georgemiller

Publish Date: Mon, 02 Jun 2025, 07:04 AM

Key takeaways

- Emerging market local currency debt looks positioned to do well in a backdrop of high real yields, strong fundamentals, and a weakening US dollar.

- Last week saw the last of the Magnificent Seven mega-caps deliver Q1 profits numbers – which once again beat analyst expectations.

- Asset market volatility this year has focused investor attention on ways of giving portfolios sufficient ballast.

Chart of the week – Bond market vigilantes are back

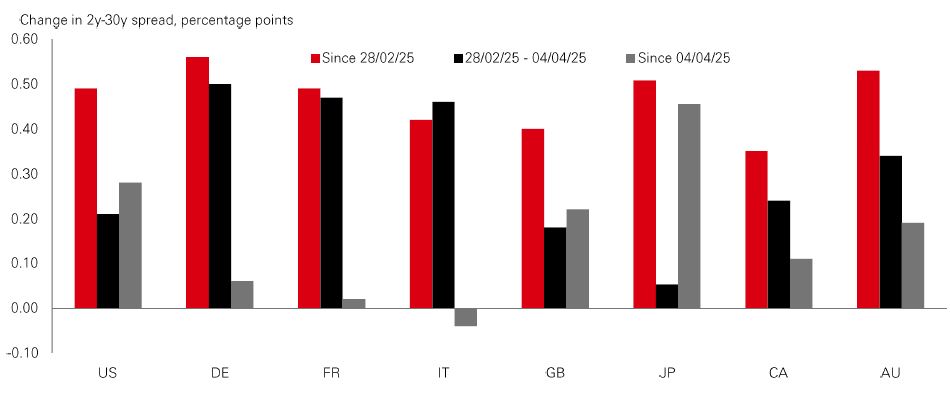

The “bond market vigilantes” have been spotted riding back into town. Yields on long-dated bonds across the G7 have been rising recently, with a marked steepening in 2y-30y spreads since the end of February.

The initial pick-up in yields during March coincided with the news of a major fiscal support package in Germany, which boosted Bund yields along with their French and Italian equivalents and likely pushed up yields globally. This element of the move in long-dated rates can be seen as positive – reflecting a reflation of the eurozone economy driven by the country with ample fiscal space to do it.

Since early April, the 2y-30y spreads for Germany, France and Italy have moved very little, but those for the US, Japan and the UK have moved higher. This is potentially more worrying. It coincides with a spike in US policy uncertainty, forcing higher bond risk premiums, together with growing concerns about the fiscal position of the US, Japan, and the UK.

The US administration’s fiscal plans imply a further widening of the deficit from an already-unsustainable level. Japan’s gross government debt of well over 200% of GDP is sustainable in a low global rate environment, but not when global yields move to pre-GFC levels. As Japanese yields rise, self-reinforcing dynamics can take over – with higher yields raising questions over sustainability, driving risk premiums higher, in turn putting more pressure on sustainability.

For investors, developments in the bond market – and the impact on asset prices – is a key focus. With US Treasuries in turmoil, traditional safe assets are less reliable (see page 2), while higher rates could eventually weigh on stocks. With the risk of “deficits forever”, the bond vigilantes won’t be leaving any time soon.

Market Spotlight

Building new synergies

Over the next 25 years, investments totalling an estimated USD150 trillion are going to be needed to achieve global energy transition targets. Key to that will be the development of infrastructure projects in areas like clean energy, transport, and digital. It comes at a time when traditional lending is scaling back in this space – and according to some Infrastructure Debt specialists, it’s leaving a financing gap that is driving strong demand from both companies and investors for private credit in infrastructure funding.

Large-scale infrastructure projects often attract financing from major institutions, which is why infrastructure debt has historically been dominated by insurance companies seeking long-term, investment-grade assets. Yet, specialists see mid-market deals (of USD50-250 million) remaining largely underserved. It is an area now attracting pension funds, family offices, and investors seeking higher-yield, shorter-duration opportunities. For investors that allocated heavily to direct lending in recent years, it also offers a potentially lower-risk alternative while still offering attractive returns versus public markets. Overall, the synergy between private credit and infrastructure financing is reshaping how institutional investors approach alternative assets.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 30 May 2025.

