georgemiller

发布日期: Thu, 17 Apr 2025, 12:01 PM

Key takeaways

- US equity markets sold off after Fed Chair Jerome Powell indicated no “Fed put” despite slower US growth outlook and market volatility triggered by tariff uncertainty. Powell reiterated the wait-and-see approach, as he expected inflation to rise and the labour market to come under pressure due to higher tariffs.

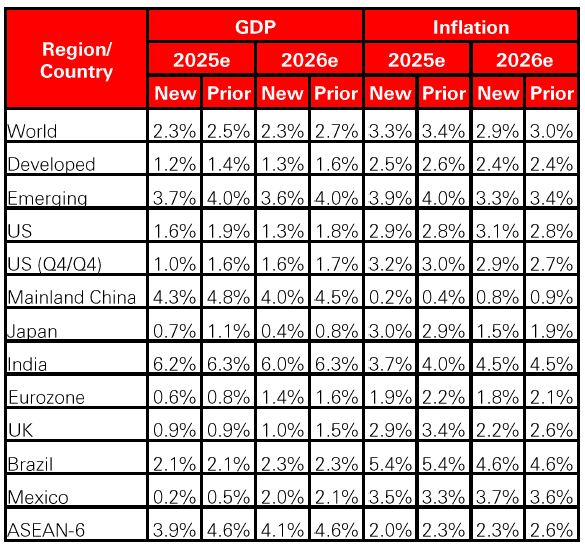

- We now project US GDP growth to slow to 1.6% for 2025 (down from 1.9% previously) and 1.3% for 2026 (down from 1.8% previously). On the inflation front, we have raised US CPI forecasts to 2.9% in 2025 and 3.1% in 2026.

- We continue to see potential headwinds from fiscal tightening and downward revisions to 2025 earnings as tariff uncertainty persists. In this challenging environment, we maintain a defensive strategy with a strong focus on multi-asset diversification, active management and long-term structural themes to mitigate market volatility.

What happened?

US equity markets sold off after Fed Chair Jerome Powell indicated no “Fed put” despite slower US growth outlook and market volatility triggered by tariff uncertainty. In his speech delivered at the Economic Club of Chicago, Powell cautioned that tariff-induced price rises may end up becoming more persistent, and the labour market conditions could come under pressure.

In response to a media question about the “Fed put” to support financial markets, Powell said “no” to dismiss market expectations of immediate central bank intervention to boost the equity markets.

Powell pushed back against any idea of disorderly market behaviour or anything that would need the central bank to step in right now. He said the financial markets remained orderly and functioning well, citing abundant reserves and healthy liquidity conditions. He reconfirmed policymakers are in no hurry to change the central bank's benchmark policy rate and said the Fed remained well positioned to wait for greater clarity before considering any policy adjustments.

Regarding the tariff impact on inflation, Powell said the level of the tariff increases announced so far was significantly larger than anticipated, adding that the inflationary effects could also be more persistent. Powell noted both survey- and market-based measures of near-term inflation expectations have moved up significantly, but longer-term inflation expectations appear to remain well anchored, as market-based break evens continue to run close to 2%.

Powell emphasised the need to prevent tariffs from triggering a persistent rise in inflation, ensuring that a one-time price increase does not become an ongoing inflation problem. We think this is good news for the bond market.

Both the markets and the Fed expect lower rates and weaker growth by the end of 2025. The Fed’s own median projections expect two 0.25% rate cuts by end-2025. Traders are just taking that impulse further, as they brace for the possibility that the economic hit of tariffs will slow economic activity beyond policymakers’ predictions.

Higher tariffs and increased global trade frictions will result in slower global growth and higher inflation in the US. We have downgraded US and global growth forecasts for both 2025 and 2026 to reflect the negative impact of tariff escalation and growing policy uncertainty under the new US administration.

In the US, we have cut GDP growth forecasts to 1.6% from 1.9% for 2025 and to 1.3% from 1.8% for 2026. Our lower US growth forecasts have factored in the impact of tariffs and the policy uncertainty emanating from Washington. But we do not expect the US economy to slide into a recession as we expect the Fed to start cutting policy rate in June. On the inflation front, we have raised US CPI forecasts to 2.9% in 2025 and 3.1% in 2026.

Investment implications

We continue to see potential headwinds from fiscal tightening and downward revisions to 2025 earnings as tariff uncertainty persists. In this challenging environment, we maintain a defensive strategy with strong focus on multi-asset diversification, active management and long-term structural themes to mitigate market volatility.

We continue to look for short-term USD weakness and US equity market underperformance compared to Europe and Asia. As investors rotate away from USD assets, we are bearish on USD. Gold should continue to benefit.

On the equity front, we maintain a neutral stance and continue to take a defensive sector stance in the West and focus on quality and large caps. We think rotation flows will support German and Eurozone stocks and have upgraded Europe ex-UK equities to overweight.

We maintain our overweight on Asia ex-Japan equities despite very high two-way US-China tariffs. Chinese equities only derive 3% of earnings from US exports and we expect more domestic stimulus. We further intensify our focus on domestically oriented companies. We have downgraded Japanese stocks to neutral due to the country’s high exposure to US exports and the strong JPY.

HSBC’s new macroeconomic forecasts

Source: HSBC Global Research forecasts, HSBC Global Private Banking and Wealth as at 17 April 2025. Forecasts are subject to change.

On fixed income, US Treasuries have temporary lost their appeal as a safe haven, especially longer-dated bonds, but they represent some value for long-term investors. The first signs of an economically damaging slowdown in global trade are already emerging and the Fed may be forced to acknowledge the risk to growth and employment. We believe this should support DM government bonds and we focus on 7-10-year maturities. We favour UK gilts, Eurozone sovereign, Eurozone and UK IG bonds. We remain neutral on DM and EM credit as credit spreads may remain choppy with some potential for overshooting.

Despite our new forecasts for weaker US growth, we do not expect any shift in Fed policy. The financial markets should not expect a “Fed put” to come to the rescue amid market volatility. We continue to expect the Fed to deliver three rate cuts this year, beginning in June. The three rate cuts would be 0.25% in each quarter, leaving the Fed funds rate at 3.75% by year-end.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/powell-signals-no-fed-put-despite-slower-growth-and-market-volatility/