georgemiller

Publish Date: Mon, 14 Apr 2025, 12:01 PM

Key takeaways

- Ongoing US policy uncertainty has created a bifurcated USD, leading us to rethink our USD framework…

- …which now consists of cyclical, political, and structural drivers…

- …and sees the DXY facing some downward pressures.

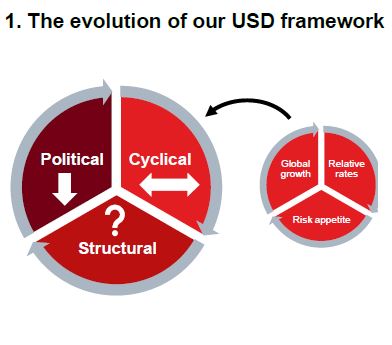

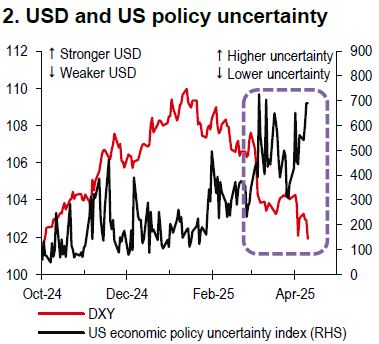

Our trifactor framework, resting on US growth vis-à-vis the rest of the world, relative yields and risk appetite, which has helped us decide whether the USD will strengthen or not, is not working (the right pie in Chart 1). Currently, USD yields are still higher than for other currencies, along with slowing global growth and intensifying risk aversion, but the USD has been weakening. We notice that there is a bifurcated USD whereby it is struggling versus other core G10 currencies (i.e., EUR, JPY, and CHF) but coping versus many smaller G10 and emerging market ones. This points to the risk aversion channel via US policy uncertainty dominating (Chart 2).

Source: HSBC Global FX Research

Source: Bloomberg, HSBC

Most recently, US President Donald Trump’s decision on 9 April to limit reciprocal tariffs to 10% for 90 days to allow for negotiations provoked a big reaction in equity markets globally, but the impact on FX has been more modest and short-lived. A blanket import tariff of 10% is still significant, while the 100%+ tariffs between China and US are stratospheric. Negotiations may offer an escape, but it is worth noting that the phase 1 trade deal between the US and China came 21 months after US President Trump first raised tariffs. Now the US is also trying to negotiate with 70+ trading partners in 90 days. The clock is ticking.

All this led us to circle back to another framework to think about the USD, which we used in US President Trump’s first year in 2017. It was helpful to assess the USD against its cyclical, political, and structural drivers (see the left pie in Chart 1). Back then, the USD struggled as global growth was accelerating, US policy uncertainty lingered, and questions about the USD’s structural outlook surfaced amid Trump’s tax cut proposals. In some ways, history is rhyming.

Currently, the USD’s cyclical backdrop is less supportive in isolation, but the global outlook argues against being overly negative on the currency. US policy uncertainty is high and is weighing on the US Dollar Index (DXY) via risk aversion. There are questions about its structural properties. After considering the US current account position, fiscal risks and holdings of US securities, we think that the structural discussion around the USD is louder, and the tail risk is higher. Putting these together tells us that the DXY will likely be in a softer position over the coming quarters.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-to-soften-in-the-quarters-ahead/