georgemiller

Publish Date: Tue, 22 Apr 2025, 12:01 PM

Key takeaways

- US tariffs and heightened uncertainty look set to deliver a significant blow to global growth through various channels.

- US inflation is likely to rise, but lower energy prices, stronger FX, and China trade diversion could lower inflation elsewhere.

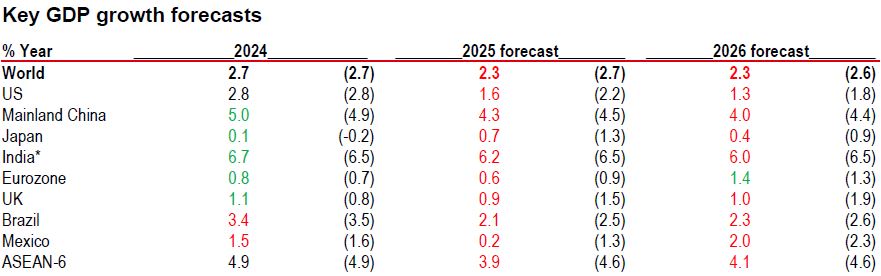

- We recently lowered our global GDP growth forecasts to 2.3% for both 2025 and 2026.

The pace of US policy shifts since the ‘Liberation Day’ announcements has been dramatic. The reciprocal tariffs, related financial market turmoil, the US’s rapid Uturn, and a doubling down on mainland China tariffs will undoubtedly weigh on trade flows, investment plans, and broader activity. And for many economies the impact is likely to be substantial.

Relative winners and losers

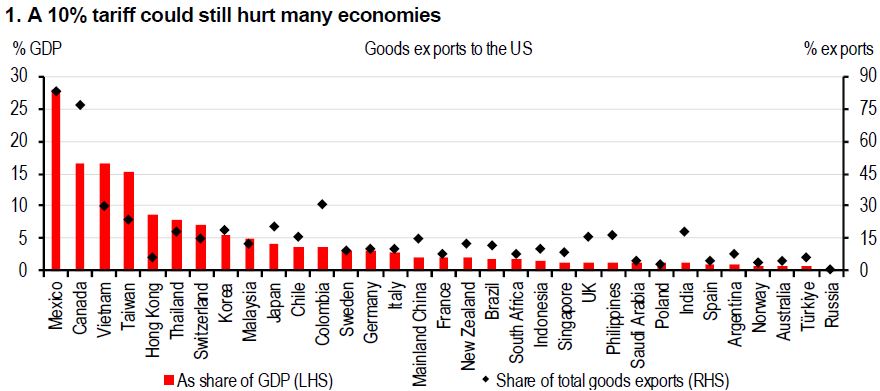

The tariff turmoil is bad news for the global economy but there will still be relative winners and losers. Countries with lower exposure to US imports of tariffed items, particularly if also set to benefit from China and EU fiscal stimulus, will be more immune, and vice versa. Others could gain by supplying goods currently sourced from China, if US trade actions make them prohibitively expensive. Vietnam, Mexico, Thailand, and India are top of that list, if they can avoid large tariffs themselves. Meanwhile, economies like Brazil could benefit if China sources more agricultural products from outside the US.

Note: Mexico and Canada are exempt from the baseline 10% tariff.

Source: IMF DOTS

The biggest uncertainty effects may be in the US itself. At a minimum, there will be enormous disruptions to supply chains for a vast array of small and large US companies. The tariffs might slow imports and push up prices for companies and consumers. US profit margins are likely to be squeezed. And companies reliant on foreign components could be less competitive in international markets and consumer goods prices will rise.

Sector-specific vulnerabilities

As well as overall dependence, product mix of trade flows will also determine the direct impact. Some products are exempt from the 10% baseline reciprocal tariffs – either because they fit into the categories of energy and critical minerals, or because the US can’t easily source them domestically – for example zinc, tin, and other base metals. Products that face higher tariffs include autos, steel, and aluminium (already in place), and, potentially, pharmaceuticals and semiconductors.

