georgemiller

Publish Date: Tue, 22 Apr 2025, 08:05 AM

Key takeaways

- Escalating tariff tensions between China and the US pose heightened risks to economic growth…

- …but may also prompt more support for consumption, along with additional monetary and fiscal easing.

- With larger-than-expected external shocks, China will need to act decisively and quickly to support domestic demand.

China data review (March, Q1 2025)

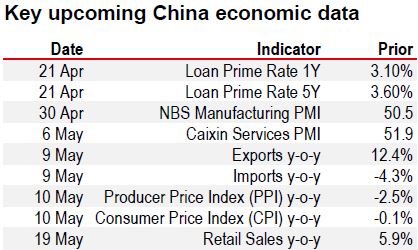

- GDP growth rose 5.4% y-o-y in Q1 with upside surprises in March’s industrial production and retail sales pointing to stronger domestic activity ahead of the recent tariff escalations. Accelerated policy support, backed by fiscal spending, alongside some improvement in consumer sentiment have likely helped, though the property sector remained a weak point. Meanwhile, frontloading of exports ahead of tariff uncertainty also provided a cushion.

- Industrial production was up 7.7% y-o-y in March, boosted by the strongerthan-expected exports activity from frontloading and supply chain rejigging. The ongoing domestic policy push to promote equipment upgrading, technology and Artificial Intelligence development will also remain key for supporting the manufacturing sector; equipment and Hi-Tech manufacturing production rose 10.9% and 9.7% y-o-y in Q1, respectively.

- Retail sales rose by 5.9% y-o-y in March, driven by increased purchases from the trade-in programmes, which have been effective in lifting sales in home appliances (up 35% y-o-y), communications goods (29% y-o-y) and autos (5.5% y-o-y). While overall autos sales were more muted compared to the other categories, this is partly due to ongoing price cuts as a result of competition. Electric Vehicle sales on the other hand have been performing strongly.

- Headline CPI stayed in contraction, falling by 0.1% y-o-y in March, owing to weaker food prices and softer global crude oil prices weighing down energy costs. However, Core CPI rebounded to 0.5% y-o-y supported by a modest rebound in services. Meanwhile, PPI saw a deeper fall of 2.5% y-o-y due to lower global commodity prices, overcapacity concerns and ongoing pressures in the property sector.

- Exports saw a broad-based increase in March, up 12.4% y-o-y, as companies sought to frontload shipments ahead of potentially higher tariffs being imposed. Meanwhile, imports continued to stay low, falling by 4.3% y-o-y, due in part to weaker global commodity prices for iron ore and crude oil which weighed on imports value. While frontloading has provided some cushion and the recent pauses in some tariffs can also help, external headwinds have clearly risen.

More domestic support to counter tariffs

Trade tensions continue to climb. In the recent round of escalations, President Trump sharply raised tariffs on Chinese goods to 145% (effective as of 9 April), prompting countermeasures from China which raised reciprocal tariffs on US goods to 125% (effective as of 12 April).

But this may be the upper limit for tariff actions. Alongside China’s tariff announcement, it stated that it will not respond to further US tariff hikes (MOFCOM, 11 April). Meanwhile, the recent US electronics exemptions mean Chinese goods in these categories (RMB102bn or c23% of US imports from China) only face 20% tariffs, as opposed to 145%, although the exemption may only be temporary.

To mitigate tariff impacts, China is strengthening diplomatic engagement globally. For example, it recently signed 45 bilateral cooperation agreements with Vietnam across areas including Artificial Intelligence, agriculture and sport (Xinhua, 14 April), while China’s Commerce Minister has held discussions with the EU, ASEAN, G20, BRICS, and Saudi Arabia on countering US tariffs.

More domestic policy support

Policymakers may need to provide more domestic support for economic growth to counter tariffs, including more fiscal and monetary easing, and expanded policies for consumption. Premier Li Qiang conducted a field survey in Beijing on 15 April and stressed the importance of stimulating inner circulation and boosting consumption to counter external headwinds (Stcn, 15 April).

Expanded consumer goods trade-ins: These initiatives have seen robust participation since their launch last year, with over 100mn home appliance trade-ins completed (People’s Daily, 12 April). Funding has doubled this year (to RMB300bn) and more product categories are expected to be added. Guangzhou has said that residents from Hong Kong, Macau, Taiwan, and foreigners with permanent residence are eligible for trade-in subsidies (Securities Times, 12 April).

Boosting service consumption: Last week, China unveiled plans to support consumption in health and sports (Xinhua, 11 April). Local governments, including Hohhot, have introduced childcare subsidy policies, with more expected to join. Two dairy producers have also launched subsidy programmes worth RMB2.8bn in April (Xinhua, 11 April). And a "Shop in China" campaign will promote consumption nationwide focusing on goods, dining, and cultural tourism (Xinhua, 14 April).

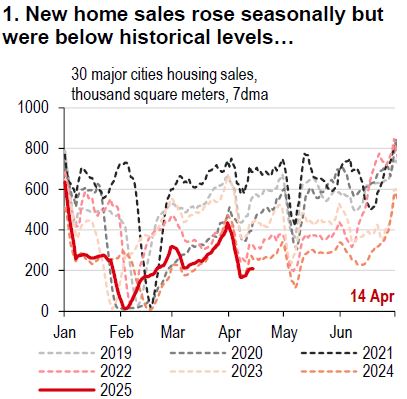

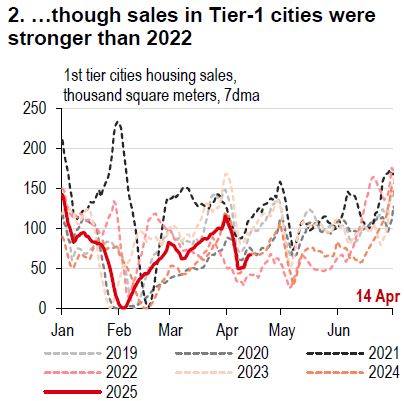

Other measures in the pipeline: Policies to raise household incomes, expand public services based on residency, and stabilise property – a key drag on household wealth and consumer confidence – are accelerating. Property saw renewed pressure in the first 14 days of April, as new home sales in 30 major cities fell 11% y-o-y, underscoring the need for intensified policy support, including from local government funds and potential direct central government funding.

Source: Wind, HSBC

Source: Wind, HSBC

Exporters selling locally: The Ministry of Commerce has pledged to help exporters boost domestic sales, by helping with market access, distribution channels, financial services and logistics (Xinhua, 11 April). The ministry has convened discussions with industry associations, retailers, and logistics firms, with many announcing that they would help exporters go domestic through increasing purchases. Among them, JD.com pledged RMB200bn for the cause (Cailianshe, 11 April).

Source: LSEG Eikon

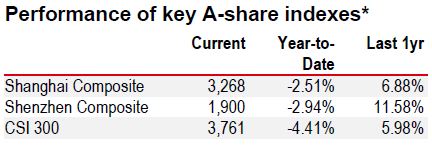

* Past performance is not an indication of future returns

Source: LSEG Eikon. As of 15 April 2025, market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/more-domestic-support-to-counter-tariffs/