georgemiller

Publish Date: Mon, 05 May 2025, 08:05 AM

Key takeaways

- The BoJ delivered a dovish hold in May…

- …with markets less certain about a rate hike this year.

- The JPY weakened as a result, alongside receding “safe haven” flows.

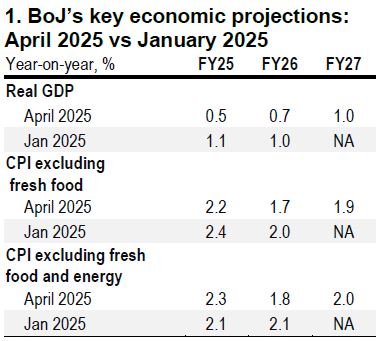

On 1 May, the Bank of Japan (BoJ) kept its policy rate unchanged by unanimous decision, continuing to guide the uncollateralised overnight call rate at around 0.5%, as widely expected. The tone of the meeting was rather dovish, with the latest BoJ forecasts (Table 1) suggesting downside risks to both growth and inflation.

In our economists’ view, BoJ’s inflation forecasts edged lower, but not sufficiently enough to suggest its 2% price stability goal has been derailed. BoJ Governor Ueda’s press conference dwelt on the heightened uncertainty around the economic outlook vis-à-vis US tariffs but said that the BoJ would raise rates further if the economy continued to move in line with its outlook. Our economists expect the BoJ to hike once more this year, most likely in October; while markets are less sure for now, with a 25bp rate hike by year-end viewed as a coin toss (Bloomberg 1 May 2025).

NA=Not applicable, as BoJ only starts to provide FY27 forecasts in its

Outlook for Economic Activity and Prices (April 2025).

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

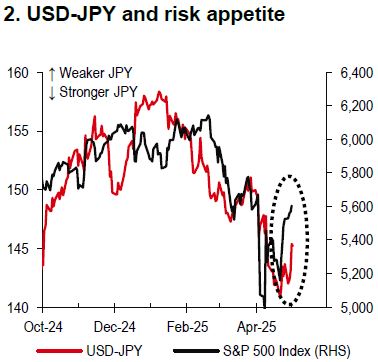

The dovish hold by the BoJ has hit the JPY, alongside receding “safe haven” flows with the S&P 500 Index edging higher (Chart 2). Positioning wise, net long positions on the JPY among speculative traders recently climbed to an all-time high, according to data from the Commodity Futures Trading Commission (as of 22 April 2025). This could temper the enthusiasm for an extension.

The path looks choppy ahead, as undershooting (market fear) and overshooting (market relief, short squeeze, or even temporary USD funding stress) of USD-JPY are likely. A short squeeze in USD-JPY could continue, if previously accumulated net long JPY positions continue to unwind as trade tensions ease. China’s Commerce Ministry said in a statement that it had noted senior US officials repeatedly expressing their willingness to talk to Beijing about tariffs (Bloomberg, 2 May 2025). Japan officials said that they aim to accelerate the talks from mid-May and achieve a trade agreement with the US in June (Bloomberg, 2 May 2025). On the other hand, an alleviation of tariff-induced downside risk to Japan’s growth could revive market expectations about the BoJ’s rate hikes. If there happens to be any FX clause in the potential trade agreement, which has thus far been denied (Bloomberg, 2 May 2025), that could also send USD-JPY lower.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-bojs-dovish-hold-met-with-a-short-squeeze/