georgemiller

发布日期: Mon, 09 Jun 2025, 12:01 PM

Key takeaways

- The Reserve Bank of India (RBI) surprised the markets by delivering a larger-than-expected 0.50% rate cut in its June MPC meeting. However, the central bank changed the monetary policy stance to “neutral” from “accommodative” previously. The RBI also reduced the Cash Reserve Ratio (CRR) for banks by 1% to 3%.

- In our assessment, the RBI’s larger-than-expected rate cut was done to front-load the rate cuts rather than being an indication of sharp downside risks to growth. We now expect the RBI to remain on hold in the August and October meetings, before delivering a 0.25% cut in December MPC meeting to take the benchmark rate to 5.25%.

- We retain our overweight stance on Indian equities and favour large-cap stocks as we believe they are better positioned to navigate the uncertain environment. Given the elevated global uncertainty, we like more domestically-oriented sectors and favour financials, healthcare and industrials. We are bullish on Indian local currency bonds and expect 10-year government bond yields to edge lower by end-2025.

What happened?

In the Monetary Policy Committee (MPC) meeting on 6th June 2025, the Reserve Bank of India (RBI) surprised the markets by delivering a larger-than-expected 0.50% rate cut. In the lead-up to the meeting, most of the economist surveys by Bloomberg were expecting a 0.25% rate cut by the RBI.

Five out of the six MPC members voted for a 0.50% rate cut. However, the central bank changed the monetary policy stance to “neutral” from “accommodative”. The RBI Governor Malhotra highlighted that the shift in the monetary policy stance means that the future policy direction would be largely data dependent.

In addition to the jumbo 0.50% rate cut, the RBI also reduced the Cash Reserve Ratio (CRR) for banks by 1% to 3%. The 1% cut will be enacted in a staggered manner with 0.25% cuts each fortnight starting from 6th September.

The RBI highlighted that this measure should release approximately INR 2.5tn (USD29.1bn) liquidity in the Indian financial system by November 2025.

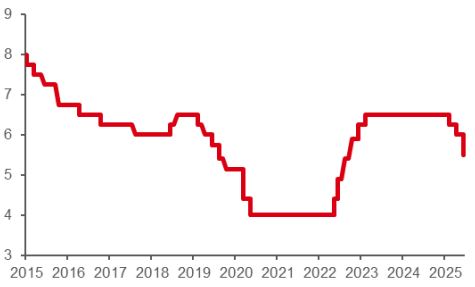

The RBI lowered Indian repo rate to 5.50%, the lowest since 2022

Source: Bloomberg, HSBC Global Private Banking and Premier Wealth as of 6 June 2025. Past performance is not a reliable indicator of future performance.

The RBI kept its FY26 (April 2025-Mar 2026) GDP growth forecast unchanged at 6.5%. RBI Governor Malhotra highlighted that amid global uncertainties, Indian economy was a picture of strength and stability.

Private consumption is expected to remain healthy with a gradual rise in discretionary spending and a pick-up in rural demand, due to a good monsoon season. Governor Malhotra also mentioned that while India has agreed on a trade deal with the UK and is negotiating with other countries, the central bank remains vigilant against downside growth risks due to geopolitical tensions.

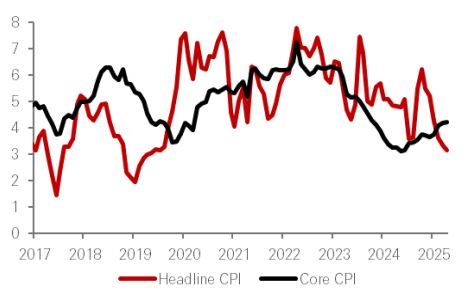

RBI Governor Malhotra also highlighted that the outlook for food inflation had softened while the core inflation outlook remained benign. As a result, the RBI lowered its FY26 inflation projection to 3.7% from 4.0% previously. Governor Malhotra also said that the battle against inflation, which has declined to a six-year low, had been won and indicated that the central bank would increase its focus on supporting growth.

In our assessment, RBI’s larger-than-expected rate cut was done to front-load the rate cuts rather than being an indication of sharp downside risks to growth. The change in monetary policy stance to “neutral” and the RBI governor’s comments suggest that this was done to ensure a minimal time lag in the transmission of monetary easing to the real economy.

Investment implications

We now expect the RBI to remain on hold in the August and October meetings, before delivering a 0.25% cut in December MPC meeting to take the benchmark rate to 5.25%.

RBI’s monetary policy decision was viewed positively by the equity markets, which rose sharply following the announcement. Easier monetary policy to boost growth is generally supportive for the broader market. In particular, the 0.50% rate cut and the lowering of CRR are positive for banks, real estate and the consumer discretionary sector. 10-year government bond yields declined initially before edging 2-3bps higher at the time of writing, while USD/INR was largely unchanged.

We retain our overweight stance on Indian equities, as most of the fundamentals and technical factors remain supportive.

India’s headline CPI inflation declined to the lowest level in nearly 6 years

Source: Bloomberg, HSBC Global Private Banking and Premier Wealth as of 6 June 2025. Past performance is not a reliable indicator of future performance.

From a fundamental perspective, in addition to the tailwind from robust GDP growth, we see (i) potential signs of stabilisation in the earnings trajectory, with expectations of double-digit earnings growth and (ii) a healthy Return on Equity (RoE) of around 15% offsetting the concerns about valuations.

From a technical perspective, the resilience of domestic investors, which was a big unknown, is viewed as a big positive. Also, there are visible signs of the return of foreign investor inflows and from a seasonal perspective, June – September has historically been a strong period for Indian equities.

We favour large-cap stocks over the small- and mid-cap stocks. Large caps continue to trade at a sizeable discount and their larger size makes them more defensive should market volatility spike again. Given the still-elevated global uncertainty, we prefer domestically-oriented sectors, with a greater exposure to the Indian consumption story. We continue to favour the financials, healthcare and industrials sectors.

We are bullish on Indian local currency bonds and expect them to outperform cash in 2025. We expect 10-year government bond yields to edge lower by end-2025.

https://www.hsbc.com.my/wealth/insights/market-outlook/special-coverage/rbi-delivers-a-surprise-cut/