georgemiller

Publish Date: Mon, 23 Jun 2025, 07:04 AM

Key takeaways

- The Bank of Japan kept rates on hold this week, but its QT tapering announcement could support the JPY.

- JPY has drifted sideways lately with another round of “dedollarisation” likely needed to break the stalemate.

- We see USD-JPY heading lower on US policy uncertainty, JPY undervaluation, and potential US policy easing.

The Bank of Japan (BoJ) kept interest rates on hold at 0.5% for the third consecutive meeting this week and remains non-committal to the timing of the next rate hike amid growth uncertainties. The market has the next rate hike fully priced in only by March 2026. The BoJ’s announcement to start quantitative tightening (QT) tapering (reducing the pace of balance sheet expansion) from April 2026 can be considered marginally positive for the JPY as it may help contain local investors’ bond outflows. But fiscal and supply concerns remain while the economic outlook stays subdued. In short, Japanese markets need more visibility on a US-Japan trade deal.

USD-JPY has been drifting sideways for the past two months. Our modeling suggests that (1) the pair is now mostly driven by the USD itself; (2) correlation with historical explanatory factors such as yield differentials and risk sentiment remain lower than usual; and (3) the range of model-derived USD-JPY values has been stable at roughly 140-150. Another wave of ‘de-dollarisation’ is probably needed to break USD-JPY out of this stalemate while global investors' diversification inflows to Japanese equities have slowed much more than flows to Europe since April.

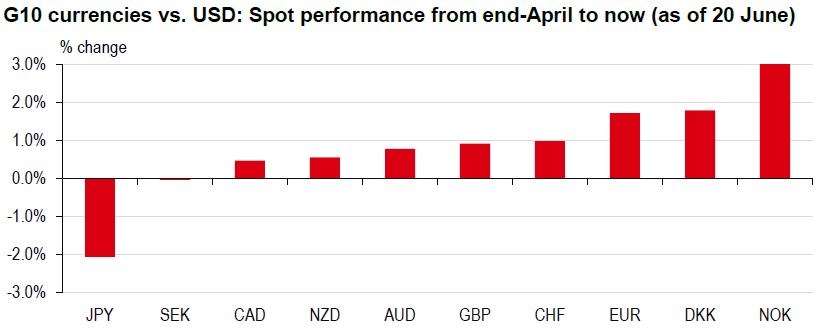

Indeed, the JPY has underperformed other currencies since late April (see chart). This is probably to do with earlier extreme long JPY positioning. Net long JPY futures and options position surged to an all-time high in late April, based on CTFC data. In comparison, the market was only modestly net long European currencies at the time. Some market participants may have bought JPY as a portfolio hedge in April but with global equity markets having recovered since then, that demand likely waned. The number of net long JPY contracts has fallen by 20% since late April.

Overall, we expect the JPY to strengthen against the USD by the end of the year on the back of US policy uncertainty, JPY undervaluation, and renewed expectations for the Federal Reserve easing. However, the market remains sensitive to headlines about US-Japan trade talks, especially regarding FX discussions.

Source: HSBC, Bloomberg

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-upside-despite-steady-policy-rates/