georgemiller

Publish Date: Tue, 10 Jun 2025, 08:05 AM

Key takeaways

- Progress on trade deals calmed the tumbling survey data in May, but the hard data may be starting to soften…

- …at a time when fiscal concerns have revived and the future course of US import tariffs hinges on the courts of appeal…

- …adding to challenges for businesses and monetary policy.

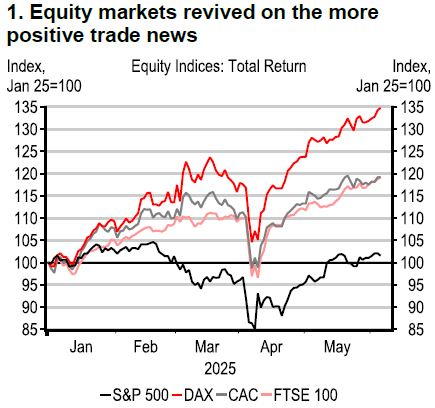

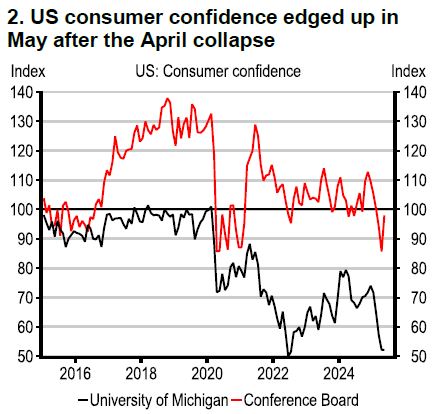

US trade and fiscal policy has dominated the global narrative over the past month. Progress on framework trade deals with the UK and, more importantly, China, following on from the 90-day pause on the highest reciprocal tariffs announced on 9 April, calmed some of the fears about worst case scenarios on US tariffs. This, in turn, helped revive equity markets, while the May business and consumer confidence survey data stabilised or improved after the dismal April readings.

Source: Macrobond

Source: Macrobond

Tariff challenges

Trade uncertainty still reigns though, following the US Court of International Trade (CIT) ruling that the US President had overstepped his authority by imposing reciprocal tariffs globally using the International Emergency Economic Powers Act (IEEPA). While the US administration immediately lodged an appeal and won a temporary ‘stay’ on the CIT’s order to remove the IEEPA tariffs, US importers and consumers, as well as foreign exporters, cannot know whether some tariffs will be sustained or cancelled after the appeal, or even increased post 9 July.

Debt concerns

If there is a loss of tariff revenues, which rose in April, it will have no direct implications for the so-called Big Beautiful Bill (BBB) Act as there was no explicit connection to tariff revenues in the Republican budget reconciliation package now in the Senate. However, the latter was already a major factor in Moody’s May downgrade of the US sovereign credit rating which coincided with heightened market concerns over the hefty budget deficit and much higher debt projections implied by the BBB. The US 10-year yield hit 4.6% and the 30-year hit 5%, keeping US mortgage rates high.

Divergent data

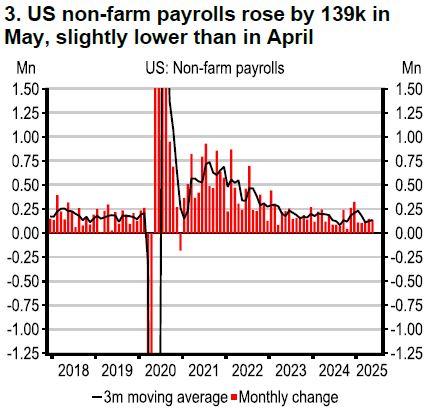

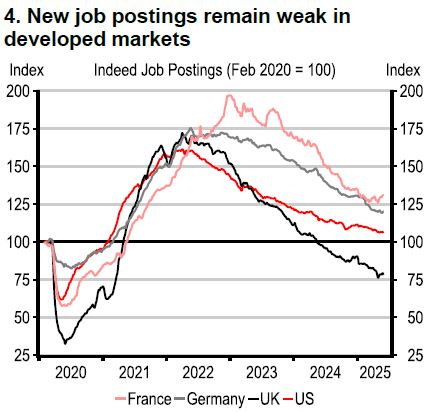

Yields have now edged lower again amid a few signs that the hard US data, which have generally still been more resilient than surveys, may finally be softening a touch. Non-farm payrolls increased at a slightly slower pace in May, while unemployment remained unchanged at 4.2%. Although layoffs in the US remain low, the rate of hiring has slowed. In Europe and in parts of Asia Q1 GDP was stronger than expected, helped by frontloading ahead of tariffs, but Q2 industrial data are mostly showing signs of softening.

Source: Macrobond

Source: Macrobond.

Falling inflation

US inflation releases for April were lower, but the Federal Reserve will remain wary of inflation expectations as tariff effects feed through: early signs of rising input cost were evident in the US manufacturing and services PMI/ISM data and May wage data were higher. Eurozone inflation fell below 2% in May as Easter effects unwound and lower energy prices and a stronger euro should mean it falls further, even if global food prices (dairy and meat) continue to edge higher. The European Central Bank (ECB) is in a good place after cutting interest rates to 2%, which could prove to be the last cut of the cycle, but we still see disinflationary effects against a backdrop of already low inflation driving policy rates lower across Asia, except Japan.

Source: Bloomberg, HSBC

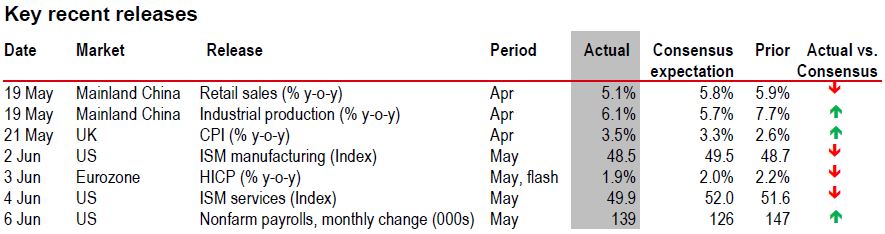

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: LSEG Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/ongoing-trade-and-debt-uncertainties/