georgemiller

Publish Date: Wed, 09 Jul 2025, 07:05 AM

Key takeaways

- The reciprocal tariff discussions are keeping markets on their toes…

- …with the recent economic data proving messy making it hard for policymakers to get a clear steer on the economy.

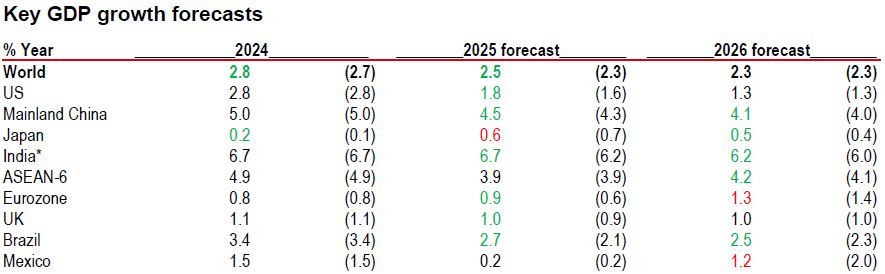

- We recently raised our 2025 global GDP growth forecast to 2.5%, with notable upgrades in India and Brazil.

Ahead of the revised 1 August deadline for additional reciprocal tariffs, tariff-related news has come to the forefront again. At the time of writing, it remains unclear what this means for multiple economies in terms of final tariff rates going forwards, but the door is open to more bilateral deals, or new tariff rates on economies with which the US is unlikely to reach an agreement.

Trade talks ongoing

Vietnam is an economy exposed to tariff uncertainty and has moved towards a deal that would see a 20% tariff on all US imports from Vietnam and 40% tariff on transhipped imports. Earlier agreed trade deals with the UK and mainland China are also in effect.

For the UK, sector tariffs on autos and aerospace have been relaxed, but steel tariff rates remain uncertain, while China agreed to approve export licenses for critical minerals. In return, the US will lift recent export controls on Chinese goods (Fortune, 27 June). Trade talks with key trading partners are ongoing, though their outcomes remain uncertain.

