georgemiller

Publish Date: Mon, 24 Mar 2025, 08:05 AM

Key takeaways

- The BoE kept rates on hold in March, with a small hawkish surprise in the MPC vote split; GBP-USD largely steady.

- When growth concerns become more dominant, markets are likely to price in more BoE cuts, thereby weighing on the GBP.

- The GBP also tends to underperform in periods of high uncertainty.

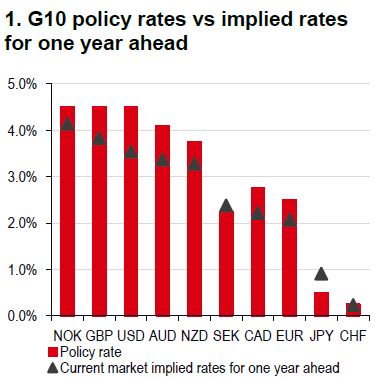

‘Uncertainty’ is the unsurprising catchphrase among major G10 policymakers at their March meetings, despite the difference in their policy rates (Chart 1). The most recent monetary policy announcement came from the Bank of England (BoE) on 20 March, which also stressed increased uncertainties in the statement. Like the Federal Reserve, the BoE also kept rates steady, as widely expected. (Please read FX Viewpoint Flash: “Fed held rates steady again, trade policy key for USD” for more details.) GBP-USD held relatively steady, despite a small hawkish surprise that only one monetary policy committee (MPC) member, Swati Dhingra, dissenting in favour of a 25bp cut, after two voted for a 50bp cut in February.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

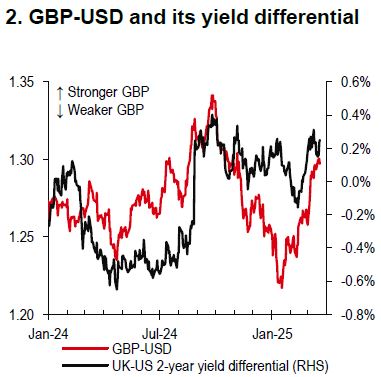

The BoE’s slow and steady pace of easing has led to a relatively stable interest rate outlook versus the US. Indeed, larger moves in US rate expectations have driven yield differential and GBP-USD over the past year (Chart 2), as markets are more concerned by the potential impact of tariff policy on the US economy.

Over the near term, the risks of US tariffs on Europe from April and an announcement from US President Trump on reciprocal tariffs, among others, would probably pose downside risks to the GBP, as the currency tends to underperform in periods of high uncertainty.

As US tariffs rise, weakness in the European and global economy would spill over to the UK economy, which has been struggling. UK survey data in recent months has shown softer labour demand, which is likely to weigh on wage growth and new hiring, pushing unemployment higher over the coming months. It also looks like fiscal policy will tighten, but it is not known when or by how much. Our economists’ base case is that growth and employment concerns will come to dominate over inflation worries. As such, when markets start to price in more BoE cuts, the GBP is likely to face downside risks.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gbp-usd-holding-the-line-for-now/