georgemiller

发布日期: Wed, 26 Mar 2025, 12:02 PM

Key takeaways

- Trade tensions are set to intensify, weighing on exports and investment across ASEAN.

- But cooling inflation and policy easing should provide a floor under domestic demand...

- ...helping the region’s economies endure the challenges in the year ahead with customary poise.

Indonesia is looking to rate cuts to help its economy and appears less exposed to the global tariff turmoil than many of its neighbours. Thailand may clock a similar pace as last year, even if the consumer looks increasingly out of breath. The Philippines may step it up a notch, driven by domestic momentum and limited exposure to global trade tensions. In Malaysia, investment is still strong, on both the public and private side, providing a floor to growth as the trade outlook turns more uncertain. Singapore will not fully escape the global turmoil, being a more open economy than most, but a slight fiscal lift will cushion things at home. In Vietnam, growth ambitions remain high, even as the risk of tariffs clouds the outlook, which may force greater fiscal spending.

Economy profiles

Key upcoming events

Source: LSEG Eikon, HSBC

Indonesia

A new innings

With Prabowo Subianto taking over as Indonesia’s president in October 2024, all eyes are on the key policies the new government champions. In the election campaign, Prabowo spoke at length about higher social welfare spending, SOE reform, and continued efforts on manufacturing down-streaming. So far, there have been key announcements on the first two. The government unveiled a free food scheme for children, a rice assistance programme, an electricity tariff discount, an accelerated housing programme, and limited the VAT rate hikes. On the SOEs front, a new Sovereign Wealth Fund (SWF) known as Danantara, reporting directly to the president, has been launched. It is mandated to oversee SOE functioning and drive investment. More clarity is now needed on the role of the erstwhile SWF, and the role of the SOE ministry.

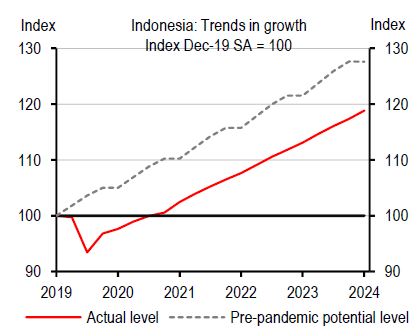

Meanwhile, growth momentum has been soft going by the PMI, bank credit growth, and core inflation. Our nowcaster model points to growth of 4.5-5%, lower than official GDP numbers of about 5%. And GDP numbers remain 7% below the pre-pandemic trend, signifying a negative output gap. As such, there is a case for looser fiscal and monetary policy in 2025.

Indonesia also wants to raise potential GDP growth as a policy priority. We believe breaking away from commodity price swings by raising geographically diversified and higher value-added exports could bring large gains. Some good things have happened in recent years. Indonesia has gained market share in global exports. It has a trade surplus with the US, and a falling trade deficit with China. But these haven’t been able to lift domestic growth, as about half of the exports are commodity-related with limited backward linkages.

However, there are encouraging nascent signs of export diversification. Indonesia’s exports to the US look very different, in fact a lot like Vietnam’s export mix, comprising a lot more apparel, footwear, electronics, and furniture. Vehicle exports to ASEAN are rising, as are electronics exports to the US and Latin America. But these are still rather small (for instance, just 9% of Indonesia’s exports go to the US) and need to be scaled up. Is that doable against an increasingly challenging global backdrop of rising trade protectionism? It would not be easy but is not impossible either. Indonesia doesn’t run a formidable trade surplus with the US, which could arguably protect it from large tariff increases. It could even benefit from supply chains getting rejigged in response to new tariffs on key exporters. But work on several fronts would be needed: enhancing infrastructure development, expanding trade agreements, developing a skilled workforce and streamlining business practices.

