georgemiller

Publish Date: Mon, 14 Apr 2025, 12:01 PM

Key takeaways

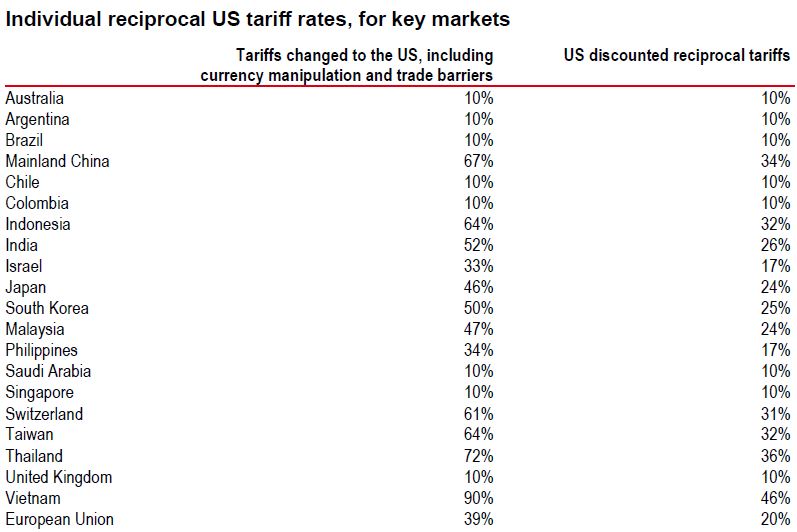

- The US has announced a 10% baseline tariff effective from 5 April, along with individual reciprocal tariffs of up to 49% on some economies from 9 April.

- US tariffs are rising in a way that FX markets deem to be a concern.

- With US tariff plans known, the FX focus will likely switch to retaliation measures by others and how the US and global economy evolves.

In the lead up to, and on, 2 April 2025, i.e., “Liberation Day”, US President Donald Trump announced the US will: (1) implement a 10% baseline tariff on all imports effective from 5 April, (2) subsequently implement higher individual reciprocal duties on partners the US has the largest trade deficits with (see the table below) effective from 9 April, and (3) impose a 25% tariff on imports of automobiles effective from 3 April, along with a 25% tariff on imports of autos parts that will take effect by 3 May.

For Canada and Mexico, the White House said that existing fentanyl/migration International Emergency Economic Powers Act (IEEPA) orders remain in effect and are unaffected by the latest announcements. United States–Mexico–Canada Agreement (USMCA) compliant goods will continue to see a 0% tariff, non-USMCA compliant goods will see a 25% tariff, and non-USMCA compliant energy and potash will see a 10% tariff.

Source: The White House

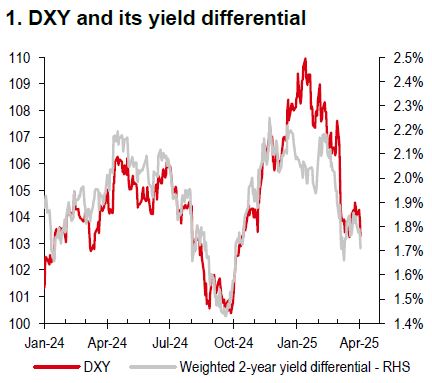

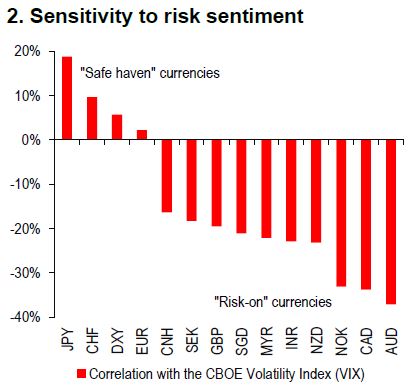

As for FX markets, we believe there was truly little priced into exchange rates given the range of outcomes and how the US Dollar Index (DXY) was largely moving in line with its yield differential (Chart 1, overleaf). The DXY dropped by c0.7% to 103.1 (Bloomberg, 3 April 2025 at 9:45am HKT) and we believe the main FX driver is likely to come through the risk channel (Chart 2, overleaf). In a “risk off” environment, “safe haven” currencies are likely to outperform “risk on” currencies.

Source: Bloomberg, HSBC

Note: Correlation is computed based on weekly changes in the period from 2014 to 2025.

Source: Bloomberg, HSBC

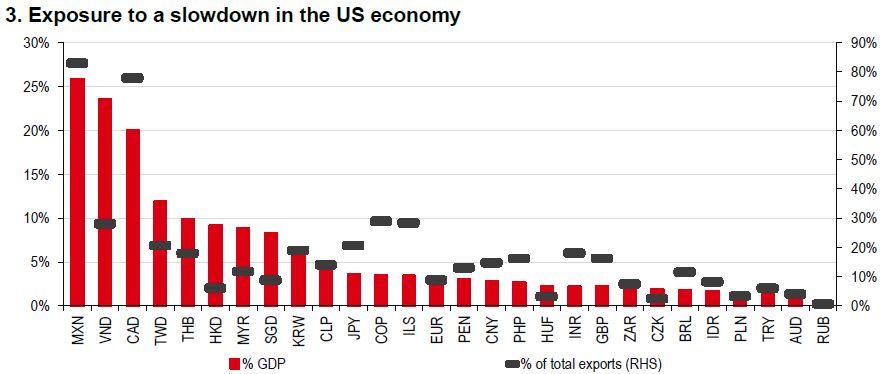

One important issue for the broad USD, which could take a few weeks, if not longer, to decipher, relates to US and global growth. The path of each will determine whether the USD can strengthen further, becomes bifurcated or stages a continued fall across the board. So, we need to be mindful of currencies that are more closely linked to the US economy (Chart 3), and how others could perform as the market anticipates the path for global growth. Relative performance may also hinge on how (or if) countries retaliate, how long it takes to negotiate an exit from US tariffs, and how their economy is placed to weather the tariff damage in the meantime.

Source: Bloomberg, HSBC

The tariff plan announced for Asia is also arguably more punitive than expected − all except Singapore face more than 10% reciprocal tariffs, ranging from 24% to 46%. We expect Asian currencies to come under depreciation pressure as a result. USD-CNY fixing rate is relatively steady at 7.1889 today, and as the trading is allowed within 2% of the fixing rate, the trading band range is 7.0451 to 7.3327 (Bloomberg, 3 April 2025). We believe the Chinese authorities have their own motivations for keeping USD-RMB reasonably stable, but some moderate and gradual adjustment may still be warranted to alleviate the impact on exporters.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/fx-liberation-day-10-baseline-tariff-and-more/