georgemiller

Publish Date: Fri, 11 Apr 2025, 07:04 AM

Key takeaways

- The Reserve Bank of India (RBI) cut the policy rate by 0.25%, bringing the benchmark interest rate to 6.0%. The RBI also changed the monetary policy stance from “neutral” to “accommodative”.

- The latest meeting reinforces our view that the RBI is likely to cut rates to 5.5% this year, with a 0.25% cut each in its June and August meetings. The central bank cut its FY26 (April 2025-March 2026) GDP growth forecast by 0.2% to 6.5%. It also lowered its inflation forecast to 4.0% (from 4.2% earlier).

- We retain our overweight stance on Indian equities, while acknowledging the increase in downside risks. Stabilisation in earnings expectations, undemanding valuations and improvement in international flows support the markets for now. The 90-day pause in the implementation of reciprocal tariffs is a positive for export-oriented sectors, though uncertainty is likely to persist. We prefer large-cap over small- and mid-cap equities and favour the financials, healthcare and industrials sectors. We also expect Indian local currency bonds to outperform cash this year. However, less favourable interest rate differentials and the risk of a rebound in the broad USD index (DXY) point towards increased downside risks for the INR.

What happened?

In line with our expectations, the Reserve Bank of India (RBI) cut the policy rate by 0.25%, bringing the benchmark interest rate to 6.0%. The RBI also changed the monetary policy stance from “neutral” to “accommodative”.

Importantly, the decision to cut rates and change the policy stance was unanimous. The RBI governor clarified that the change in stance to accommodative meant that the central bank could cut rates further and this should not be interpreted as a signal for altering liquidity conditions.

The governor also highlighted the RBI’s commitment to ensure sufficient liquidity in the financial system.

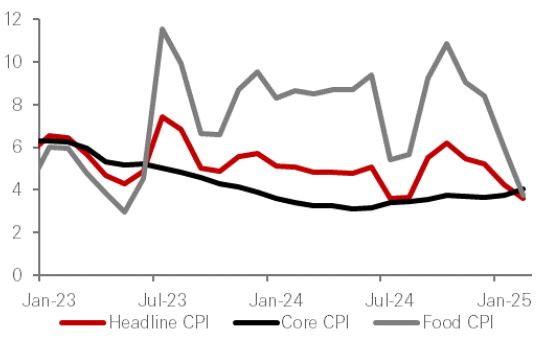

Ongoing decline in food inflation opens room for the RBI to cut rates further

Source: RBI, HSBC Global Private Banking and Wealth as of 10 April 2025

It is important to note that the RBI Monetary Policy Committee (MPC) meeting was held prior to US President Trump’s announcement to pause the implementation of the reciprocal tariffs by 90 days. Clearly, the potential impact on growth due to tariffs (which still stand at 10%) heightened financial market volatility and the potential negative second-order impact weighed on the RBI’s decision.

The central bank cut its FY26 (April 2025-March 2026) GDP growth forecast by 0.2% to 6.5%. The governor also mentioned that it is tough to quantify the impact of the trade war. Hence, we acknowledge the risk of further downward revision in GDP growth estimates should uncertainty persist.

On a positive note, the RBI also lowered its inflation forecast to 4.0% (from 4.2% earlier), aided by the durable decline in food inflation. We expect the near-term food inflation to remain subdued due to the good winter harvest. However, the upcoming months are expected to see prolonged periods of elevated temperature, which could impact crop production and raise the risk of a rebound in food inflation in 2H 2025.

Overall, the latest meeting reinforces our view that the RBI is likely to cut rates to 5.5% this year, with a 0.25% cut each in its June and August meetings. That said, given the heightened global uncertainty, it is possible that the timing of the rate cuts could be fluid.

Investment implications

In our assessment, the RBI meeting was a positive for the domestic equity markets from two aspects. First, the 0.25% rate cut should lead to marginally lower borrowing costs for companies. Secondly, the forward guidance on rate cuts and liquidity is likely to provide greater confidence to markets that the central bank is increasingly looking to support growth, given that inflation has moderated and is close to the RBI’s target of 4.0%.

We retain our overweight stance on Indian equities, while acknowledging the increase in downside risks. Stabilisation in earnings expectations, less demanding valuations and improvement in international flows support the markets for now. The 90-day pause in the implementation of reciprocal tariffs is a positive for export-oriented sectors, though uncertainty is likely to persist.

From a style perspective, the heightened uncertainty reinforces our preference for large-cap equities over small- and mid-cap. We believe their size, better access to financing and defensive nature could lead them to outperform over the next few months. We are selective and prefer domestic and service-oriented sectors, which are less exposed to tariffs. We favour the financials, healthcare and industrials sectors.

We are bullish on Indian local currency bonds and expect them to outperform cash in 2025. The supply-demand dynamics remain supportive, as lower projected net supply for FY26, coupled with robust domestic and international demand, should lead to lower yields. Given expectations of further RBI rate cuts, we expect 10-year government bond yields to edge lower by end-2025. On a relative basis we see better value in AAA corporate bonds, owing to the recent spread widening.

However, less favourable interest rate differentials and the risk of a rebound in the broad USD index (DXY) point towards increased downside risks for the INR.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/rbi-hints-at-continued-policy-support/