georgemiller

Publish Date: Mon, 26 May 2025, 12:01 PM

Key takeaways

- The RBA delivered a dovish 25bp cut in May, and a 50bp move was discussed.

- The AUD weakened after the decision…

- …but we continue to see scope for a stronger AUD.

On 20 May, the Reserve Bank of Australia (RBA) lowered its key policy rate by 25bp to 3.85%, in line with market expectations. This was the second rate cut in the current easing cycle. The RBA Governor, Michele Bullock said after a short discussion about whether to remain on hold, the conversation moved swiftly to the thought of a 50bp or 25bp cut (Bloomberg, 20 May 2025).

There were broad-based negative revisions to the RBA’s quarterly forecasts. The RBA now forecasts GDP growth of 2.1% y-o-y in 4Q25 (previously 2.4%) and 2.2% in 4Q26 (previously 2.3%), an unemployment rate of 4.3% in 4Q25 and 4Q26 (previously 4.2%), and trimmed mean inflation of 2.6% in 4Q25 and 4Q26 (previously 2.7%), assuming two more 25bp cuts by end-2025 and one more cut by mid-2026.

Rate markets now see the RBA policy rate to end the year at c3.1%, lower than c3.3% before the decision (Bloomberg, 22 May 2025). The AUD edged lower against the USD after the announcement before recovering its loss.

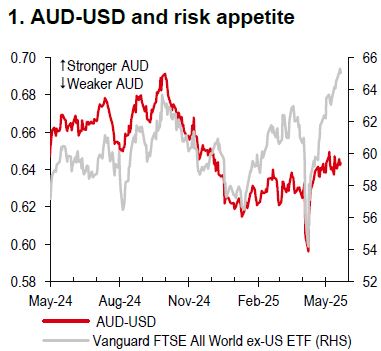

Nevertheless, this is a dent but not an end to our bullish AUD view. Externally, trade tensions are de-escalating. This should alleviate the pressure on the regional growth outlook to a certain extent, improve overall risk sentiment (which we use Vanguard FTSE All World excluding US ETF as a proxy), and benefit the AUD (Chart 1). Domestically, the incumbent centre-left Australian Labor Party, led by Prime Minister Anthony Albanese, won the Federal election on 3 May and a second term, with an increased majority of the vote. The current government has ample room and clear willingness to deliver fiscal support if domestic conditions warrant, as the net national debt is low at 19.9% of GDP in 2024-25 (according to the budget 2025-26 released on 25 March).

Source: Bloomberg, HSBC

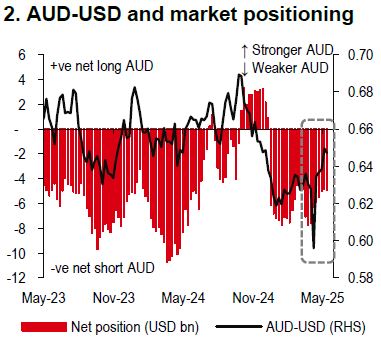

Source: Bloomberg, HSBC

Positioning wise, AUD-USD has traded at a discount to its key drivers since the US election, in line with still sizable net short positions (Chart 2). Positioning readjustment, in addition to a potential increase in the FX hedge ratio by Superannuation Funds could also be positive for the AUD. All things considered; the risk-reward balance may move in favour of the AUD in the months ahead.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/aud-beyond-the-rbas-dovish-cut/