georgemiller

发布日期: Mon, 19 May 2025, 12:02 PM

Key takeaways

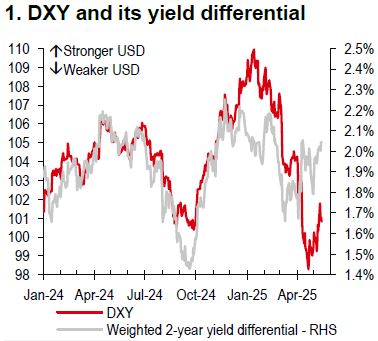

- DXY is still below what its yield differential implies, but the gap is closing as trade uncertainty recedes, for now.

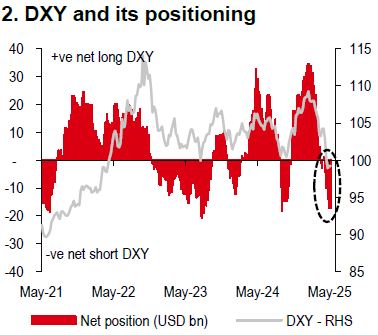

- The recovery in the USD may also have been helped by positioning adjustment.

- Cyclical factors could regain traction; DXY consolidation seems likely, while the AUD and NZD may strengthen over the near term.

For most of 2024, the US Dollar Index (DXY) had been tracking its yield differential, but the USD developed a premium to its yield differential in early 2025 amid US growth resilience. That premium came to an end due to US trade policy uncertainty, followed by a swift swing to a USD discount since 2 April when “reciprocal tariffs” were introduced. At one point, the DXY was c7% below the level implied by its yield differential.

More recently, that discount has begun to narrow (Chart 1). This started with the USUK trade deal but got real impetus when the US and China announced an official trade truce on 12 May, with big reductions in effective tariff rates for 90 days. The recovery in the USD may also have been helped by positioning adjustment, given the stretched short DXY positioning (Chart 2).

Nonetheless, it seems appropriate that the discount still exists, as negotiations are ongoing with no guarantee of success. The US will also want to secure resolutions with other trading partners with whom it runs sizeable deficits, for example, the EU where the process may run more slowly, given the multitude of countries and interests in play. Progress would see the USD gain, and setbacks see it wilt.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Still, the improvement in global trade news flow may reopen the door to cyclical factors getting more traction. A pause in parts of US trade policy should also allow the Federal Reserve to extend its pause on rate cuts so long as the resilience of the labour market and inflation data cooperate. Markets also expect the Fed to keep its policy rate unchanged at its 17-18 June meeting (Bloomberg, 15 May 2025). Until then, DXY is more likely to consolidate than see a big move in either direction.

De-escalation in US-China trade tensions and positive news around potential trade deals between the US and other Asian economies should alleviate pressure on the regional growth outlook and improve overall risk sentiment. As such, AUD-USD and NZD-USD are likely to edge higher over the near term.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/dxy-closing-the-gap-with-yield-differential/