georgemiller

Publish Date: Tue, 18 Mar 2025, 12:02 PM

Key takeaways

- China’s National People’s Congress (NPC) announced a c5% GDP growth target and steady policy support.

- Policy is shifting to supporting consumption and rolling out structural reforms to urbanise the migrant population.

- New laws to build a business-friendly environment should boost confidence and facilitate innovation.

China data review (January-February 2025)

- Retail sales rose by 4% y-o-y in January-February on the back of the recent expansion in consumer durable goods trade-in programs. Consumer durable goods trade-ins were front-loaded in January with a quota of RMB81bn, which was expanded to include consumer electronics (phones, tablets, and smart watches). By category, communications appliances (+26%) and household appliances (+10.9%) were the stand outs.

- Despite the improvement in consumption figures, there are warning signs that the key drivers for consumption growth (income and wealth) are facing pressure, with the unemployment rate rising to 5.4%, the highest level since 1Q23. Meanwhile, the property market remained under pressure as property investment declined 10% y-o-y in January-February, residential floor sales fell 3.4%, and new floor starts were down 29% y-o-y.

- Industrial production sustained elevated growth rates, up 5.9% y-o-y in January- February, due to robust export growth and equipment trade-in programs. However, there may be some pressure on manufacturing to come with the impact of tariffs and a drag from global demand is likely to pick up. Meanwhile, policy moves to adjust industrial capacity in some sectors such as steel may also be accelerated, which could lead to a near-term hit for production, although this should help lead to better adjustment in prices and in turn profitability.

- Headline CPI contracted 0.7% y-o-y in February given distortions from the earlier (January) start to the Chinese New Year (CNY) holiday this year and a plunge in food prices. Indeed, the National Bureau of Statistics noted that excluding the earlier CNY, CPI actually rose 0.1% (NBS, 9 March). Meanwhile, PPI deflation saw a slight improvement to 2.2% y-o-y in February amid recovery of some demand for industrial products.

- Exports rose 2.3% y-o-y in January-February showing resilience despite the implementation of 10% US tariffs on 4 February. Indeed, exports continued to rise, both to the US (+2.3%) and to intermediary markets such as ASEAN (+5.7%) and Latin America (+3.2%). However, imports dropped 8.4% y-o-y in January-February, partly related to lower prices as well as supply-side adjustments in industrial sectors, e.g., iron ore imports were down 30%.

NPC wrap-up: Expanding domestic demand on all fronts

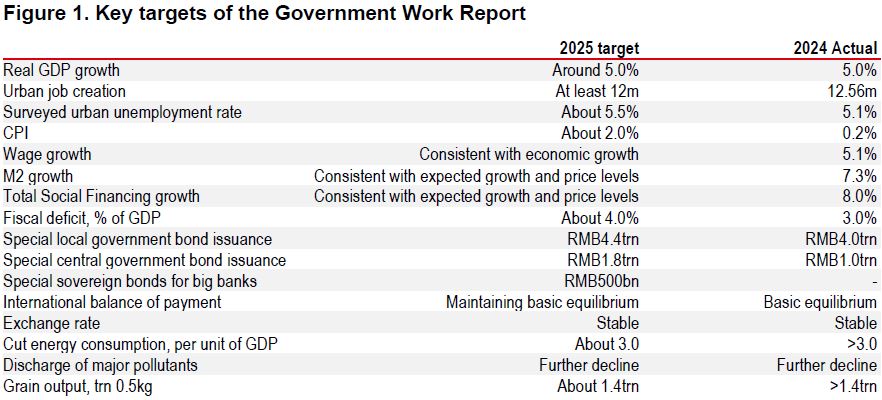

China’s week-long annual policy setting meetings concluded on 11 March. In addition to the key briefings on the Government Work Report and the fiscal budgets (Figure 1), there were six press conferences led by department heads throughout the week, highlighting key policy details for their respective fields. We discuss the key takeaways.

Plans to boost growth

Policymakers set an ambitious growth target of “around 5%” for 2025, while reiterating it would implement proactive macro policies to support growth. The Government Work Report and fiscal budgets provide overall guidance while the press conferences held throughout the week provided more details on how the government will prop up domestic demand this year. This has become more critical as the global backdrop remains highly uncertain and more tariff risks remain on the horizon. The key policy themes were centred around boosting technology and innovation, unlocking consumption in more areas (e.g. services) and accelerating support for China’s structural transition. Now, it comes down to implementation.

Technology development in the spotlight

Various department heads noted a range of measures to support ongoing technology innovation and adoption, which should help build on the recent momentum stemming from new Artificial Intelligence (AI) developments in China such as DeepSeek and Manus. The policy measures announced were broad and emphasised capital market and financing support such as the development of a technology board for the bond market, promotion of merger and acquisitions for more indebted technology companies, expanded relending facilities for technology transformation, and boosting education capacity.

Building a business-friendly environment

While DeepSeek’s success has lifted business confidence regarding China’s technology innovation, a broad-based recovery is still needed. A new law aimed at ensuring the legal protection of private enterprises – the Private Economy Promotion Law – is on a fast-track, while the construction of a unified national market is likely to accelerate, which is designed to tackle internal trade barriers and level the playing field (source: Xinhua, 9 March).

Cyclical and structural policies to boost consumption

Domestic demand strength is likely to rely on sustainable consumption growth. To support this, direct cyclical policies have been expanded (e.g. funding for consumer durable goods trade-in programs doubled to RMB300bn), more spending is earmarked for higher quality public services, and measures have been rolled out to boost household disposable income. Of particular importance is the upgraded ‘Hukou reform’ – c300m migrant workers and their families will be eligible for public services, including schools, healthcare, and social housing based on their residence.

Other structural policies include increased support for lower income groups and social welfare such as increasing minimum basic standards for pensions (which should help 320m people), increasing fiscal subsidies for medical insurance, and the gradual rollout of free pre-school education – currently China provides nine years of free, compulsory education covering primary school and middle school years. Such policies can help to improve income levels, unlock precautionary savings, and also help to address demographic challenges.

There’s also an emphasis on supporting service consumption, which only accounts for c50% of total consumption spending despite the rapid growth witnessed post-pandemic. The commerce minister said that the primary challenge in developing service consumption is the shortage of quality supply. In addition to supporting domestic players to provide diversified services, China is promoting opening-up in telecommunications, healthcare, and education industries as well as advancing the orderly opening of sectors including internet and culture.

Additional policies for China’s transition

Aside from expanding consumption and improving innovation, which are key aspects of supporting China’s longer-term productivity, there was also mention of adjusting capacity. While policymakers have lowered this year’s inflation target to 2%, there will be more policies to promote consumption, which should help CPI inflation. But equally important will be adjustments in supply. Policymakers have noted that they would aim to withdraw outdated and inefficient capacity, which could involve raising production standards or window guidance for firms. This should in turn help to lift prices and improve profitability for firms.

Source: Government Work Report 2025, Xinhua, HSBC

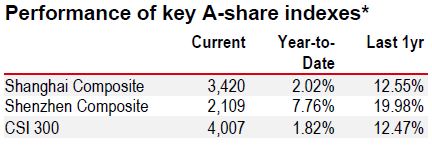

Source: LSEG Eikon

Note: *Past performance is not an indication of future returns. Priced as of 14 March 2025.

Source: LSEG Eikon

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/npc-wrap-up-expanding-domestic-demand-on-all-fronts/