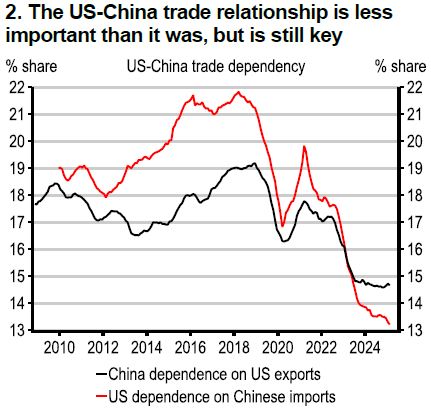

US-China breakdown

The main area of bilateral trade with the US that looks set to plummet is between the US and China. However, the world’s two largest economies are less reliant on each other than in the past: just over 13% of US imports are from mainland China and less than 15% of mainland China’s exports go to the US. On the other side of the relationship, only c7% of US exports go to mainland China and only c6% of mainland China’s imports are from the US (Chart 2).

Inflationary impact

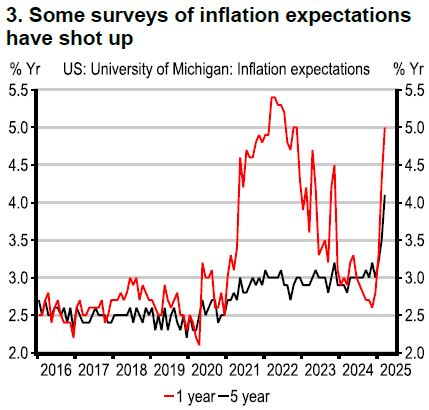

The path for inflation is uncertain, but tariffs are likely to mean US goods prices are higher, even if much of the tariff impact weighs more on US growth. That risk is clearly being reflected in consumer surveys, with inflation expectations rising (Chart 3). Elsewhere, weaker growth, lower oil and gas prices, and recent currency appreciation point to lower inflation. Trade diversion may also mean a near-term disinflationary impulse as goods intended for the US market are re-routed: just how much depends on how many more trade actions are taken by other countries vis-a-vis China.

Source: Macrobond

Source: Macrobond

Our forecasts

We recently lowered our global GDP growth forecasts to 2.3% (from 2.5%) for 2025 and to 2.3% (from 2.7%) for 2026. Our forecasts for nearly every economy have been lowered, even Canada and Mexico, which were not hit by additional tariffs in April, in response to the deteriorating outlook for US growth.

There has been a more diverse impact on our inflation and monetary policy forecasts. Although we have lowered our US growth forecast materially to 1% 4Q/4Q in 2025, the deteriorating growth-inflation trade-off means we have not changed our long-held Federal Funds view of no more than 75bp of rate cuts in 2025-26.

We expect stronger policy responses elsewhere, including more from the European Central Bank and many emerging economies, even though we are not expecting aggressive rate cuts. It is not just monetary policy that could soften the blow from trade uncertainty, which is already spurring fiscal, deregulatory, and structural measures from Europe to Asia.

Note: *India data is calendar year forecast here for comparability. Previous forecasts are shown in parenthesis and are from the Macro Monthly dated 20 December 2024.

Green indicates an upward revision, red indicates a downward revision.

Source: Bloomberg, HSBC Economics

Source: Bloomberg, HSBC

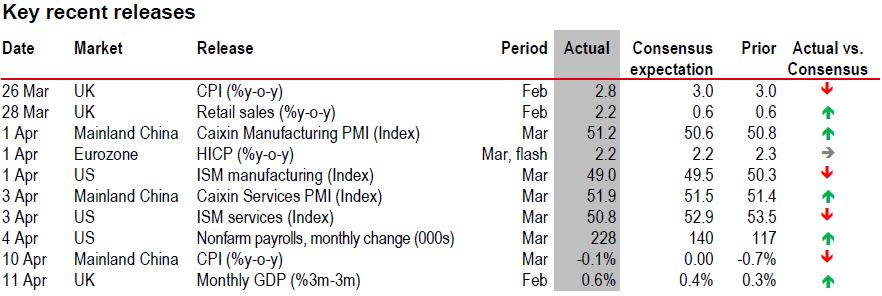

⬆Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/tariff-risks-weighing-on-global-growth/