georgemiller

Publish Date: Mon, 02 Jun 2025, 12:02 PM

Key takeaways

- US trade court ruled that US import tariffs imposed for national emergency reasons are unlawful.

- With the appeals process having already resulted in a temporary “stay” to keep them in place…

- …the USD’s initial bounce was short-lived; we still expect the USD to be on softer ground in the months ahead.

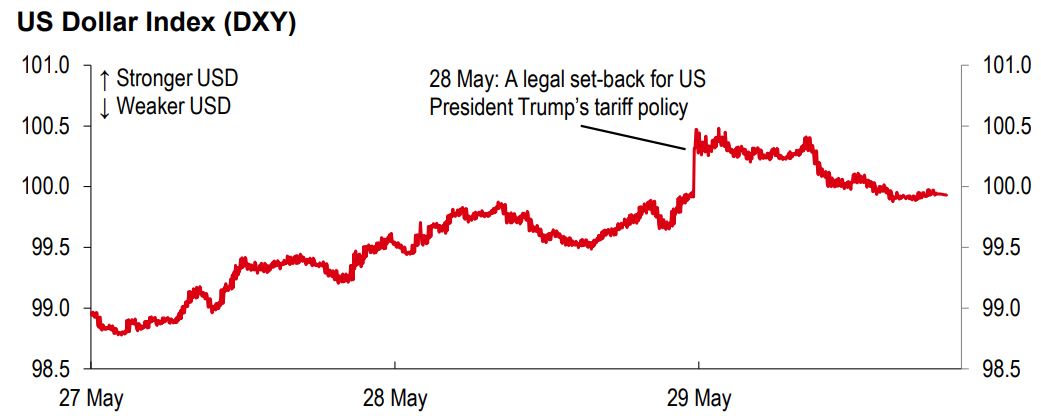

The US Dollar Index (DXY) rallied past the 100 level after the US Court of International Trade (CIT) unanimously ruled on 28 May that tariffs imposed on the basis of a national emergency (International Emergency Economic Powers ActIEEPA) were unlawful and should be removed within ten days (Bloomberg, 29 May 2025). The judgement blocks the reciprocal tariffs, the baseline 10% tariffs, and the fentanyl-related tariffs on China, Canada, and Mexico. Sector-specific tariffs enacted using different trade legislation (Section 201, 232, and 301) remain in place.

The USD’s initial bounce shows that FX markets have retained their reaction function that good news on the trade front (i.e. lower tariffs) is also good news for the USD. It seems the lens through which markets are examining tariffs is whether it reduces or increases US policy uncertainty. FX markets may also reward the USD for lower tariffs because it is seen as reducing the drag on US growth.

Source: Bloomberg, HSBC

However, the USD bounce was short-lived. The US administration immediately lodged an appeal with the Federal Circuit Court where it won a temporary “stay” on the CIT’s order to remove the IEEPA tariffs. A full appeal could take months. But US President Trump has other options for delivering tariffs, for example, the sector-specific tariffs (which will involve a consultation period before going in place) or universal tariffs of up to 15% for a maximum of 150 days under Section 122. So, FX markets have chosen not to view this CIT decision as a gamechanger, but the ruling does complicate matters. It also removes the threat of swift punitive tariffs from the US administration’s toolkit.

Tariff pauses and the CIT decision may create a sense of a return to normality, but tariffs remain elevated, and the threat of a return to even higher tariffs in July looms large. The futures market expects the Federal Reserve (Fed) to adopt a “wait and see” approach, with the next rate cut only fully priced for the 28-29 October meeting (Bloomberg, 29 May 2025). After assessing cyclical, political, and structural factors, we think that the USD should be on softer ground in the months ahead.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/usd-us-trade-tariff-uncertainty-continues/