georgemiller

Publish Date: Mon, 07 Jul 2025, 07:04 AM

Key takeaways

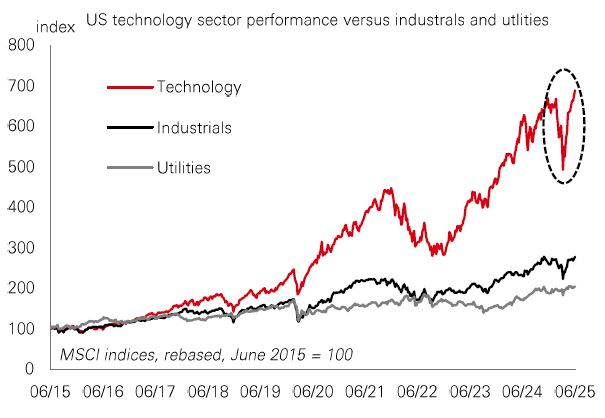

- After selling-off earlier this year, the US equity market is back at all-time highs. Technology stocks – which account for 35% of the MSCI US index – have driven the rally.

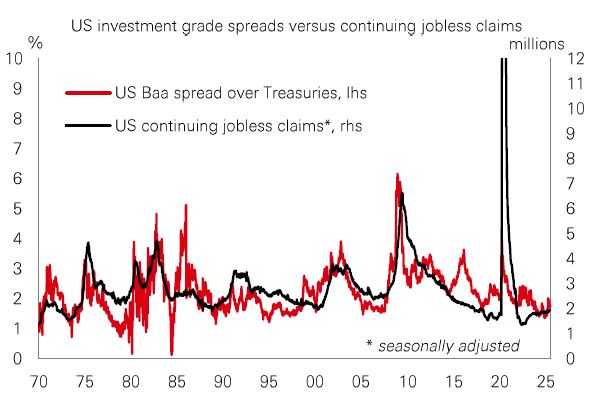

- US credit markets have staged an impressive comeback since the ‘Liberation Day’ tariffs announcement in April. The initial sell-off was in line with previous episodes over the past 10 years, but the recovery in Investment Grade has been quicker than it was after President Trump’s first round of tariffs in late 2018, the inflation shock of early 2022, and the collapse in oil prices in late 2015.

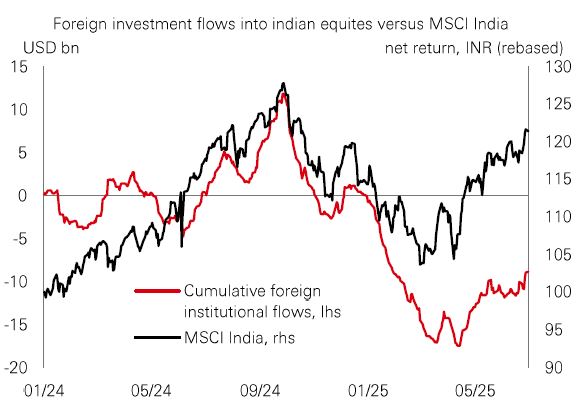

- After a blistering two-year rally, Indian stock markets took a breather coming into 2025, with relatively high valuations ticking down on a softer profits outlook. But price momentum picked up again in Q2.

Chart of the week – US stocks rally, but what comes next?

US equities hit another record high last week. All is well again in the world. But can it really be that the policy shocks of recent months are simply going to fade into the background?

One important caveat is that the S&P 500 only hit a record in US dollar terms. Measured in any other major currency, it is still short of its highs seen earlier in the year. Indeed, the pace of dollar decline has picked up again recently in tandem with a jump in the S&P 500. In part, the dollar’s latest leg lower is likely a function of risk-on sentiment. But it may also reflect President Trump’s desire to announce an early replacement for Fed Chair Powell – a so called “Shadow Chair”. Combined with the President’s calls for the Fed to cut rates, this marks a further risk to US policy credibility and, potentially, faith in the dollar as the ultimate reserve currency.

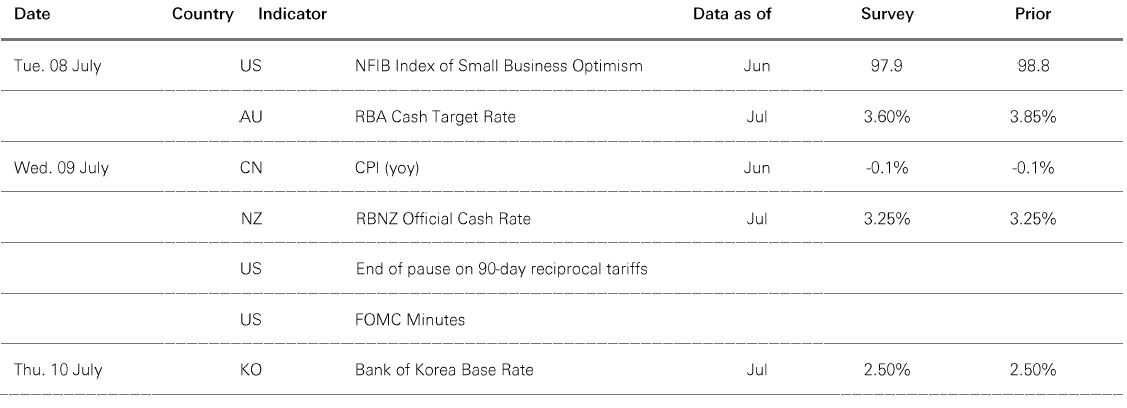

Looking ahead, having rallied hard, US stock markets could now be sensitive to negative news (see page 2). On top of concerns over “fiscal policy” and Fed leadership, any re-escalation of tariff tension on 9 July may reignite volatility. However, perhaps the bigger risk is that the data flow over the summer shows the economy cooling in a more decisive way. While June's headline payrolls number surprised to the upside, some other labour market indicators were soft (private payrolls and ADP employment) and consumer spending fell in May. On average, recent data have surprised to the downside. A period of below trend growth would bring with it the risk of the economy hitting its “stall speed” – historically, if US growth drops c.1.0pp below trend, it has often then dropped into a recession. After an early summer break, volatility could be on the horizon later this year.

