georgemiller

Publish Date: Wed, 14 May 2025, 08:05 AM

Key takeaways

- The US and China agreed to big reductions in effective tariff rates for the next 90 days, as trade talks continue.

- The USD was notably stronger, with DXY rising past 101.

- Rate differentials and data releases could regain market attention amid a de-escalation in trade tensions.

The high-level trade talks between the US and China on 10-11 May were constructive, and both sides issued a joint statement on 12 May, delivering a significant breakthrough in rolling back tariff levels:

- The US will roll back its 125% tariffs on Chinese imports announced since 2 April to 10% for 90 days. The earlier 20% tariffs imposed on China for the fentanyl issue will remain in place.

- China will roll back reciprocal tariffs on the US to 10% for 90 days and lift nontariff countermeasures imposed on 2 April (retaliatory measures taken in relation to tariffs imposed for the fentanyl issue will remain in place).

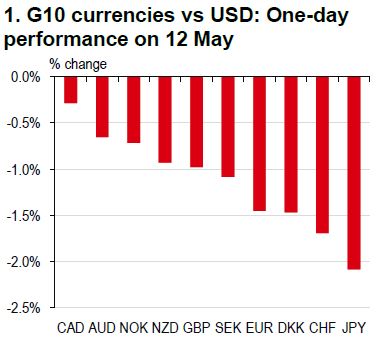

The reduction to a 30% tariff rate for China (20% fentanyl-related + 10% baseline) was better than the 80% that US President Trump hinted at before the talks (Bloomberg, 10 May 2025). This also came alongside positive official rhetoric. It was in both countries’ interest to prevent the effective trade embargo remaining in place. The immediate market reaction saw the USD strengthen against all other G10 currencies, in particular, the low yielding, “safe haven” JPY and CHF, as global equity market rallied, US rate cut expectations eased, and FX position adjusted.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

It is worth noting that the AUD (and NZD) did not capitalise against the USD but did make gains vs the EUR and safe haven currencies. One could make the case that the reduction in trade tariffs would have allowed the AUD to outperform in the G10 space, given its China linkages and positive correlation with risk appetite. But the USD is capitalising on reduced trade tensions, an appropriate mirror to its weakness as trade tensions rose. It suggests the USD could gain on evidence of progress in US trade talks with China (and others) but may remain vulnerable to any setbacks. Another aspect to note is the US retention of a 10% baseline tariff on China. This echoes the US-UK trade deal and suggests a 10% baseline tariff may be here to stay, irrespective of what else the US agrees with trade partners.

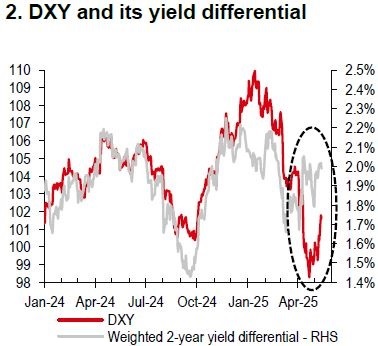

The US Dollar Index (DXY) has been weaker than what its rate differentials imply (Chart 2), probably reflecting market concerns over US policy and structural issues. But if trade tensions are at least temporarily relegated down the list of market priorities, rate differentials and data releases could once again see renewed traction. This cyclical factor currently suggests the DXY could go higher.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/dxy-higher-on-us-china-trade-truce/