Indonesia runs a negative output gap

Source: CEIC, HSBC

Inflation is well below BI’s 2.5% target

Source: CEIC, HSBC

Malaysia

A steady ship in choppy waters

Malaysia has been gaining attention on the international stage, and it’s not hard to spot the reasons for optimism. To name just a few, the MYR was the best performer in Asia in 2024, growth accelerated to 5.1% and large tech giants have committed billions of dollars of investment. Political stability and policy reforms have contributed to better sentiment both onshore and offshore.

The question is, can Malaysia’s positive momentum be sustained in 2025? It’s not an easy one to answer, as global uncertainty introduces volatility. That said, there are good reasons to believe in Malaysia’s robust economic fundamentals. Keeping the ship steady is the key task in 2025.

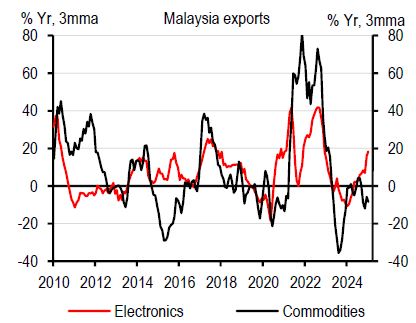

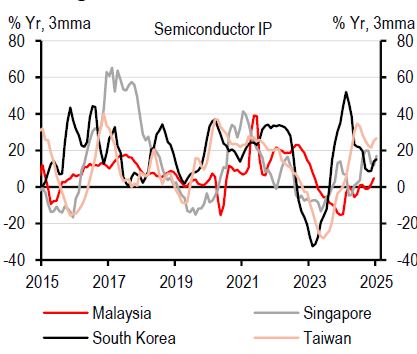

As a tech-exposed economy, there is more room for Malaysia’s trade to improve, as net exports contribution to growth was minimal in 2024. After all, Malaysia has seen a much slower recovery in semiconductor production than peers. That said, there is a large degree of uncertainty in the US administration’s tariff policies. The good news is that Malaysia’s well-diversified trade portfolio and not-so-chunky trade surplus with the US may offset some tariff risks. However, the US’s proposal of a 25% tariff on semiconductor imports may cloud Malaysia’s trade prospects.

Despite external uncertainty, Malaysia has the domestic strength to mitigate some of the impact. There are pockets of resilience in private consumption, given still generous subsidies and wage hikes in civil servants’ pay. On investment, the country has been witnessing an investment boom, thanks to ongoing infrastructure projects and FDI inflows, though the latter may see some near-term caution among investors, given tariff uncertainty.

All in all, we cut our 2025 growth forecast slightly to 4.7% (previous: 4.8%), reflecting our caution on global trade prospects. We keep our 2026 growth forecast at 4.5%.

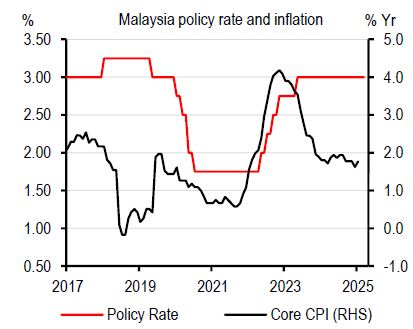

In addition, inflation remains in check. Headline inflation decelerated slightly to 1.7% y-o-y in January, down from 1.8% in 2024. Given subdued inflation momentum, we lower our headline inflation forecast to 2.4% for 2025 (previous: 2.7%). That said, we acknowledge upside risks to inflation from the potential subsidy rationalisation on RON95, expansion of sales and services tax (SST) coverage and civil servants’ wage hikes. We believe that Bank Negara Malaysia (BNM) will likely keep its policy rate unchanged at its comfortable level of 3%, a view we have held for some time.

