georgemiller

发布日期: Mon, 28 Apr 2025, 08:05 AM

Key takeaways

- The ECB cut rates by 25bp in April, in line with expectations.

- The EUR is stronger than what its yield differential implies, which could be explained by the EUR’s safe haven persona.

- The EUR is likely to strengthen against the USD (but at a slower pace) in the weeks ahead.

On 17 April, the European Central Bank (ECB) delivered a 25bp cut, bringing the deposit rate to 2.25%. This was its sixth consecutive cut (and the seventh in total for this cycle since last July), in line with market expectations. “Economic risks are starting to materialise,” noted Bank of Finland governor Ollie Rehn. He added that, “There are few good reasons to pause rates…and the ECB shouldn’t rule out larger cuts” (Bloomberg, 24 April 2025), illustrating the increasingly dovish sentiment within the ECB governing council.

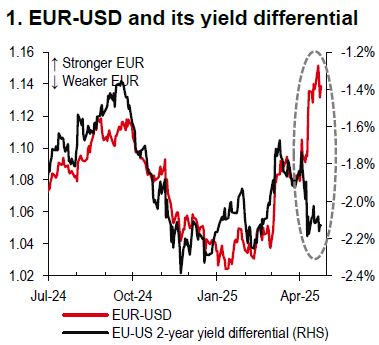

Markets may also be more attuned to the deteriorating economic outlook in the Eurozone and the prospect of more rate cuts to come, with further easing of c62bp by the end of the year in the price (Bloomberg, 23 April 2025). It is worth noting that the EUR looks rich relative to its rate differentials (Chart 1). It may not be enough to turn sentiment on the EUR, but it is another factor likely to quell the topside, especially if the Federal Reserve is offering a pause policy when the ECB is still cutting.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

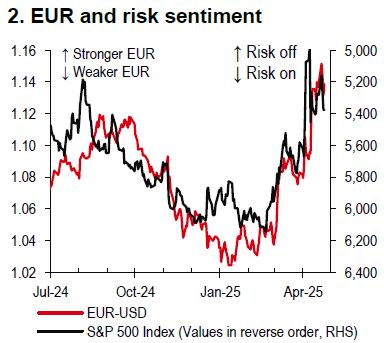

Meanwhile, the EUR is exhibiting a “risk off” persona (Chart 2), perhaps aided by the timely afterglow of the European fiscal policy U-turn in 1Q25. On the flip side, US political uncertainty has diminished the USD’s “safe haven” brand. Uncertainty around US trade policy is likely to persist, alongside “tariff on-tariff off” headlines, and news flow around the multiple trade negotiations. The key challenge is whether the flows into EUR continue, and this relies on a “risk off” mood being evident more often than not. If the mood music around trade changes, so too will the EUR.

All things considered, a move higher in EUR-USD seems more probable than not in the weeks ahead.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/eur-s-safe-haven-persona/