georgemiller

发布日期: Mon, 07 Apr 2025, 12:02 PM

Key takeaways

- Global trade tensions sharply escalated after the “Liberation Day” announcement and China’s announcement of retaliatory actions. Key US trading partners in Asia are seeking negotiations or exemptions in trade deals with Washington.

- We believe reciprocal and auto tariffs will increase earnings risks for Japan and South Korea while domestically-driven markets such as China and India will stay relatively resilient in their earnings outlook.

- As the markets are quickly repricing for increased US recession risks, we expect further rotation out of the US equity market into Asia and Europe. Within our neutral positioning in global equities, we favour Asia ex-Japan markets with strong domestic growth drivers and policy stimulus, including China, India and Singapore, preferring the consumer discretionary, communications services, financials and industrials sectors. Global trade uncertainty and continued disinflation also underpin a more accommodative Asian central bank policy stance, supporting our preference for high quality Asian credit.

What happened?

Risk assets sold off sharply around the world after US President Donald Trump announced far-reaching and steeper-than-expected reciprocal tariffs that triggered market fears of an escalation of global trade war and recession risks.

On 4 April, China announced 34% retaliatory tariffs on all imports from the US, matching a 34% reciprocal tariff on Chinese imports announced by the White House. China’s retaliatory tariffs will be effective on 10 April, one day after the US reciprocal tariffs will be implemented. The newly announced 10% baseline tariffs already came into effect on 5 April.

China further announced a series of “countermeasures”, including export restrictions of seven types of rare earth minerals to the US, export controls on 16 American enterprises, an addition of 11 American enterprises to the unreliable entry list, and launching of an anti-dumping probe into medical CT tubes from the US.

Asia stands out in the epicenter of the US tariff tantrum with the highest reciprocal tariff rates hitting key US trading partners in the region – 46% on Vietnam, 36% on Thailand, 34% on mainland China, 32% on Taiwan, 25% on South Korea, and 24% on Japan.

According to the Cato Institute report, China’s 2023 trade-weighted average tariff rate was only 3% based on WTO trade data, which is much lower than the 67% “foreign tariff rate” calculated by the Trump administration. The formula disclosed by the Office of the US Trade Representative (USTR) was based on countries’ trade surpluses with the US, divided by the value of their total exports to the US, and ten dividend in half. This implies that individual reciprocal tariff rates are determined by the size of countries’ trade surplus with the US rather than absolute levels of their import tariff rates.

The ASEAN countries face the highest reciprocal tariff rates due to their large trade surpluses with the US. On 5 April, Vietnam proposed to cut tariffs on US imports to zero from the current 9.4% while Singapore stated it would not retaliate against the 10% minimum US tariff rate imposed on the country. Indonesia has pledged to ease trade rules and Cambodia also promised to cut its own tariffs on US goods and import more American products.

We believe reciprocal tariffs will bring substantial earnings impact on North Asia – Japan, South Korea and Taiwan, which have sizeable export sales and trade surpluses with the US. Although mainland China faces a hefty total effective US tariff rate of 74%, the actual revenue and earnings impact on the Chinese equity market may be less significant than expected due to MSCI China’s limited export goods sales exposure to the US at only 2%. Since the US-China trade war in 2028, Beijing has substantially reduced its trade dependence on the US market.

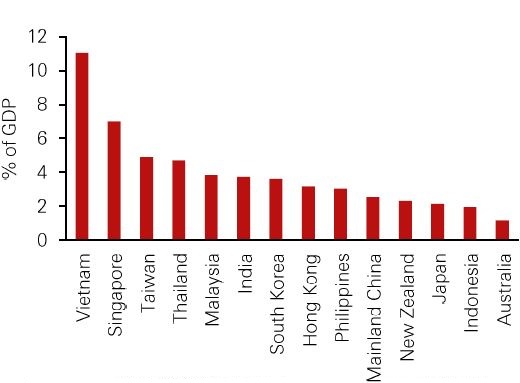

Asian exports to the US as percentage of GDP

Source: CEIC, HSBC Global Private Banking and Wealth as of 7 April 2025.

The additional tariffs on automobiles and auto parts are expected to hit the sales of Japanese and South Korean automakers. Automotive exports to the US account for nearly 7% of Japan’s total exports of all products to the world. Senior Japanese government officials said they would continue to request for exception from the reciprocal tariffs and are ready to offer funding or other support for the local economy.

We think Taiwan is better positioned than Japan and South Korea to withstand the tariff shocks because semiconductor products are exempt from reciprocal tariffs. With stronger pricing power, some of the most advanced and competitive chip exporters may be able to pass on the additional costs to their customers.

Investment implications

As the markets are quickly repricing for increased US recession risks in the wake of the tariff tantrum, we expect further rotation out of the US equity market into Asia and Europe. We attach an even stronger emphasis on domestic resilience in positioning in the Asian equity and credit markets.

We remain overweight on Asia ex-Japan equities and favour markets with strong domestic growth drivers and policy stimulus, including China, India and Singapore. Both India and Singapore stand out as relative safe havens amid global tariff escalation. The exemption of pharmaceuticals, a key Indian export to the US, should help mitigate the tariff impact on the Indian economy.

We expect severe tariff headwinds will prompt the Chinese government to further ramp up fiscal and monetary stimulus to strive for the government’s 2025 GDP growth target of “around 5%”. The DeepSeek-driven AI innovation and investment boom should offer an important domestic growth engine. The newly announced 30 special initiatives are on the right track to boost the demand side of private consumption.

We recently upgraded the domestically-driven sectors of consumer discretionary and financials in Asia to overweight to mitigate tariff risks. China’s AI-led investment boom and more forceful consumption-focused stimulus should bode well for the outlook of the Asian consumer discretionary and communications services sectors. We cut Asian IT to neutral given that technology hardware companies are significantly exposed to US tariff and growth risks.

The chances of significant policy easing in Asia have gone up amid global trade uncertainty and continued disinflation in the region. A more accommodative Asian central bank policy stance reinforces our preference for high quality Asian credit. We stay focused on Asian USD investment grade bonds, favouring Asian financials, Indian local currency debt, Chinese hard currency bonds in technology, financials and SOEs.

Outside of Asia, as we worry that the tariffs on China and retaliation will start to weigh on analyst sentiment towards the technology sector, while inflation concerns will also lead to weaker demand for consumption, we have downgraded Technology to neutral and Consumer Discretionary to underweight globally, and in the US and Europe.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/seeking-haven-in-asias-domestic-resilience-amid-tariff-tantrum/