georgemiller

Publish Date: Wed, 09 Apr 2025, 07:04 AM

Key takeaways

- Markets are unlikely to get much clarity after the “Liberation Day” tariff announcements on 2 April as countries now consider retaliation or negotiation, which could lead to more tariff changes. Economic uncertainty will last even longer as businesses and consumers try to assess the impact on them and may postpone investment and consumption decisions.

- We think that US growth and earnings will be more negatively affected than in most other countries, as the broad-based tariffs make almost all imported inputs more expensive for US firms. That either puts more pressure on inflation or on corporate margins. We expect investors to continue their rotation into other markets, but without adding overall exposure till markets stabilise more.

- We think the sharp fall in valuations and positioning adjustment we have already seen are not enough to put a bottom under markets. So, investors will continue to watch the very busy news flow, reduce concentrated bets, and diversify across asset classes and markets. European and Asian nations will try to increase trade with other trading partners outside of the US and stimulate local consumption. Given lower inflation pressures than in the US, we expect to see easing of monetary policy there, supporting high quality bonds. An active multi-asset strategy with a focus on quality, including bonds and gold, makes sense.

What happened?

On 2 April, the US government announced the most historic tariff hikes since 1930’s Smoot-Hawley tariffs Act across almost all of its trading partners. Since then, global risk appetite has taken a hit across asset classes and geographies. Various countries are already planning to impose reciprocal tariffs on the US, increasing the risks of a global trade war.

Since 2 April, the S&P500 is down by 11%, while FTSE250 and EuroSTOXX have fallen by 7% and 12%, respectively. In Asia, Hang Seng Index has also corrected by 13%, at the time of writing. Risk-off sentiment is fuelling the demand for safe haven with safe haven bond yields falling.

While the correction in the early markets has made valuations a bit more attractive, analysts have only made mild downward revisions to their earnings forecasts so far. We expect more downward revisions as businesses provide negative guidance and see little scope for any convincing bounce.

The combination of tariffs and heightened uncertainty is expected to further slow down the global economy, and the US, in particular, as businesses and consumers will put a hold on their spending and investment decisions.

But while US equity sentiment has fallen, investor positioning has still not been reduced enough to provide a floor for markets. Hence, we expect the rotation out of the US to continue in the near term.

We believe the objectives of the tariffs include the creation or protection of US jobs, the wish to bring US borrowing costs down and get better access for US companies to foreign markets. These ambitious objectives suggest that the government is willing to go through a period of uncertainty before there is any substantial easing of the tariffs.

The impact of tariffs is expected to be higher in the US than in the rest of the world. This is because the broad-based tariffs on almost all trading partners do not provide US companies with any ‘cheap’ imports. As a result, either their margins will be compressed or inflation will be raised, hurting the consumer.

For now, the market expects a ‘transitory’ inflation spike and is happy to price in four Fed cuts this year, potentially starting in May. We think the Fed may choose to prioritise growth and financial stability concerns. As a result, government bond yields should come down further, aided as well by their safe haven appeal.

Asian countries are topping the list of the hardest hit by US tariffs. Open economies like Japan, South Korea, Vietnam and Thailand may be more vulnerable than others. Reciprocal plus auto tariffs will hit the earnings for auto markets in Japan and South Korea the most, while stimulus and domestic consumption should support China and India earnings against the tariff headwinds.

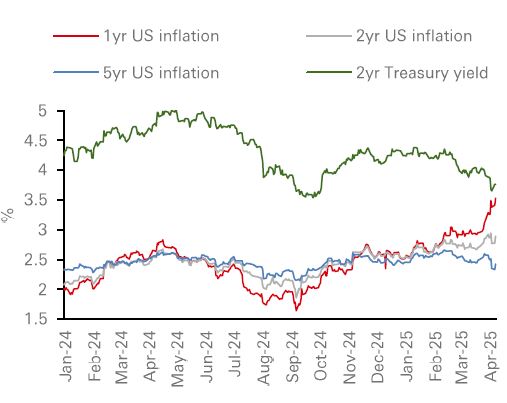

Inflation expectations have risen while GDP growth forecasts are coming down

Source: Bloomberg, HSBC Global Private Banking and Wealth as of 8 April 2025. Past performance is not a reliable indicator of future performance.

Investment implications

While we see further downside for US stocks in the short term, we hold a neutral view on a 6-month horizon. Globally, our focus in equities is defensive, selective and focused on quality. We prefer services over goods, and companies with strong cash flows and brand names.

We maintain our relative preference for Asia, including China, India, Japan and Singapore due to their domestic resilience. Singapore and Inda stand out as safe havens to tariffs. Tech and domestic sectors including banking and consumption remain our pick in Japan, while the financials, healthcare and industrials sectors with a large-cap bias are our favourites in India. Inflation also remains well under control for the region, providing more room for Asian central banks to cut rates further, supporting growth ahead.

In China, we await tactical opportunities from mispricing caused by the tariffs to capture structural growth opportunities, focusing on AI enablers and adopters from the internet, ecommerce, software, smartphones, semiconductors, autonomous driving, and robotics. We also favour the consumption, financial and industrial leaders, as well as quality SOEs paying high dividends.

Exports to the US account for 25% of European companies’ revenues, but the impact of tariffs is substantially lower as much of this is related to services, and some of the goods sold are produced in the US. Also, we see Europe’s recent response to the tariffs more balanced in an effort to avoid escalations. However, we would be careful not to misread any announcements by the EU. European markets are trading at 65% discount to their US peers. Additionally, stimulus packages for defence and Germany’s infrastructure package have further added to the appeal.

The UK is in a relatively good spot with ‘only’ a 10% tariff and is already in close talks with the US to come to a trade agreement. By not retaliating, we think inflation pressures can be contained, helping to cap borrowing costs for the government and boosting gilt performance. At the same time, the UK is also looking at expanding its trade relation with other countries, like India. While we like UK and Eurozone equities, we maintain our neutral stance and are awaiting sentiment to stabilise before adding further.

Amid persistent volatility, we think safe haven assets including high quality bonds and gold should benefit. Multi-asset strategies can help us diversify across geographies and assets, while an active approach in fixed income can capture tactical opportunities as they arise.

While we keep an eye on how the governments across the world respond to the US tariffs, and how they focus on driving domestic growth through government stimulus and support, we remain optimistic that markets will rebound in the long term as the fundamentals around re-onshoring, AI innovation and energy security remain strong.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/liberation-day-and-market-turmoil-implications-for-investors/