georgemiller

发布日期: Mon, 16 Jun 2025, 07:04 AM

Key takeaways

- The Fed is widely expected to leave the funds rate unchanged at its meeting this week. What Chair Powell says and how the Fed factors US import tariffs into its updated forecasts will be the focus.

- US technology dominates the artificial intelligence revolution. But recent advances by Chinese AI firm DeepSeek have shown China to be a serious competitor.

- Asia’s investment in renewable energy is slowing as its governments struggle to balance decarbonisation objectives with delivering reliable and more affordable power sources. A scarcity of traditional funding options is adding to the headache.

Chart of the week – EM central banks in easing mode

Recently, the Reserve Bank of India (RBI) delivered front-loaded policy easing with a surprise 0.50% rate cut and liquidity easing through lower reserve requirements. Falling inflation and a broadly dollar-bearish backdrop have opened the door for the RBI to deliver bold moves this year – with a quick, cumulative 1% rate cut, substantial liquidity infusions, and multiple relaxations of macro-prudent measures. Big moves like this aim to speed up policy transmission through the banking sector and boost credit growth, helping to bolster consumer spending and capital investment. The measures are likely to support local stocks too, especially in rate-sensitive sectors like real estate and some financials. It comes as Indian equities have been under pressure this year amid heightened global policy risks. They’re also likely to lead to further spread compression on rupee-denominated corporate and supranational bonds, which offer attractive spreads over Indian government bonds.

But this isn’t just an India story. A number of emerging market central banks have taken decisive policy action recently – as the US Fed continues to hold. Among them have been Mexico, Indonesia, Poland, South Africa, and Egypt. In some cases, countries have been able to act because their fiscal outlooks are improving. But the critical factor has been the weaker dollar, as investors reassess its status as a global safe haven. A weaker dollar is an obvious EM positive. It typically eases dollar debt servicing, helps trade, supports capital flows, and boosts returns in stocks and local currency bonds. With many EM economies transforming their macro structures since the “fragile five” phase a decade ago, and amid faltering confidence in American exceptionalism, no wonder investors are paying more attention.

Market Spotlight

Trading places

Over the past decade, emerging market economies – especially in Asia and Latin America – have enjoyed closer integration when it comes to regional trade and banking. The result has been better growth, access to alternative sources of credit, and less volatile government spending. But this closer regional EM integration has come at a time of rising geopolitical tensions that have led to more fragmentation at a global level. This rewiring of global trade linkages is the focus of a new bulletin by the Bank of International Settlements.

The BIS research explores how, prior to the 2010s, global trade expanded faster than GDP, but then slowed as geopolitical wrangling intensified. Meanwhile, integration in global banking fell sharply after the financial crisis and didn’t recover much afterwards. But at a regional level, trade and banking integration have continued to progress in emerging Asia and LatAm. According to the BIS authors, these trends – and the economic drivers behind them – have the potential to act as a buffer against geopolitical shocks that lead to global fragmentation. Their encouraging conclusion is that the reinforcing nature of trade and banking means that deeper regional integration in EMs – and the better growth and regional stability that comes with it – is likely to develop.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 13 June 2025.

Lens on…

Taking the summer off

The Fed is widely expected to leave the funds rate unchanged at its meeting this week. What Chair Powell says and how the Fed factors US import tariffs into its updated forecasts will be the focus. In March, the Fed expected 1.7% yoy growth in Q425 with core PCE inflation at 2.8%. The current Bloomberg consensus figures are 0.9% and 3.3% respectively, giving some sense of how the Fed’s numbers could change. The March “dot plot” implied two rate cuts in 2025, in line with current market pricing, which suggests investors have interpreted higher expected inflation and lower expected growth as broadly offsetting.

The latest data don’t argue for the Fed to guide market rate expectations in one direction or the other. Activity and survey data have been mixed. The labour market is cooling gradually but remains resilient. Importantly, March, April, and May inflation data have been softer than expected, implying that, absent tariffs, underlying price pressures are reasonably well contained. Modest policy easing later in 2025 appears appropriate. One catch is that a data-dependent Fed risks intensifying the sensitivity of the macro system to news, which could spur US market volatility.

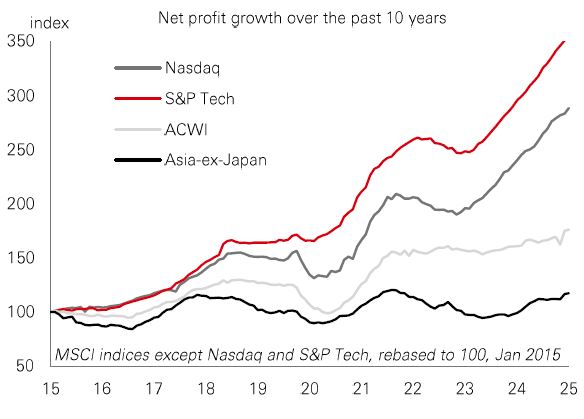

Artificial intelligence, real profits

US technology dominates the artificial intelligence revolution. But recent advances by Chinese AI firm DeepSeek have shown China to be a serious competitor. A new research by some Equity Research teams finds that while the US is still likely to lead on AI innovation – driven by Silicon Valley start-ups and Magnificent 7 mega-caps – China could lead globally in engineering optimisation, production, and widespread commercialisation.

