georgemiller

Publish Date: Mon, 24 Mar 2025, 07:04 AM

Key takeaways

- As expected, the Federal Reserve kept rates unchanged at 4.25%-4.50%, making it the second consecutive pause.

- The FOMC’s latest summary of economic projections (SEP) showed slower GDP growth and higher core inflation vs. projections from December 2024. Mr. Powell acknowledged the increased uncertainty over the economic outlook amid policy changes, but reiterated the wait-and-see approach, apart from slowing the quantitative tightening process, which can be seen as a mild easing step.

- For US equity investors, the widespread use of tariffs and the potential for accelerating inflation continues to dampen the outlook for corporate profits and economic growth in 2025. Amid uncertainties, we expect US equities to remain volatile in the near term and continue to diversify into the Forgotten 493 stocks in the US and into international markets. We see tactical opportunities in credit as the Fed policy easing should resume soon and continue to expect three rate cuts this year (June, September and December).

What happened?

As expected, the Federal Reserve kept the federal funds target range unchanged at 4.25%-4.50%.

The FOMC continues to balance dual risks of higher short-term inflation due to tariffs on the one hand and the rising tail risk of recession (not our core case) due to the recent weakening of economic data on the other hand.

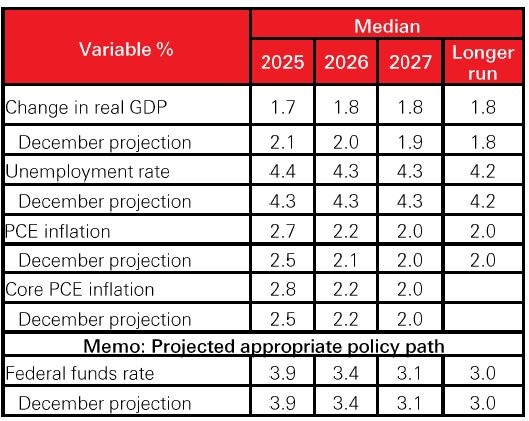

The latest summary of economic projections (SEP) showed slower GDP growth and higher core inflation compared to the previous set of projections made in December 2024.

The projection for the unemployment rate at the end of this year was raised modestly from the prior forecast. The inflation outlook was lifted, perhaps taking into account the potential implications of tariffs. However, inflation is still expected to reach the Fed’s 2% target by year-end 2027.

Median of the FOMC economic projections, March 2025

Source: Federal Reserve, HSBC Global Private Banking and Wealth as at 19 March 2025. Forecasts are subject to change.

In an attempt to mitigate damage caused by the Federal government passing the debt ceiling, effective 1 April 2025, the monthly redemption cap on Treasury securities will be reduced from USD25 billion to USD5 billion, while the cap on agency debt and mortgage-backed securities remains unchanged at USD35 billion. This adjustment signals a more gradual approach to balance sheet normalisation.

The potential downside risks to growth and upside risks to inflation, in part from tariffs and trade policy uncertainty, create a complication for the monetary policy outlook.

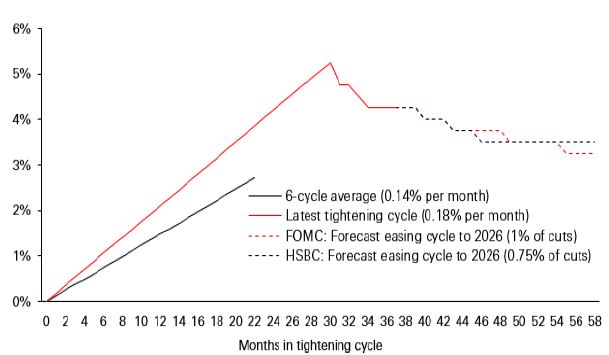

The dot plot, which provides insights into the Committee's expectations for the Federal funds rate, shows that the median projection for 2025 is 3.875%, implying two 0.25% rate cuts by year-end, i.e. a total reduction of 0.50% from the current midpoint of 4.375% (within the 4.25%-4.50% range). We continue to forecast 0.75% of rate cuts in 2025, followed by no change in policy rates in 2026.

Will the most aggressive Fed tightening ever result in aggressive easing as well?

Source: Bloomberg, HSBC Global Private Banking and Wealth as at 19 March 2025. Forecasts are subject to change.

Powell described tariff-driven inflation as potentially transitory and highlighted that short-term inflation expectations have risen due to tariffs, but long-term expectations remain “well-anchored” near the 2% target, suggesting confidence in the Fed's ability to manage inflation over the long run. He explained that central bankers often view tariff effects as one-time price level increases rather than ongoing inflation, unless they trigger broader changes in consumer behaviour or retaliation cycles. He noted that the Fed has revised its 2025 core PCE inflation forecast upward to 2.8% from 2.5%, reflecting these pressures, but stressed the need for more data to assess whether these effects will persist or fade over time.

He also estimated a roughly 1-in-4 chance of a recession over the next year, noting that while some forecasters have raised recession probabilities, they remain at moderate levels.

Investment implications

For fixed income investors, while the disinflation process is occurring more slowly than previously forecast, it seems that the Fed is content with inflation heading toward 2%. As a result, the Fed policy easing should resume soon, which means any backup in market rates is an opportunity. We maintain our preference for an active approach in fixed income.

For US equity investors, the widespread use of tariffs and the potential for accelerating inflation continues to dampen the outlook for corporate profits and economic growth in 2025. The FactSet consensus earnings growth estimate for the S&P 500 has been revised from 15% to 11.5%.

This sizable downward revision should incorporate a mild slowdown in economic growth and tighter corporate margins if tariffs are enacted and companies choose to absorb part of the increased price levels. Until the tariff policy decisions are finalised, US equities may remain volatile and the outlook for corporate profits is uncertain.

It is also important to note that despite the near-term risks, the 2026 forecast for S&P 500 corporate earnings shows a sharp acceleration to 14.2%. Valuations are now much more reasonable, and market sentiment is fairly weak, suggesting that perhaps the worst of this repricing of US equities may be behind us soon.

We believe diversification is key and continue to diversify into the Forgotten 493 stocks in the US and across sectors and markets, including China, Singapore, Japan and India. Multi-asset portfolios with an active approach are best placed in this environment to manage ongoing uncertainties.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/the-fed-stays-patient-recognising-increased-economic-uncertainty/