Market Spotlight

Taking the credit

Private credit activity cooled in early 2025 amid tough competition from the syndicated loans market and subdued conditions for mergers and acquisitions deals, driven by macro uncertainty. Yet, some private credit specialists expect further growth for the asset class as banks continue to retreat from the market and private equity (PE) firms turn to private debt funds to finance mid-market leveraged buyouts. For now, private credit managers are staying active – focusing on refinancing and add-on deals, especially in defensive sectors like healthcare and business services, where there is strong support from PE sponsors and lower default risk.

For investors, the appeal of private credit lies in its potential for attractive all-in yields, stable income, and role as a portfolio diversifier given its low volatility. Private credit default rates remain low by historical standards. And while recent tariff uncertainty has impacted on borrower creditworthiness, the use of tools like payment-in-kind interest and flexible loan structures is helping borrowers navigate headwinds – as well as protect investor capital. The prospect of rate cuts in 2025 should be good for borrowers and encourage a revival in deal activity – supporting the private credit outlook.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 04 July 2025.

Lens on…

Tech’s back… but risks remain

After selling-off earlier this year, the US equity market is back at all-time highs. Technology stocks – which account for 35% of the MSCI US index – have driven the rally. And that’s no surprise given that, together with the communications services sector, technology accounts for over 60% of expected US profits growth in 2025.

But while sentiment is now risk-on, the temptation to overweight tech (and particularly the AI theme) in portfolios demands caution. The sector saw one of the sharpest drawdowns when momentum collapsed in April – falling 26%. It reflected the sensitivity of stocks priced for perfection but suddenly faced with trade policy uncertainty – and some of those risks could still remain. Yet, price/book valuations are back at 12-month highs.

In addition, while recent tech sector profits (and forecasts) have been strong, growth has been concentrated in the race for AI chips and data centre construction – where the longer-term profit model is not certain. So, for now, it could pay to take a more ‘picks and shovels’ approach to AI.

Credit recovery

US credit markets have staged an impressive comeback since the ‘Liberation Day’ tariffs announcement in April. The initial sell-off was in line with previous episodes over the past 10 years, but the recovery in Investment Grade has been quicker than it was after President Trump’s first round of tariffs in late 2018, the inflation shock of early 2022, and the collapse in oil prices in late 2015. The recovery in High Yield credit has been just as impressive. This has mirrored the recovery in stocks.

In part, the rapid rebound has been driven by solid fundamental credit metrics, with US corporate profitability proving resilient. Strong technical support in the market has also played a part. That said, recent macro data has seen signs of weakness, with continuing jobless claims hitting a cycle high. There have also been signs of strain in recent NIPA corporate profits data, and in personal consumption in the latest US Q1 GDP data. So, some caution could be warranted.

Alpha in India

After a blistering two-year rally, Indian stock markets took a breather coming into 2025, with relatively high valuations ticking down on a softer profits outlook. But price momentum picked up again in Q2. And this time, India’s strong structural tailwinds are benefiting from favourable domestic macro policies and a return of foreign investor interest.

Profit expectations have felt the strain from global trade and geopolitical uncertainties, weaker domestic demand, and slow credit growth. But that now appears to be stabilising. Downward profit revisions are slowing, with the cyclical outlook improving on brighter consumer sentiment, front-loaded monetary easing, fiscal policy support, and lower inflation.

Profits are expected to grow by just over 10% year on year in 2025, accelerating to mid-teens in 2026. Valuations have also improved. And while trade policy remains a risk, India’s tendency to be domestically oriented could give it some protection.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 04 July 2025.

Key Events and Data Releases

Last week

The week ahead

Source: HSBC Asset Management. Data as at 7.30am UK time 04 July 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Market review

Risk market sentiment improved last week following an earlier-than-usual US jobs report that beat consensus expectations and the announcement of a US-Vietnam trade deal. The US dollar continued to weaken, while US Treasury yields rose, with the yield curve flattening. UK Gilt yields also increased during a volatile week, as fiscal concerns returned to the forefront. German Bunds outperformed with yields rising marginally after an uneventful eurozone HICP flash print. In stock markets, US equities saw broad-based rallies, while European markets rose more modestly, with the DAX declining. Japan's Nikkei 225 retreated following last week’s gains. Other Asian markets traded mixed: mainland China’s Shanghai Composite rose, whereas Hong Kong’s Hang Seng led the regional losses, driven by tech shares’ weaknesses. In commodities, oil prices rose, as did gold and copper.

https://www.hsbc.com.my/wealth/insights/asset-class-views/investment-weekly/us-stocks-rally-but-what-comes-next/