georgemiller

Publish Date: Mon, 14 Jul 2025, 08:06 AM

Key takeaways

- The RBA kept rates on hold in July, despite widespread expectations for a 25bp cut.

- The RBNZ’s rate pause was, nevertheless, much anticipated, with its tone turning slightly more dovish.

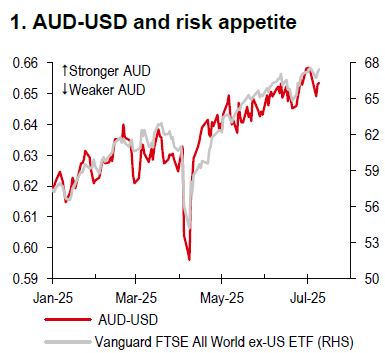

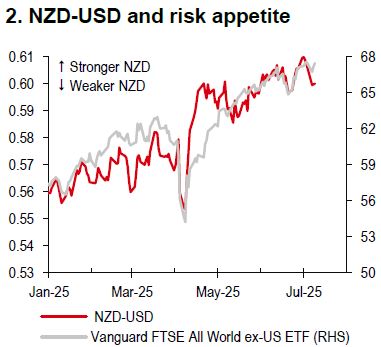

- We turn neutral on AUD-NZD and believe risk sentiment will be crucial for AUD-USD and NZD-USD in the months ahead.

On 8 July, the Reserve Bank of Australia (RBA) surprised markets with a 6-3 vote in favour of keeping its policy rate unchanged at 3.85%. The RBA wanted more information on inflation and mentioned that the downside risks to global uncertainty have receded. We think the decision is only marginally positive for AUD-USD, as the conviction should remain for further RBA easing, albeit in a less front-loaded manner. Markets currently almost fully price in a 25bp cut in the RBA’s next meeting on 12 August (Bloomberg, 10 July 2025).

Unlike the RBA, the Reserve Bank of New Zealand’s (RBNZ) decision on 9 July was in ine with expectations. Elevated near-term inflation (driven by food prices and dministered price increases) and strong export prices convinced the RBNZ to keep its olicy rate unchanged at 3.25% and wait for more data to be released, like 2Q CPI data 21 July) and the labour market report (6 August). Markets see a c70% chance for he RBNZ delivering a 25bp cut in its 20 August meeting (Bloomberg, 10 July 2025).Overall, the RBNZ’s tone has turned slightly more dovish from the last meeting.Given the latest rhetoric of both central banks, we turn neutral on AUD-NZD.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Looking beyond the central banks’ decisions, we believe “risk on” sentiment is likely to support both the AUD and NZD (see charts above) in the months ahead. Nevertheless, the headlines around US trade policy will drive the narrative over the near term. A sequence of letters has recently been sent to several US trading partners, outlining new tariff levels that will come into effect on 1 August. There was also the announcement of copper tariffs of 50% to be implemented from 1 August, and a mooted 200% tariff on pharmaceuticals, although the implementation here may be some way off. With the tariff deadline extending, the impact on FX markets has been rather muted, but if there is any re-escalation in trade tensions, the AUD and NZD could underperform the EUR, JPY, and CHF.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/aud-and-nzd-julys-rate-pause-amid-trade-uncertainty/