georgemiller

Publish Date: Thu, 08 May 2025, 12:02 PM

Key takeaways

- Sentiment in the UK plummets in an ‘awful April’ for the UK economy…

- …as global uncertainty is compounded by a flurry of domestic challenges for businesses, households, and the government.

- But there are green shoots of positivity including lower interest rates.

Source: HSBC

Uncertainty seems to be the only certainty

The world continues to be gripped by US tariff policy and what it could mean for the global economy, but with so many questions still unanswered, uncertainty remains the dominant theme. A delay in the imposition of reciprocal tariffs until 9 July offers some hope that trade deals can be reached. Regardless of their outcome, US President Trump has made tariffs central to his presidency and therefore a full reversal of recent announcements seems unlikely.

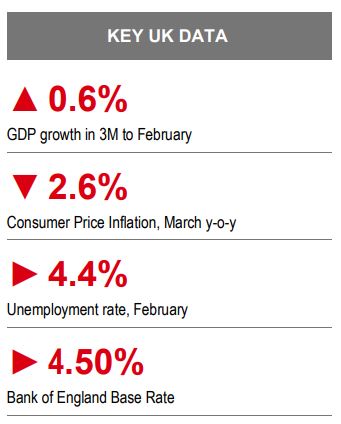

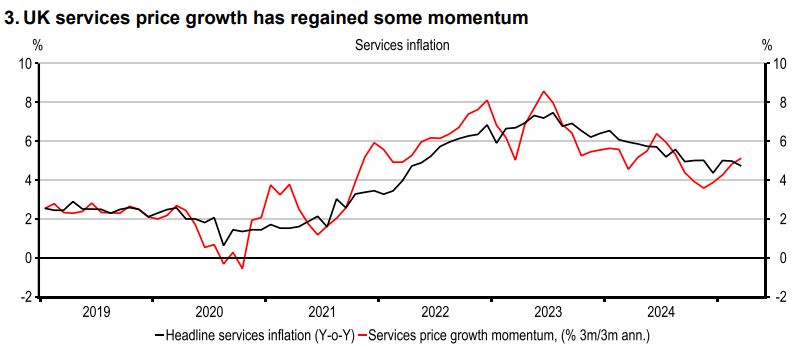

In the meantime, as economic data becomes available, it is increasingly clear that uncertainty alone coupled with a global slowdown may be the greater drag on UK growth than the tariffs themselves. The UK PMI survey for April reported its first monthly contraction in the UK economy since October 2023. External demand declined at its fastest rate since 2009 and confidence in future output growth fell to its lowest level in two and a half years (chart 1). Sentiment is currently comparable to other periods of significant uncertainty – the pandemic, the EU referendum, and the 2008 global financial crisis (GFC). Indeed, we have revised down our growth forecast for 2026, reflecting the weaker global backdrop, loss of confidence, and subsequent lower investment.

Awful April

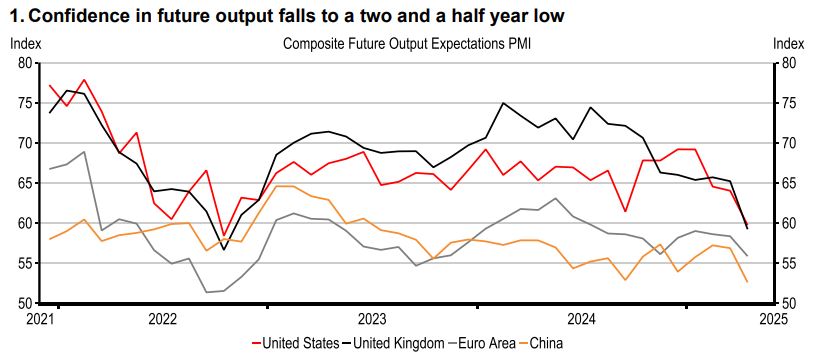

April also marked an eventful month domestically. Data confirmed that the government overshot borrowing expectations in 2024/25. House prices fell 0.6% m-o-m in April as stamp duty thresholds were lowered. Businesses faced the long-awaited increase in employer’s national insurance contributions (NIC) and national living wage (NLW) amongst other input price rises. Meanwhile, households faced a broad based rise in the cost of living, including high water bills, energy prices, and council tax rises. Moreover, the median household disposable income was broadly unchanged in 2024 versus 2023. It is no surprise then that consumer confidence remains weak, particularly across lower income households (chart 2).

It’s not all bad news

More positively, beyond US policy, the UK is positioned to take advantage of opportunities globally from strong growth in the Middle East, to a trade deal with India, and continued discussions with the EU. While domestically, even without the rise in the NLW, earnings continue to rise in real terms and the labour market, despite the headwinds, is resilient.

That is not to say it has not deteriorated: while surveys point to employment growth stalemate, notices of potential redundancies are within normal ranges. Consumer demand had been picking up in the first quarter, retail sales volumes increased 1.6% q-o-q, its best performance since 2021.

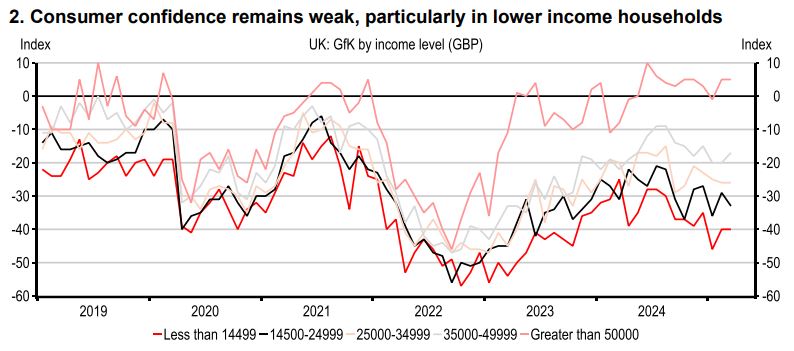

Lower interest rates would also help businesses, households, and the government. Members of the Monetary Policy Committee have appeared more concerned with the new downside risks to growth and have noted the disinflationary effects from US tariffs (source: Megan Greene, Bloomberg TV, 22 April 2025) and associated declines in oil and gas prices. In our view, the Bank of England will continue its ‘steady as she goes’ cutting cycle throughout 2025, assuming that the global backdrop avoids a larger shock and recession. Domestic inflationary pressures are more acute, and although we expect the recent pick up in services price momentum to be temporary (chart 3), it remains too high to be consistent with the 2% inflation target over the medium term. We maintain our view that the Bank Rate will end 2025 at 3.75%.

Source: Macrobond, S&P Global, HSBC

Source: GfK, HSBC

Source: Macrobond, ONS, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/uk-in-focus/uncertainty-weighing-on-growth/