georgemiller

发布日期: Fri, 20 Jun 2025, 12:02 PM

Key takeaways

- No bazooka stimulus – the aim is to solve structural problems with reforms; watch out for the 15th Five-Year Plan.

- Household goods consumption is similar to global levels, but services consumption lags; Hukou relaxation can help.

- US-China talks have eased tensions, though uncertainty remains; China’s exports may face headwinds in 2H.

China data review (May 2025)

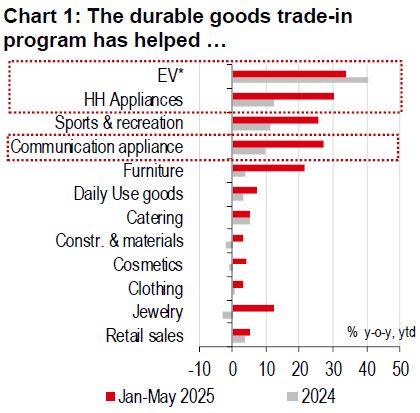

- Retail sales grew 6.4% y-o-y in May, the fastest pace since December 2023, driven by the consumer goods trade-in programs. Sales of home appliances rose by 53% y-o-y, communications appliances by 33% y-o-y, and electric vehicles by 28% y-o-y (the latter is based on CPCA data). The Ministry of Commerce reported that the trade-in subsidies helped drive RMB1.1trn in sales this year as of end-May (or cRMB380bn for May, 9% of retail sales) (Xinhua, 1 June).

- Industrial production (IP) accelerated 5.8% y-o-y in May supported by robust export figures but the domestic story was mixed. Policy support for equipment upgrading and for new growth drivers has kept equipment (+9.0% y-o-y) and high-tech manufacturing (+8.6% y-o-y) elevated. But, sectors along the housing supply chain continued to underperform, as IP growth in non-metal minerals (-0.6% y-o-y) and ferrous metals manufacturing (-4.8% y-o-y) were more muted.

- The property sector came in a bit weaker with a deeper fall in primary home sales (-4.6% y-o-y) and lower property investment (-12% y-o-y). There continues to be policy tweaks on the margin which can help to prevent the sector from seeing a faster slump. A larger push might still be needed, though the urgency of propping up the property market may fall behind supporting other sectors such as exporters and boosting consumption.

- Headline CPI inflation dropped 0.1% y-o-y in May as drags from energy prices persisted. However, core CPI inflation picked up to 0.6% y-o-y given ongoing policy support to boost consumption. Meanwhile, PPI inflation saw a deeper fall, -3.3% y-o-y, as deflationary pressures from some excess capacity along the housing supply chain and falling oil prices have yet to abate. Trade uncertainty suggests that domestic demand will remain the key driver to boost price levels.

- Exports rose 4.8% y-o-y in May as a deeper fall in US exports (-35% y-o-y) was offset by robust exports elsewhere, including ASEAN (+15% y-o-y), Eurozone (+12% y-o-y), and Africa (+33% y-o-y), reflecting China’s moves to diversify more of its exports and supply chains. Imports declined at a faster pace, -3.4% y-o-y in May, as lower global commodity prices and ongoing weakness in China’s property sector have continued to weigh on domestic demand.

Top five questions about China’s economy

What comes to mind if you are asked to name the most pressing issues facing China’s economy right now? Trade tensions, labour market pressure, a deflationary trap, sluggish consumption, and where is the bazooka stimulus? Let us provide you with some answers.

Q1: How fast is domestic consumption recovering?

Retail sales surprised on the upside in May, driven in part by government subsidies (e.g. tradein programs). Smaller cities (tier-3 and 4) are faring better than larger ones in terms of retail sales, helped by urbanisation trends. While China’s goods consumption is in line with global levels, services consumption lags. More policies emphasising services demand and structural reforms to support people’s welfare (such are Hukou relaxation) will help sustain consumption.

Note: *EV refers to retail volume. HH = household.

Source: CEIC, CPCA, HSBC

Source: Wind, HSBC

Q2: How is the labour market faring?

The headline unemployment rate has edged down (5% in May), but there are still pressure points. The youth unemployment rate is c16% and may prove to be sticky, given the rise in the number of graduates and a lack of quality entry level jobs. Low-income and migrant workers have seen a slower pace of income growth relative to both the rest of the population and the pace of GDP growth. However, the government’s increased policy focus and the roll out of measures to support people’s livelihood and boost income growth can help.

Q3: Deflation, deflation, deflation: Is there any way out?

China is experiencing its longest stretch of contraction in the GDP deflator. While CPI weakness stems from volatile items, core CPI is relatively steady. PPI deflation has been affected by weak demand and excess capacity. Measures to adjust supply and improve profitability may be accelerated, particularly in the industrial sector. Addressing shortfalls in the social safety net and stabilising the labour market are also essential.

Q4: Why have exports stayed resilient this year despite the added US tariffs?

This comes down to frontloading and trade restructuring. We estimate that China’s direct US exports were largely frontloaded in 4Q last year, spilling over into 1Q ahead of the “Liberation Day” announcements. These exports took a hit in April and May due to the tariffs. The restructuring of trade to other markets, particularly emerging markets such as ASEAN and Latin America, have helped to fill the gap. But other countries may also be facing higher US tariff rates. We expect overall exports to slow in 2H.

Q5: Does a China stimulus package depend on US-China relations?

We do not expect China to deliver a bazooka stimulus package, as policymakers tend to favour policy workhorses rather than show horses. With trade talks heralding a period of relative calm and domestic activity data holding relatively firm, China will likely continue the steady pace of policy implementation.

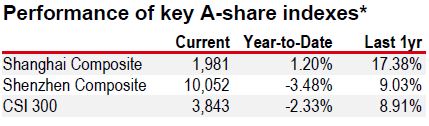

Source: Refinitiv Eikon

Note: *Past performance is not an indication of future returns. Priced as of 19 June 2025.

Source: Refinitiv Eikon

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/top-five-questions-about-chinas-economy/