georgemiller

Publish Date: Tue, 20 May 2025, 12:01 PM

Key takeaways

- China officials announced a raft of policy measures during a recent press conference, backing their pro-growth stance…

- …including interest rate cuts, support for Central Huijin as a stabilisation fund and policies to bolster the real economy.

- US-China trade talks have ignited hopes for a de-escalation and, if successful, present upside risks for economic growth.

China data review (April 2025)

- Retail sales grew at 5.1% y-o-y in April, helped by expanded funding for tradein programmes (RMB162bn year-to-date versus RMB150bn last year). Products covered by the scheme saw double-digit growth in April, including communication appliances (19.9% y-o-y) and household appliances (38.8%). For autos, sales volume continued to be strong, up 15% y-o-y, while electric vehicles (EVs) were up 34%, based on CPCA data.

- Industrial production was up 6.1% y-o-y in April, reflecting the stronger-thanexpected export growth, which was driven by trade restructuring. Policy incentives to promote large-scale equipment upgrading (RMB200bn of funding support) and cultivate technology and innovation also helped boost production. However, some labour-intensive sectors, such as textiles (2.9% y-o-y), may have been hit due to the increased external uncertainties.

- The property sector remained a key drag on the economy in April, which saw deeper falls in investment (down 11.3% y-o-y), primary home sales (down 2.4% y-o-y in volume terms) and home prices (second hand home prices down 0.4% m-o-m). The government may need to step up support to help reverse the slump, and it still has ample tools to do so.

- Inflation prints hinted at tepid consumer prices as CPI fell 0.1% y-o-y in April, and rising downward producer price pressures, with PPI down 2.7% y-o-y. Volatile items, such as pork, remained drags to headline CPI, while core CPI continued to receive support from consumption policies. Despite robust export growth in April, its momentum may fade in the coming months, so domestic demand will need to pick up the slack, while helping to stabilise prices.

- Exports rose 8.1% y-o-y in April, despite prohibitive US tariffs on Chinese goods being imposed at the start of the month. This was helped by a low base and exports to third countries (especially ASEAN), on accelerated trade restructuring, related front-loading and rerouting of direct US-China shipments. Meanwhile, imports fell 0.2% y-o-y but were ahead of market expectations, on improved processing imports, likely related to exports to third countries.

China easing: a raft of stimulus

Following the pro-growth stance denoted in the April Politburo meeting, the heads of the People’s Bank of China (PBoC), the National Financial Regulatory Administration (NFRA) and the China Securities Regulatory Commission (CSRC) held a press conference on 7 May to roll out financial market stabilisation measures (Table 1). The package, however, did not include direct fiscal support for domestic consumption, in line with our view that China will focus on implementing various fiscal easing already announced during the National People’s Congress in early March.

Monetary easing

Numerous monetary easing measures were rolled out, including lowering the policy rate by 10bp, structural relending rates by 25bp (from 1.75% to 1.5%) and the Pledged Supplementary Lending rate by 25bp (from 2.25% to 2%). Liquidity injections included an outright 50bp cut in the required reserve ratio (equivalent to a RMB1trn liquidity injection) and creation of several new monetary policy tools. If fully utilised, the new tools add an additional RMB2.1trn of liquidity to the real economy. We think more easing will follow, likely through additional rate cuts in the second half of the year and the PBoC resuming treasury purchases from the secondary market.

Stock market stabilisation

The CSRC emphasised that market stability is critical to economic growth and the interests of investors, while pledging support for Central Huijin to play the important role as a market stabiliser. There has been a substantial change in policy stance towards the stock market since 24 September 2024, with ‘stock market (and housing) stabilisation’ written into this year’s target. Indeed, Central Huijin announced purchases of A-share ETFs in early April when the trade escalations shocked the market (Securities Times, 8 April); however, this is the first time the CSRC has referred to it as the quasi-market stabilisation fund.

The NFRA also announced that it would lower risk factors for insurance companies to increase equity exposure, encouraging more ‘patient capital’ to make stock investments.

Supporting the real economy

The three ministries consistently pledged support for the real economy. The PBoC’s new monetary tools are aimed at directing new funds towards technology innovation, expanding elderly care and supporting small businesses. The CSRC is prioritising reforms to provide capital support for technology innovation, while enhancing investor protection to increase market reliability. And the NFRA is focusing on financing support for real estate developers, exporters and importers, and adapting regulations to help industrial transformation and upgrading.

Reviving consumption

Though not a focus of the press conference, we think reviving consumption remains the primary policy target this year. The Labour Day holiday showed improving activity, but we stay cautious as outcomes of tariff negotiations remain highly uncertain, while negative impacts may just be starting to unfold. A mix of both near-term measures, like trade-in programmes and services consumption subsidies, as well as structural measures, such as improved social safety net coverage, pension reforms and stabilisation of the housing sector, will likely be rolled out.

US-China trade talks

China and the US announced a tentative trade truce in Geneva on 12 May, agreeing to suspend new tariffs for 90 days and scale back existing tariffs (China to face 30%, the US to face 10%). Both sides agreed to establish a ‘consultation mechanism for trade and economic issues’, laying the groundwork for future high-level dialogue. The pullback will be most welcomed by businesses on both sides that were starting to feel the pinch from reciprocal tariffs and presents upside risks to economic growth.

Source: SCIO, HSBC

Source: LSEG Eikon

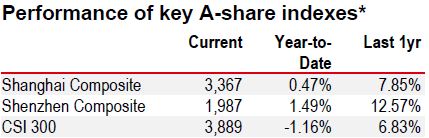

*Past performance is not an indication of future returns

Source: LSEG Eikon. As of 16 May 2025, market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/china-easing-a-raft-of-stimulus/