of tariffs on a variety of goods and economies. The early-April decision on reciprocal tariffs for economies with import taxes on US goods looms large for many across the world.

Source: Macrobond

Source: Macrobond

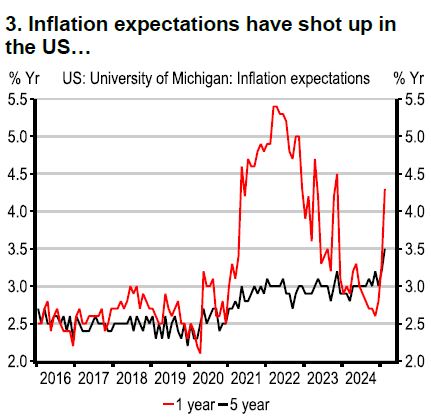

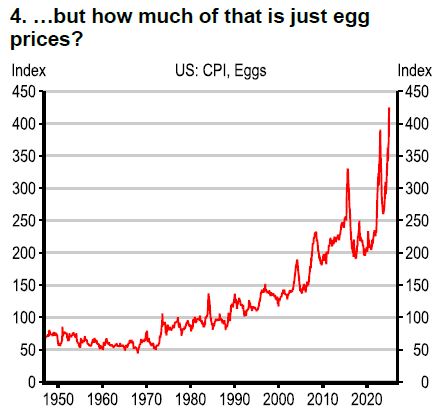

But equally, for American consumers, some are worried about their job prospects from the cuts across government (and the spillovers to private contracts), while others are getting more nervous about inflation – with expectations rising sharply in the latest surveys. How much of that is tariffs, and how much is egg prices remains to be seen.

Source: Macrobond

Source: Macrobond

Confidence remains soft

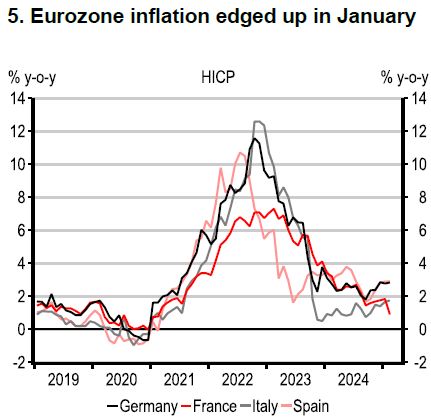

In Europe, where confidence has been subdued for some time, rising energy and food prices threaten the progress made on inflation. Adding the risk of tariffs in the coming months and uncertainty about the geopolitical situation in Ukraine, it’s no surprise that growth in the region has been sluggish. The hope is that the increased spending from Germany helps to turn this around, and that is being reflected in the strong moves in European equities in recent weeks.

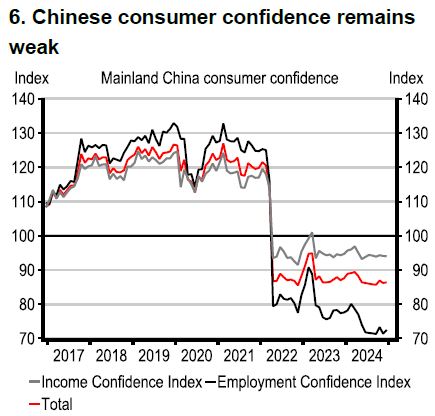

In Asia, much will depend on the success of Chinese stimulus measures. Faced with the impact of tariffs from the US, policy has focused on the domestic economy, and the National People’s Congress saw the growth target for 2025 set at 5.0% and more fiscal stimulus measures announced.

Source: Macrobond

Source: Macrobond

There is also a question of how much of any resilience seen in the manufacturing data in early 2025 is just front-loading. US imports surged in January and surveys have picked up. But if the decline in shipping rates post the Lunar New Year are anything to go by, it looks like we may be seeing a pay back in demand – suggesting further downside risks.

Policy-related uncertainties aren’t likely to go away in the coming months. That makes for a very uncertain world for policymakers, and we expect central banks to be cautious, even if rate cuts are likely to continue. The world, however, needs the confidence to improve.

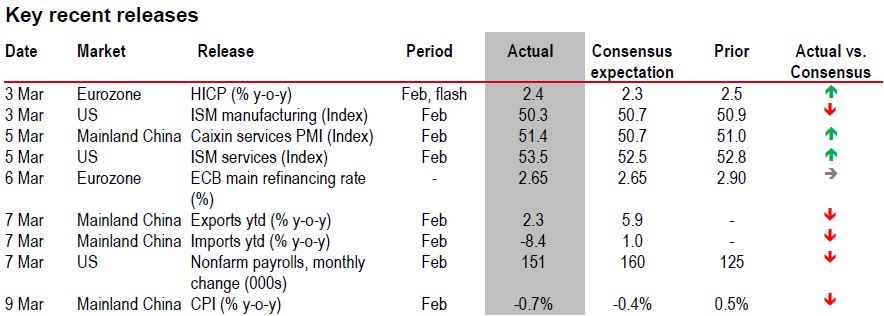

Source: Bloomberg, HSBC

⬆Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/needing-a-confidence-boost/