georgemiller

Publish Date: Mon, 31 Mar 2025, 12:02 PM

Key takeaways

- While the BoJ is in a hawkish pause, it is uncertain when the next rate hike will come.

- The near-term focus for the JPY is likely to be risk appetite around US trade policy.

- The JPY may outperform ‘risk on’ currencies, but not the USD.

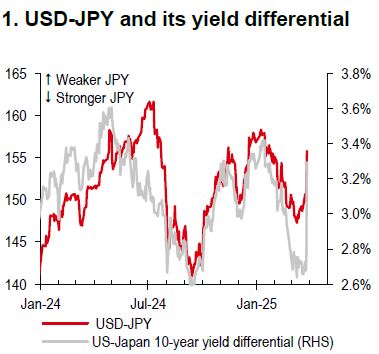

The JPY was the best performing G10 currency in the first two months of the year, but its outperformance has not continued into March. Indeed, USD-JPY has been rising since 11 March, as US-Japan yield differentials have stopped narrowing and even widened again recently (Chart 1).

While both the Federal Reserve and the Bank of Japan (BoJ) kept their rates steady in March, the BoJ guidance suggests that rates are likely to rise further so long as the domestic economy progresses as expected. But it is still uncertain when the next BoJ’s rate hike will happen. Our economists’ base case is July, while markets are pricing in a c60% chance for this to take place in June (Bloomberg, 27 March 2025).

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

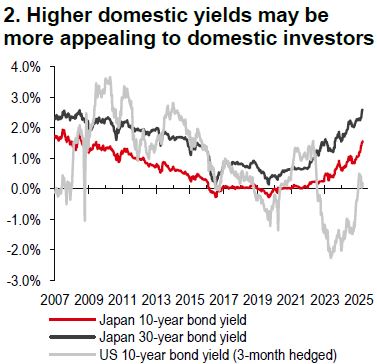

Meanwhile, some wonder if higher interest rates in Japan (Chart 2) could prompt a domestic pivot by local investors, leading to reduced portfolio outflows, if not outright repatriation inflows. A significant pivot by Japan’s Government Pension Investment Fund (GPIF) to domestic assets for the next five years (if it happens) could see the JPY strengthen. However, Nikkei reported on 11 March that the GPIF will not change its asset allocation targets. At the same time, Japanese Prime Minister Shigeru Ishiba’s government approval rating continued to fall (The Japan Times, 24 March 2025).

Over the near term, we think the JPY may not be an entirely ‘clean’ safe haven currency since Japan is also exposed to US tariff risks (e.g. auto tariffs will come into effect at 12:01 am Washington time on 3 April, initially targeting fully assembled vehicles, Bloomberg, 27 March 2025). Nevertheless, the JPY may still outperform other currencies that are even more exposed to US tariff risks (like the EUR and the CAD) or are highly risk-sensitive (like the AUD and the NZD). We are also cognizant of the possibility that the JPY may be called out by the US administration for its undervaluation.

All things considered; we see USD-JPY moving sideways over the near term before rising modestly later in the year when the US economy overcomes growth concerns and the BoJ is closer to its neutral rate range.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-not-a-clean-safe-haven/