Lens on…

Emerging diversifiers

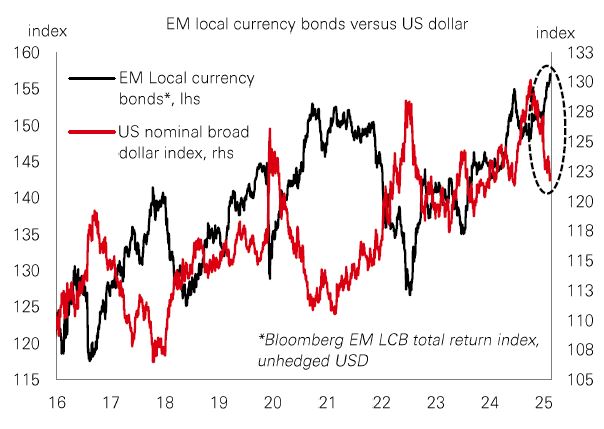

Emerging market local currency debt looks positioned to do well in a backdrop of high real yields, strong fundamentals, and a weakening US dollar. Indeed, strengthening EM currencies, combined with falling inflation, are allowing EM central banks to ease policy, further boosting the appeal of EM local bond markets to global investors. And while US tariffs could drag on growth, the demand shock could be disinflationary for EMs, potentially speeding up their policy easing cycles.

Despite broad tailwinds, it makes sense to take a differentiated view of the EM bond universe. EM currencies – especially those backed by large external surpluses, some of them in Asia – are likely to outperform. EMs have built up buffers against external risks at differing speeds, and they have varying exposure to global trade. For Indonesian bonds, historically high real yields, low inflation, manageable external balances, moderate debt levels, and reassurance from the finance minister have alleviated market concerns over fiscal risks.

A Q1 profits bang – but 2025 whimper?

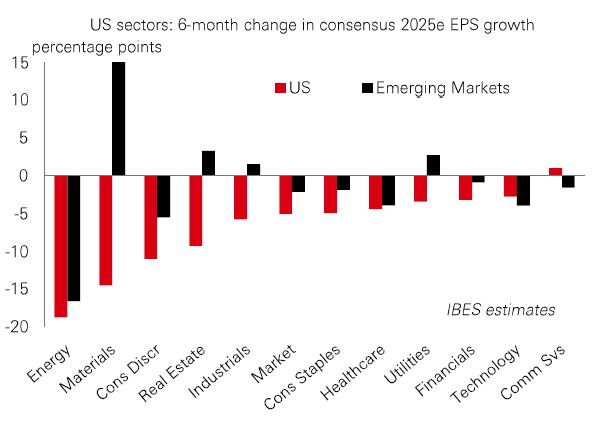

Last week saw the last of the Magnificent Seven mega-caps deliver Q1 profits numbers – which once again beat analyst expectations. Overall, US Q1 profits have delivered a bang, growing 13% year-on-year versus an expected 7% at the start of the quarter. But while sectors like healthcare and technology have raised guidance for the full year, most sectors are pencilling-in flat to falling growth in 2025.

In fact, consensus y-o-y profits growth for 2025 has fallen from 14% in January to just over 9% today. Energy, materials and consumer discretionary have seen the deepest downgrades. Revisions in consumer discretionary follow a stellar run for the sector, which is up by 218% over 10 years. But with a 12-month forward price/earnings valuation of 29x (higher than US Tech on 27x). Industrials, which is not cheap on 23x, has exposure to the US government's focus on infrastructure and re-shoring.

Beyond the US, full year consensus for Emerging Markets are better in most sectors. And with EM on a PE of 12.3x versus the US on 21.5x, EM stocks could offer more of a valuation buffer against setbacks.

In search of safety

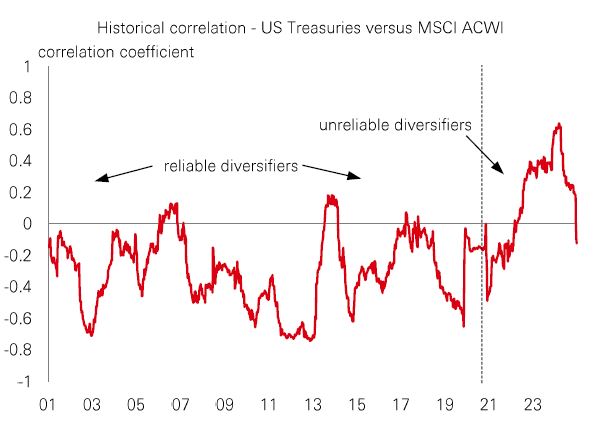

Asset market volatility this year has focused investor attention on ways of giving portfolios sufficient ballast.

For much of the first two decades of this century, a negative correlation between stocks and bonds meant bonds provided a reliable cushion in equity market downturns – good news for 60/40 portfolios. But since 2021, this dynamic has reversed. Resurgent inflation and shaky public finances led to bonds and equities selling off in tandem. For investors, it removed a comfort blanket they’ve relied on for years.