Source: Macrobond

Source: Macrobond

Improving survey data…

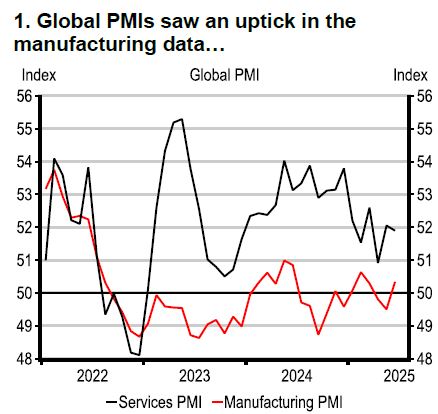

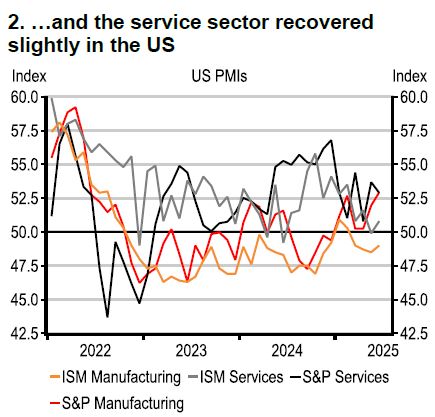

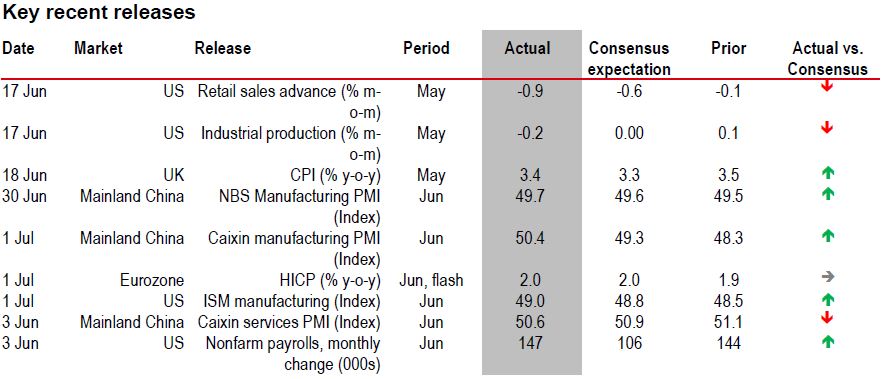

Amid all these uncertainties, the macroeconomic outlook remains very hard to read. In addition, big legislative changes in the US following the passage of the Big Beautiful Bill will have fiscal consequences. Various survey data have improved from the April lows but still don’t show any clear signs of momentum and could be heavily influenced by frontloading effects (charts 1 and 2).

In the US, business surveys fared better in June, but we are seeing signs of stockpiling of raw materials and rises in input costs. While CPI and PPI inflation are yet to reflect the impact of tariffs, we can see a lot of tariff-led inflation in the pipeline within the survey data.

…and consumer outlook

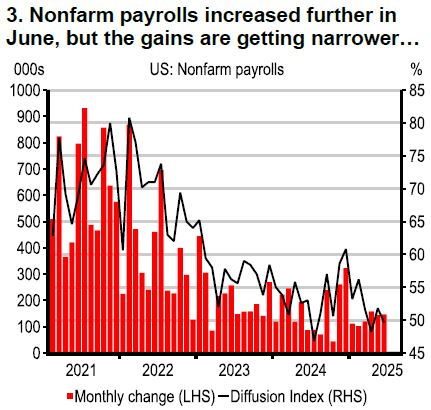

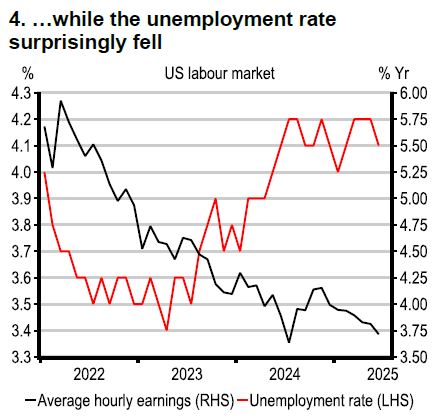

Meanwhile, the US unemployment rate fell slightly, as nonfarm payrolls surprised on the upside in June (charts 3 and 4). However, questions about the quality and reliability of data keep building – meaning that it’s getting even harder for central bankers to make informed decisions about the best path for policy. Data outside the US could be being propped up by the frontloading impacts, or, in mainland China’s case, domestic stimulus measures.

That said, we are seeing lower inflation and interest rates outside the US improve the consumer outlook.

Source: Macrobond

Source: Macrobond.

Tariffs, tariffs, tariffs

The global growth outlook remains mired in uncertainty. While Middle East tensions appear to have calmed down for now, lowering the risk of a spike in oil prices, the questions over tariff rates, timings and how trade flows react are set to keep markets and economists on their toes over the next few months.

Our GDP growth forecasts

Growth outcomes were stronger than expected in many countries in Q1. Still, we see global GDP slowing from 2.8% in 2024 to 2.5% in 2025, despite some notable upgrades to India and Brazil which are less affected by tariffs. A weaker growth picture later this year and early next means our 2026 global GDP forecast is 2.3% in 2026.

Note: *India data is calendar year forecast here for comparability. Previous forecasts are shown in parenthesis and are from the Macro Monthly dated 17 April 2025.

Green indicates an upward revision, red indicates a downward revision.

Source: Bloomberg, HSBC Economics

Source: Bloomberg, HSBC

⬆ Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

Source: Refinitiv Eikon, HSBC

https://www.hsbc.com.my/wealth/insights/market-outlook/macro-monthly/tariff-deadlines-in-focus/