georgemiller

发布日期: Thu, 08 May 2025, 12:02 PM

Key takeaways

- The impact of tariffs and related uncertainty…

- …became clearer in the April data…

- …even if the magnitude of the blow to global growth and trade flows could take time to emerge

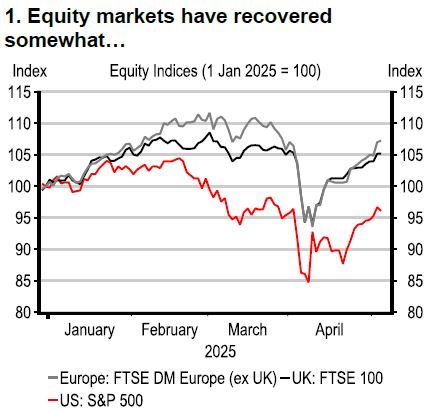

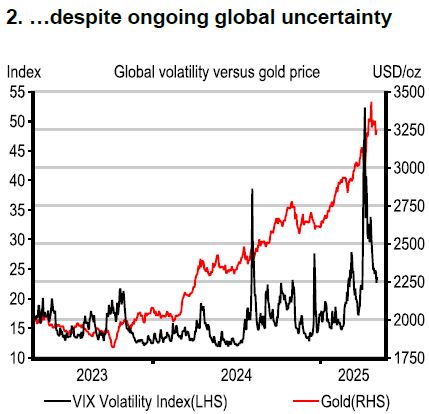

The 90-day pause on additional ‘reciprocal’ tariffs, various carve outs, and reports of progress on some bilateral US trade negotiations have restored some calm to equity markets, but the global economic outlook is deteriorating amid enormous uncertainty (charts 1 and 2).

Tariff uncertainty

A 10% baseline tariff on all US imports has been in effect since 5 April and sectorspecific tariffs of 25% are either already in place or loom for a large range of major products. The better news is that President Trump announced some exemptions for the auto sector. However, the imposition of tariffs of 145%-plus on imports from mainland China, along with the demise of the de-minimis rule, are causing US firms to alter plans or cease imports entirely, while they await clarity and hope for relief.

The Trump administration has already initiated discussions on new trade deals with over 70 countries, prioritising those geographically closer to China. But the likely outcome is highly uncertain, with President Trump having suggested he is unlikely to cut the baseline tariff below 10%. China has issued warnings of potential retaliation on third countries should such deals come at the expense of China’s trade (NY times, 21 April 2025).

Source: Macrobond

Source: Macrobond

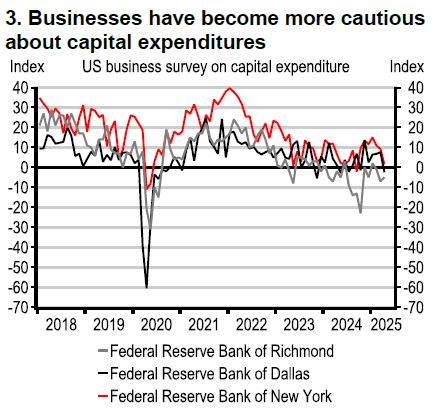

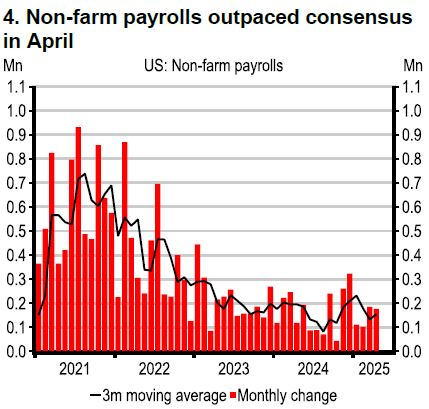

Survey softness

The associated heightened anxiety in the US was very evident across an array of business and consumer surveys for April (chart 3): hiring intentions have slowed and US households are postponing or cancelling major purchases in response to the economic uncertainty. For now, though, the April data are mostly “soft” releases, with the only notable “hard” data so far being from the US labour market, which remains resilient (chart 4).

