georgemiller

Publish Date: Mon, 07 Jul 2025, 12:02 PM

Key takeaways

- Gold prices could spike higher on geopolitical events.

- Policy and economic uncertainty, mounting fiscal concerns, and a weaker USD should sustain gold prices at high levels…

- …but positive US real rates and physical market dynamics will eventually wear on gold prices.

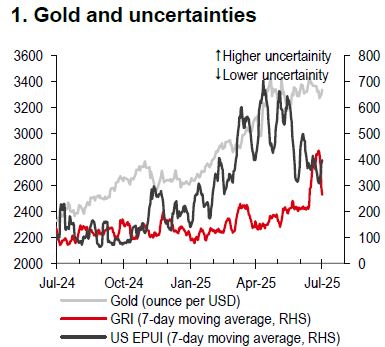

Gold hit a record high of USD3,500 per ounce on 22 April, fuelled by ‘safe haven’ demand, spurred on by geopolitical, economic, and policy uncertainties (Chart 1). The inability of gold to rise above the April high in the midst of the Israel-Iran crises is worth re-thinking whether there are sufficient risks to propel gold prices higher.

The threat of an outright ‘trade war’ may have receded, as US President Trump announced a trade deal with Vietnam, the first bilateral trade deal with Asia, followed by Indonesia’s coordinating minister who said that the US and Indonesia will sign a Memorandum of Understanding (MOU) on trade and investments on 7 July (Bloomberg, 3 July). However, there is still a great deal of US policy uncertainty, with many ongoing trade discussions. In addition, global economic uncertainty also has the potential to buoy gold. Mounting US fiscal deficits – and those of other countries – have aided the gold rally and may continue to do so. In the latest Fiscal Monitor (April 2025), the International Monetary Fund (IMF) points out that global public debt could increase to 100% of GDP well before the end of the decade. These bedrock factors are likely to sustain gold at what are historically high levels, which could further encourage momentum-related demand, in our precious metals analyst’s view.

Note: Geopolitical Risk Index (GRI) is compiled by Fed economists Dario Caldara and Matteo Iacoviello, while US Economic Policy Uncertainty Index (EPUI) based on newspaper archives from Access World New's NewsBank service, is developed by Baker, Bloom and Davis.

Source: Bloomberg, HSBC

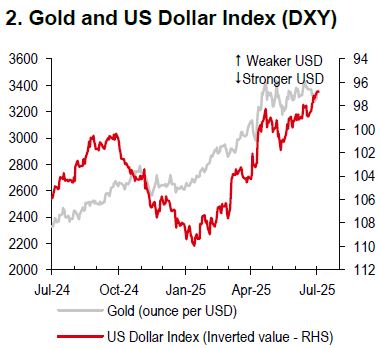

Source: Bloomberg, HSBC

Going into 2H25, our framework suggests that the USD has room to weaken moderately, which may support gold prices (Chart 2). The “de-dollarization” momentum is also positive for gold. However, our precious metals analyst believes that there is a limit to how far gold prices may go. High gold prices are limiting key physical demand and could see demand from central banks moderate, while at the same time there is higher recycling supply even as mines strain to increase output. Monetary policy, should fewer rate cuts than previously expected materialise, could weigh on gold, and positive US real rates will eventually wear on gold prices.

All things considered, our precious metals analyst expects gold prices to go higher over the near term, but when risks start to fade and other factors (like US real rates) become more dominant, weakness in gold prices could come later in 2H25.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/gold-momentum-fading/