Research by some ETF and Indexing teams shows the current correlation landscape resembles patterns seen in the 1970s, 80s, and early 90s – a time when inflationary pressures drove positive correlations between stocks and bonds. The relationship between inflation and economic growth influences how asset classes behave relative to each other. When inflation dominates, as it has post-pandemic, bonds are a less reliable hedge. That’s compounded by concerns over high deficits keeping bond yields sticky. In sum, it poses a challenge to the 60/40 model and may require a change in how investors think about risk and diversification.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 30 May 2025.

Key Events and Data Releases

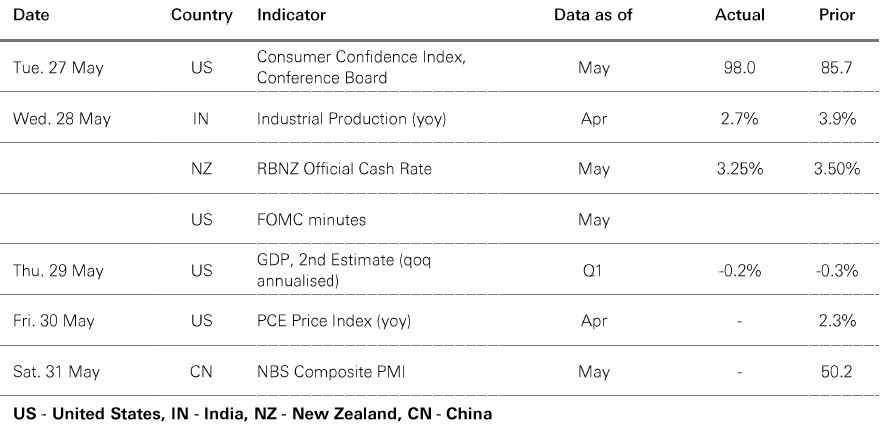

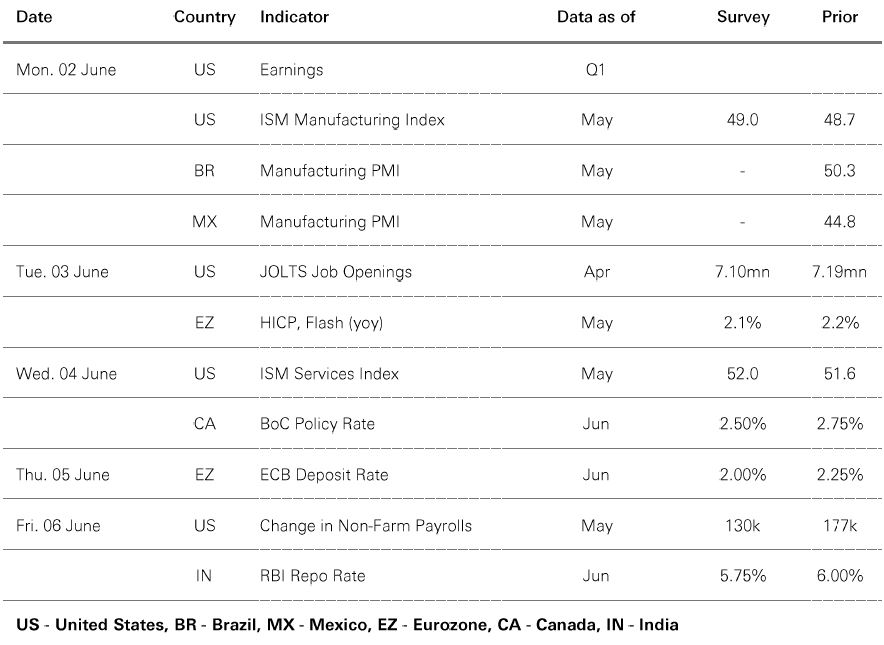

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 30 May 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Risk sentiment strengthened last week as the Q1 earnings season neared its end, and investors continued to monitor the trade negotiations and tariff developments. The dollar index rebounded modestly, and Treasury yields pulled back following solid auction results. European yields also declined. US and Euro credit spreads narrowed, with HY outperforming IG. US equities saw broad-based gains, recovering some of the prior week's losses. European markets broadly advanced, as Japan's Nikkei 225 rose amid a weaker yen and a retreat in JGB yields. Other Asian equities lacked clear direction, with South Korea's Kospi leading gains. India's Sensex and China’s Shanghai Composite traded sideways, while Hang Seng fell. In commodities, oil prices declined before an OPEC+ meeting to discuss July output, accompanied by softer gold and copper prices.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/bond-market-vigilantes-are-back/