Electronic exports continue to rebound but commodities have been contracting

Source: CEIC, HSBC

Inflation has remained benign, providing room for BNM to stay on hold

Source: CEIC, HSBC

Philippines

From the Fed to ASEAN

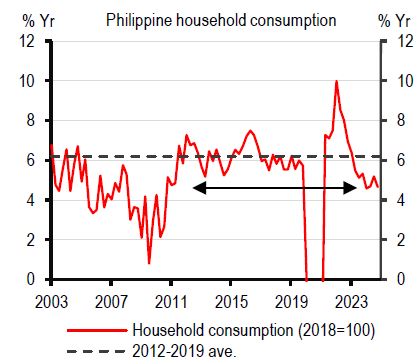

Growth came in below expectations for the second consecutive quarter in Q4. But this time, it was for a different reason. In Q3 2024, growth underperformed as typhoons took a toll on agriculture and tourism. The next quarter was more of a demand-side issue; growth surprised to the downside again as household consumption – the country’s driver for growth – decelerated to its slowest pace since the Global Financial Crisis. The slowdown, however, was not a result of households buying fewer staples. Rather, it was because they were buying fewer big-ticket items, or goods that often require a loan to purchase. Based on the Bangko Sentral ng Pilipinas’ (BSP) Consumer Sentiment Survey, households are purchasing fewer vehicles, gadgets, and education – all goods and services that are pricey enough to require credit. And, true enough, credit growth by large banks continues to clock a pace that is well below pre-pandemic levels. With consumption down, 2024 growth undershot the government’s 6-8% target for the second consecutive year at 5.6%.

If inflation took growth hostage back in 2023, high interest rates are taking a toll on the economy today. Hence, it came as a surprise when the BSP decided to start 2025 by pausing its easing cycle. The BSP was clear in its rationale: it wanted a buffer against the risk of a sharp re-pricing of Federal Reserve rates to manage any potential volatility in the peso. Nonetheless, cognizant of tight financial conditions, the BSP signalled that it is still in the middle of an easing cycle.

Once the dust settles, we expect the BSP to continue its gradual easing cycle, cutting the policy rate by 25bp each in April (previous: June), August, and December this year, bringing the policy rate to 5.00% by year-end 2025. Together with the upcoming Required Reserve Ratio cut in March, further monetary easing should rehydrate consumption and investment, and improve growth in 2025.

We expect full-year growth to be resilient at 5.9%. Apart from the support from monetary easing, the Philippines is among the most insulated economies in Asia when it comes to tariff risks. It doesn’t have a large trade surplus with the US, nor is it highly exposed to the risk of reciprocal tariffs. The country’s services exports, with digitalisation making services more tradable, also continue to make strides, growing 11% q-o-q seasonally adjusted in Q4 2024. Low inflation should also help buttress demand, more so with rice prices set to cool even further throughout the year.

Growth in household consumption decelerated to its slowest pace since 2010

Source: CEIC, HSBC

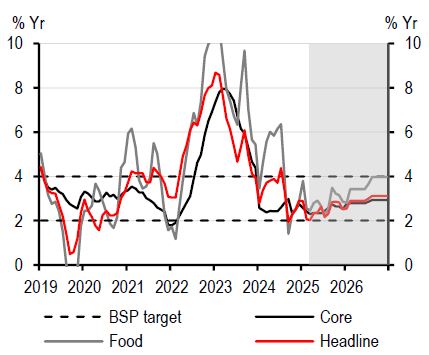

With inflation subdued, the economy has room to absorb FX-induced inflation

Source: CEIC, HSBC. NB: Shaded area represents HSBC forecasts.

Singapore

An election year budget

Singapore ended 2024 on a strong footing, largely benefitting from a trade upswing. This resulted in a more-than-decent pace of growth of 4.4% as a developed market (DM) for the whole year. That said, challenges and uncertainties warrant more policy support.

Despite strong growth in 2024, unevenness persisted. For one, the manufacturing sector’s recovery was largely aided by the rebound in electronics and the precision and transport engineering sectors. That said, it was dragged down by the pharmaceutical output, given that sector’s volatile nature.

The same trend was also observed in the services sector. While wholesale trade saw sustained strength, thanks to the positive spillover impact from a rebound in manufacturing, consumeroriented sectors contracted, suggesting a significant shift in spending by locals overseas that was not offset by the increase in international tourists.