Note: New York Fed data is for future capital expenditure and Reserve Bank of Dallas represent Texas retail outlook survey capital expenditure.

Source: Macrobond

Source: Macrobond

Trade uncertainty

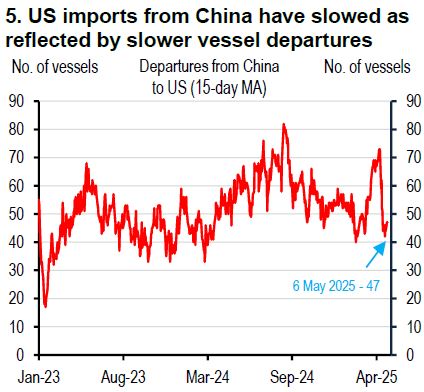

The trade data is set to remain hard to track. Shipping data show plummeting flows from China to the US in March and April (chart 5). US imports from other partners, including some Asian countries have held up better and could continue to do so during what French president Macron has called a “fragile pause” on US tariffs. But looking ahead, the world now fears inflows of cheaper Chinese goods now finding it harder to access the US market.

Note: Latest data point for 6 May 2025.

Source: Bloomberg

Source: Macrobond.

Inflation divergence

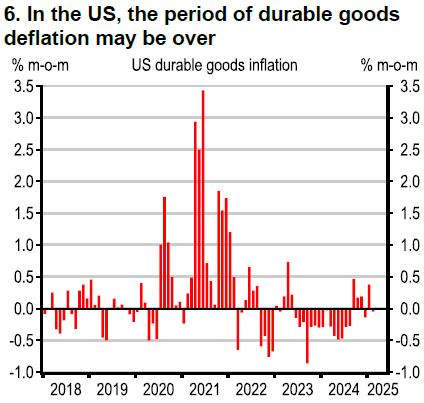

Surveys of US inflation expectations have also risen with the tariffs. Declining energy prices will be welcomed by most, but higher import costs will add to US inflation, particularly for goods (chart 6). Assuming no broad-based retaliation, Europe and particularly Asia, could see lower inflation, allowing a faster pace of monetary easing.

Data highlights

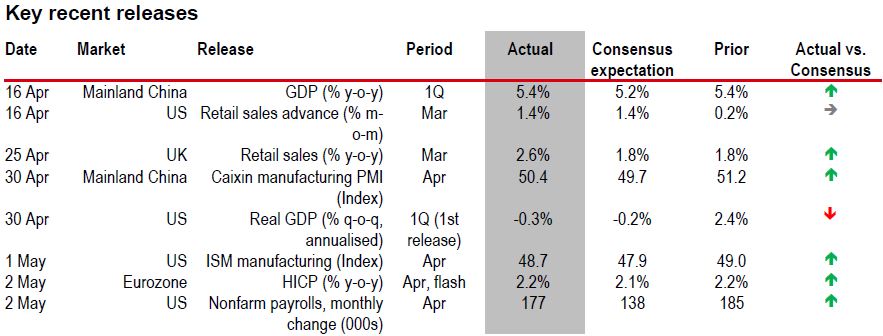

PMIs mostly fell in April, but before “Liberation Day” global data were looking OK. Mainland China reported robust GDP growth of 5.4% y-o-y in 1Q, with higher frequency indicators on the consumer side also showing signs of revival. In Europe, both GDP and the survey data showed improvement, while in the US, 1Q GDP (-0.3% q-o-q, annualised) was a mixed bag: the stagnant headline GDP print reflected a surge in pre-tariff imports while consumer spending (notably on cars) and other countries’ exports were supported for the same reason.

Note: : ⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus.

Source: Bloomberg, HSBC

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/tariff-overhang/