georgemiller

Publish Date: Mon, 17 Mar 2025, 08:06 AM

Key takeaways

- Political change in Germany and the broader debate around US outperformance have weighed on the USD lately…

- …but recent tariff headlines received only muted FX reaction.

- Beyond near-term movements, we expect the USD to remain strong over the long run.

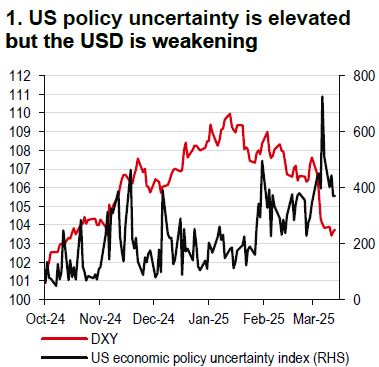

The US Dollar Index (DXY) has declined to its lowest level since November 2024, hovering around 103-104 recently. The USD’s poor showing is partly due to the German election and the incoming government’s change in fiscal stance, which have played an important role in benefiting the EUR of late. It is also because markets have reservations about the US growth outlook, treating US policy uncertainty as USD negative, rather than a source of expected USD strength (Chart 1).

Germany’s fiscal package is likely to be positive for the EUR over the near term, thereby weighing on the USD. However, it is not certain that the German and Eurozone growth outlooks will improve rapidly, given implementation risks. Plus, some of this euphoria could be offset by US tariffs that could also turn the USD stronger against the EUR and other currencies.

At the moment, tariff risks remain underpriced. The EUR shrugged off the arrival of new tariffs on exports to the US, and retaliatory tariffs from the EU on 12 March. Similarly, the CAD did not react to the escalation in trade conflicts between the US and Canada. These recent tariff headlines received only muted FX reaction, which suggests that this is all temporary noise that will be resolved.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

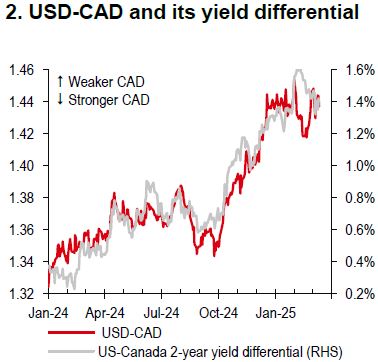

Against the backdrop of an intensifying trade war, the Bank of Canada (BoC) delivered a 25bp cut at its 12 March meeting, taking its policy rate down to 2.75%. The decision was expected, bringing total easing since June 2024 to 225bp. BoC governor, Tiff Macklem, called the trade battle between the US and Canada a “new crisis” (Bloomberg, 13 March 2025). USD-CAD continues to hover around its year-to-date average of 1.43-1.44, tracking closely with its yield differential (Chart 2). As such, if a prolonged trade war happens, significant policy easing by the BoC could see USD-CAD surge, but this is not our base case.

Our central case is that the USD will probably recover some lost ground over the long run, as US tariffs rise, the Federal Reserve does not cut more than what is already priced, and the rest of the world begins to look less exceptional again.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-still-scope-to-recover/