georgemiller

Publish Date: Mon, 16 Jun 2025, 07:05 AM

Key takeaways

- The ECB cut rates again in June but hinted at a pause…

- …but the BoC paused rate changes for a second time in a row.

- US data and events (rather than the rate differential) could be crucial for short-term FX moves.

On 5 June, the European Central Bank (ECB) delivered a 25bp cut, bringing the key deposit rate to 2.0%. This was its seventh consecutive cut (and the eighth in total for this cycle since last July). The widely expected decision was “almost unanimous” although one ECB Governing Council (GC) member did not support it. ECB President Christine Lagarde said the central bank was “very well positioned” to navigate the current uncertain conditions that are likely to come from global trade and a jump in fiscal spending in Europe. She also said inflation will remain at the 2% target over the medium term. All this reinforces our economists’ view (and also market expectations) that ECB rates are highly likely to remain on hold at its 24 July meeting. Absent any further deterioration in the economic outlook, June could be the last cut, in our economists’ view.

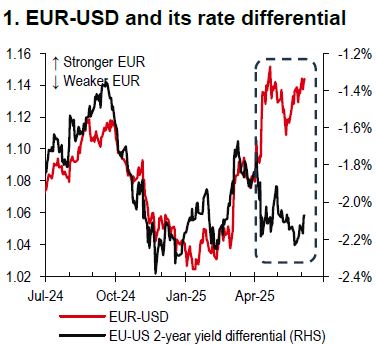

EUR-USD jumped after the announcement, within touching distance of key resistance at 1.15, albeit briefly. This could be explained by the looser ties between FX and the rate differential over recent weeks (Chart 1).

Source: Bloomberg, HSBC

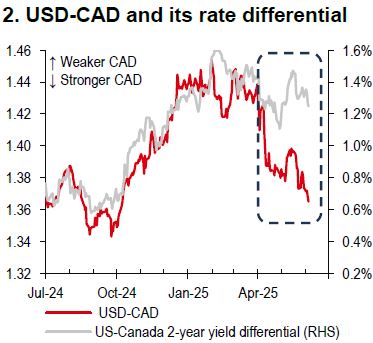

Source: Bloomberg, HSBC

Like the EUR, the CAD also remains significantly stronger against the USD than the rate differential would typically imply (Chart 2). The CAD, after underwhelming in 1Q25, has rallied c5.2% against the USD so far this quarter (Bloomberg, 5 June 2025). Relief that many Canadian exports were spared the headache of higher tariffs has helped the CAD so far. A grind higher in Canadian rate expectations for year-end 2025 may also have helped the currency.

Indeed, the Bank of Canada (BoC) decided on 4 June to hold rates steady at 2.75% for a second straight meeting. This was a dovish hold, however, as the BoC noted that the outlook for both the labour market and growth remains weak. Policymakers also hinted that if tariff risks materialise, the BoC could look to cut rates in 3Q25. Markets see a 25bp cut by the BoC in September (Bloomberg, 5 June 2025).

With the case building for a summer pause by both the ECB and the BoC, EUR-USD and USD-CAD will take more direction from US data and events. There is likely to be ongoing asymmetry for the USD to US growth, as the currency’s reaction shows more sensitivity to weaker-than-expected readings compared to stronger numbers.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/eur-and-cad-a-summer-pause/