Despite a rosy 2024 GDP print, 2025 is characterised by challenges. While Singapore may not be directly targeted by the US, as it is the only ASEAN country that runs a trade deficit, and has a Free Trade Agreement with the US, trade turbulence will likely cloud its growth prospects. Meanwhile, weakness in some domestically oriented services may also persist. While inflation has behaved well in the past year, elevated cost-of-living pressure remains a key concern. All in all, we maintain our growth forecast at 2.6% for 2025, at the upper end of the government’s growth forecast range of 1-3%, but we have tweaked our quarterly profile of GDP prints.

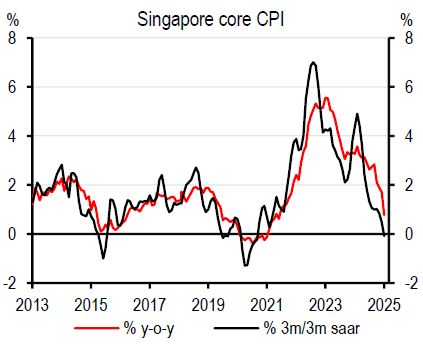

In addition, inflation has made good process. Core inflation decelerated from 4.2% in 2023 to 2.8% in 2024, on broad-based cooling of price pressures. Entering 2025, core inflation in January even fell 0.7% m-o-m seasonally adjusted, the largest drop in almost five years. This translated into subdued y-o-y inflation of only 0.8%, undershooting the Monetary Authority of Singapore’s (MAS) forecast range of 1-2%. Given the downside surprise in January and likely continued disinflationary forces from trade tensions, we revised down our core inflation forecast to 1.3% for 2025 (previous: 1.9%).

Singapore’s tech production has picked up, following Korea and Taiwan

Source: CEIC, HSBC

Singapore’s core inflation has decelerated quicker than expected

Source: CEIC, HSBC

Thailand

Wheel and axle

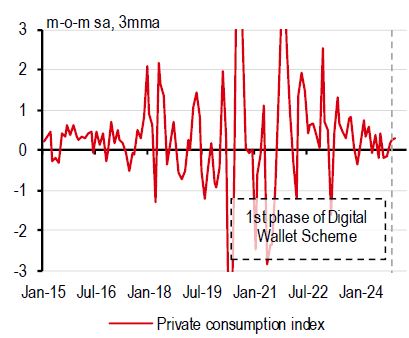

The end of the year wasn’t the positive outcome many had expected for the economy. Many had thought growth would be robust due to the implementation of the first phase of the Digital Wallet Scheme, a fiscal stimulus that gave THB10,000 of cash to each of Thailand’s most vulnerable citizens in Q4 2024. Still, growth in the quarter surprised to the downside with the impact of the stimulus limited. Many handout recipients used the cash to pay down debts and, as a result, private consumption did not accelerate as expected. After all, the household debt-to-GDP ratio in Thailand is the highest among upper-middle income economies globally. This showcases the risk of household debt blunting the effectivity of fiscal policy – which the Bank of Thailand (BoT) is looking to address.

The woes continued into the start of the year. Thailand’s tourism outlook took a hit early in January as reports of a Chinese actor missing in Thailand filled headlines in China. This dampened tourism sentiment about Thailand, enough for many Chinese tourists to cancel their Lunar New Year trip to the region. Durians also faced a pungent outlook, as China imposed a temporary import ban in January over allegations of chemical contamination (Bangkok Post, 16 January 2025). Though manufacturing exports have been surging, this was largely concentrated in electronics. These goods tend to have a high share of imported components, which, in turn, diminishes the local value-added of exports.

2025 will likely be a tough year for the economy, most especially with tariff risks looming over global trade. On one hand, direct tariffs from the US could harm Thailand, with the US its top destination for exports. On the other hand, US tariffs on Chinese goods might exacerbate import competition even further as China finds other markets to take its inventory. This would then be a headwind to Thailand’s manufacturing sector, with output already falling by 4.2% since 2022.

