georgemiller

Publish Date: Thu, 08 May 2025, 12:02 PM

Key takeaways

- The Fed held rates steady for a third time in May and flagged even higher uncertainty about the economic outlook.

- The USD was modestly stronger after the meeting, with DXY hovering around the 100 level.

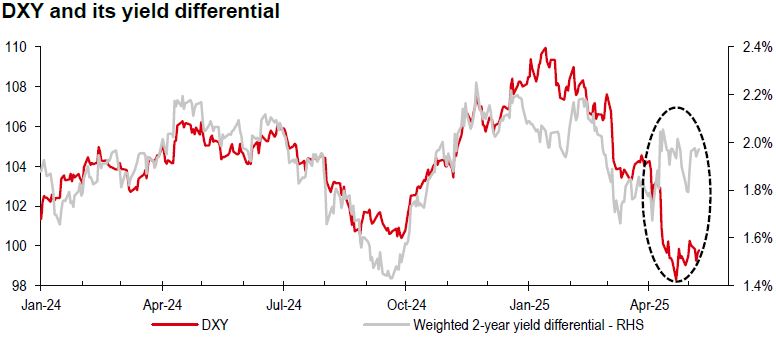

- We see the USD delinked from rate differentials for now amid US trade policy uncertainty.

For a third straight meeting in May, the Federal Open Market Committee (FOMC) voted to keep the federal funds target range unchanged at 4.25-4.50%. This was in line with market expectations. In its policy statement, the FOMC noted that uncertainty about the economic outlook “has increased further”, and added “the risks of higher unemployment and higher inflation have risen,” a new sentiment that was absent from the policy statement issued in March. In the press conference, the Federal Reserve (Fed) Chair, Jerome Powell, said that the tariffs announced on 2 April were “substantially larger than anticipated” in earlier forecasts. That said, the Fed chair also repeatedly argued that the Fed is in no hurry to alter policy, and that policymakers are in a good place to wait and see.

Even with a likely deterioration in the future growth-inflation trade-off in the US economy, our economists still expect the Fed to deliver no more than 75bp of rate cuts through 2025 and 2026. The three 25bp rate cuts would probably be delivered this year, in June, September, and December. However, if US job data for May (6 June) does not show evidence of softening (in the unemployment rate, net employment growth, or both), then the clear risk to our economists’ forecast is that the FOMC may keep policy rates unchanged again at its 17-18 June meeting. Markets currently see a 1-in-5 chance of a 25bp cut in June, and price in a c80% chance of this to happen in July (Bloomberg, 8 May 2025).

Source: Bloomberg, HSBC

FX markets did not learn a great deal new from the May FOMC meeting, leaving the USD only modestly stronger, with the US Dollar Index (DXY) hovering around 100,perhaps because Fed Chair Powell did not hint at an appetite for swift easing. In any event, interest rate differentials no longer enjoy a monopoly grip over the USD (see the chart above), with its value currently determined by political and structural factors. We expect these will keep the USD on the defensive in the months ahead. Still, the conventional drivers of monetary policy, i.e., cyclical drivers, could see their relevance resurrected if US trade policy uncertainty declines alongside possible trade deals and clarity on tariff levels.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-fed-pauses-rate-cuts-for-a-third-time/