With AI reasoning models now able to reach potentially billions of users, some investment specialists believe the AI race is no longer just about who builds the smartest machine, but who gets it to consumers at the lowest cost. And for investors, there are several implications. One is that software firms will probably lead the next stage of the AI investment cycle, as they work to get AI apps into the hands of users. Second, the influence of DeepSeek is likely to give emerging Asia inherent advantages in monetising AI tech, and that will attract increasing investor attention. As the cost of AI compute falls, the impact should be seen in a broadening-out of profits growth to emerging Asia and beyond – as the profits edge enjoyed by US tech over the past decade erodes.

Energising Asia

Asia’s investment in renewable energy is slowing as its governments struggle to balance decarbonisation objectives with delivering reliable and more affordable power sources. A scarcity of traditional funding options is adding to the headache.

In the past, infrastructure has been dominated by large country-scale projects. But the current energy transition requires more localised investments, typically ranging from USD40 million to USD250 million. This shift has created a gap, because banks are geared towards larger deals. But the good news is that private credit, which is well-suited to renewable energy infrastructure because of its flexibility, is proving a successful alternative. Microgrids across the Philippines – combining solar panels, battery storage, and smart distribution tech – are a good example of successful privately-financed energy projects.

With private credit delivering superior returns to both credits and stocks over time, and interest rates and inflation expected to remain high compared to historical levels, investor appetite for these kinds of cash-flow-generating assets with inflation protection is likely to persist.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 13 June 2025.

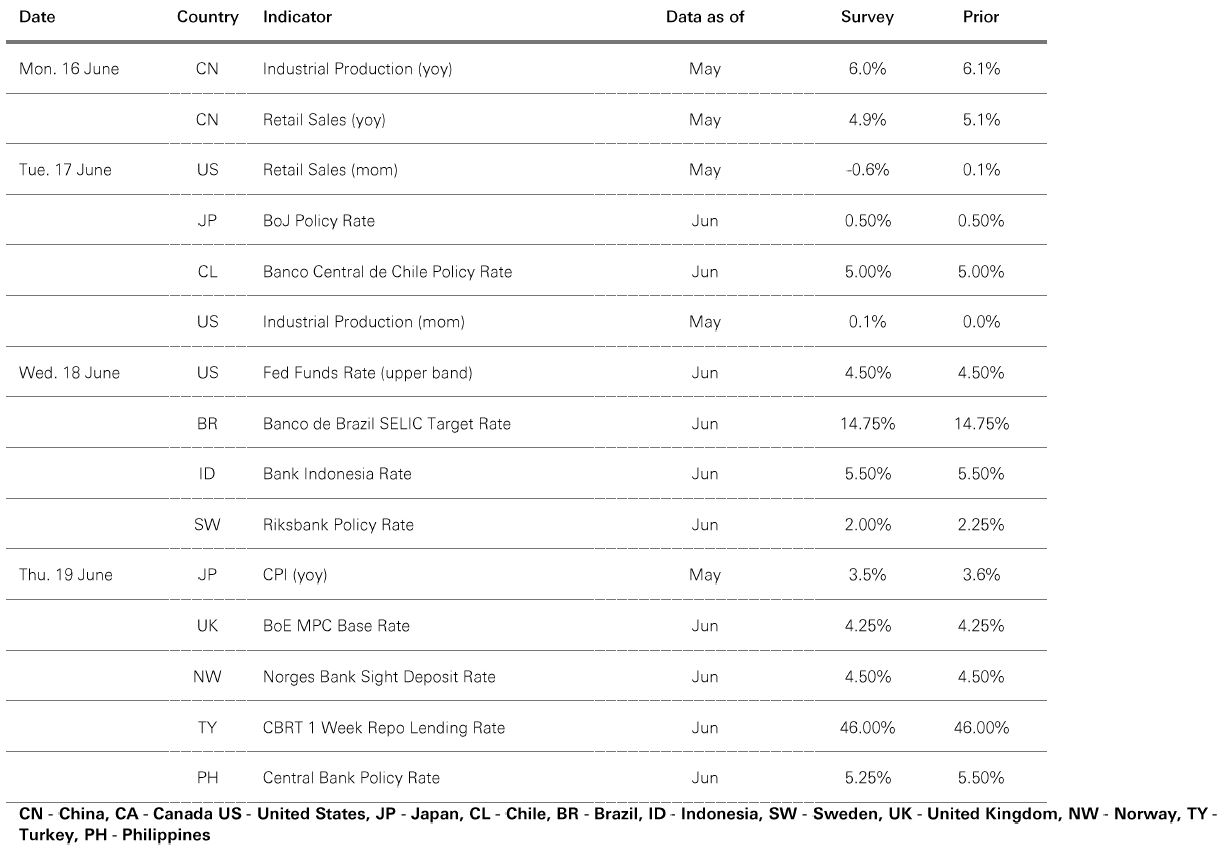

Key Events and Data Releases

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 13 June 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Risk markets struggled to make headway as investors weighed the outcome of the latest US-China trade negotiations, US inflation data, and geopolitical concerns. Oil and gold prices climbed, while the US dollar weakened further against major currencies. Core government bonds found support from tame CPI data and a solid 30-year Treasury debt auction. In equity markets, US stocks rose but EU-US trade tensions weighed on the Euro Stoxx 50, with the DAX the main casualty. Japan’s Nikkei 225 was little changed ahead of the BoJ meeting. South Korea’s Kospi led Asian markets, building on post-election gains, whereas India’s Sensex and China’s Shanghai Composite fell. In Latin America, Brazil’s Bovespa index rebounded after recent declines.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/em-central-banks-in-easing-mode/