At first, we assumed that to a certain extent, the fiscal levers would be enough support to the economy. Using monetary policy simultaneously would then risk stoking household debt. However, with fiscal policy losing traction, as exemplified by the first phase of the handout, more may be needed for Thailand to get over this economic hump. Like a wheel and axle, we expect monetary policy to help fiscal policy in cranking up growth. We expect the BoT to cut its policy rate by 25bp to 1.75% in Q4 2025, with risks tilted towards an earlier cut. However, to keep household debt at bay, we expect this cut to be the last, implying that the BoT will keep its monetary stance steady throughout 2026.

The first phase of the Digital Wallet Scheme only had a limited impact on consumption

Source: Macrobond, HSBC

The real policy rate remains slightly above pre-pandemic levels

Source: CEIC, HSBC

Vietnam

Achilles’ heel

After slow growth in 2023, Vietnam’s economy saw a strong rebound last year, growing 7.1%, restoring Vietnam’s position as ASEAN’s fastest-growing economy in 2024. That said, there is no room for complacency, given growing uncertainty on global trade prospects.

While no ASEAN economy has been targeted specifically by US tariff announcements yet, Vietnam appears to face tariff risk. Based on US Customs data, Vietnam’s trade surplus with the US ballooned to USD123bn, almost a 20% y-o-y jump, making it the country with the thirdlargest trade surplus with the US, just after China and Mexico, both of which have been targeted by US tariffs. Coincidentally, Vietnam also runs a sizeable trade deficit with China, which could gain unwanted attention from the US administration.

In addition to the trade surplus, Vietnam has the highest tariff rate differentials of ASEAN nations with the US. The US has also scrutinised trading partners with high value-added taxes (VATs) in relation to potential tariffs. While Vietnam has a low VAT among the ASEAN economies, its 2ppt VAT cut to 8% is temporary and is set to expire by mid-2025.

Shortly after the VAT proposal, President Trump announced his intention to impose tariffs “in the neighbourhood of 25%” on semiconductor imports, which will likely impact Vietnam as the US is a dominant export destination for its semiconductor shipments and accounts for almost one-third of Vietnam’s total exports.

That said, Vietnam has been proactively engaging with the US to mitigate external risks. The two countries recently signed a series of deals, valued at over USD4bn (Hanoi Times, 16 March 2025). On top of previous agreements worth USD50bn and ongoing negotiations of deals worth USD36bn, this would raise bilateral deals to be implemented to USD90bn from 2025 (Hanoi Times, 15 March 2025), but it remains unclear how much this would translate to additional US imports per annum. Overall, we forecast growth at 6.5% for 2025 and 6.3% for 2026. That said, how US trade policies evolve will be crucial for Vietnam.

Outside of growth, inflation has ticked up but was largely manageable at 3.3% y-o-y on average in the first two months of 2025. Given upside surprises from food and medical prices, we raised our inflation forecast to 3.5% for 2025 (previous: 3.0%) and 3.3% for 2026 (previous: 3.2%).

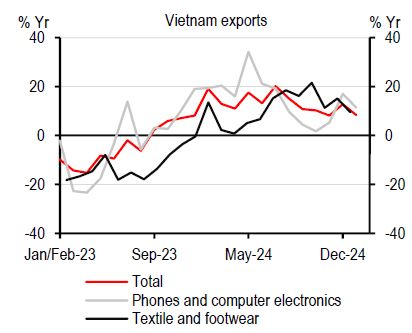

There has been some moderate frontloading impact on Vietnam’s exports

Source: CEIC, HSBC. NB: January and February are combined to adjust for Lunar

New Year distortions.

Vietnam faces elevated trade risks, requiring proactive engagement by the government

Source: CEIC, HSBC. NB: US’s trade deficit with ASEAN is data from the US side

and ASEAN’s trade deficit with mainland China is data from the ASEAN side.

https://www.hsbc.com.my/wealth/insights/market-outlook/asean-in-focus/resilience-on-display/